Electricity businesses continued their stellar performance in Q2. According to VietstockFinance, out of 58 electricity companies that published their Q2 financial statements, 43 reported profit growth (including 7 that turned losses into profits). Only 12 companies witnessed profit declines, while 2 remained unprofitable.

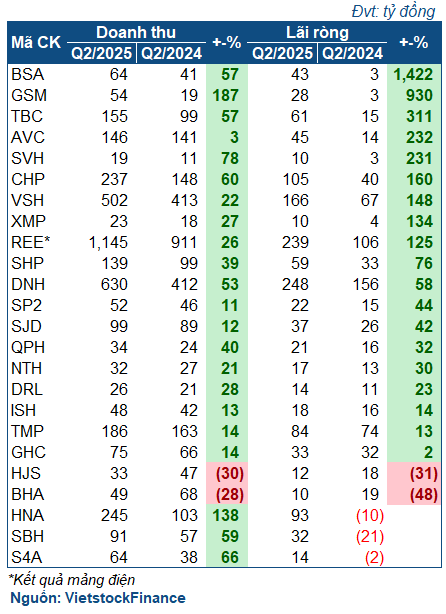

Hydropower flourishes from a low base:

|

Q2 business results of the hydropower group

|

Unlike the previous year, when they were negatively impacted by the El Nino phenomenon, the hydropower group benefited from favorable hydrological conditions this Q2. Most businesses witnessed significant profit growth compared to the low base of the previous year, with some even doubling their profits.

Vinh Son – Song Hinh Hydropower (HOSE: VSH) is a prime example. In Q2, VSH earned a profit of 166 billion VND, 2.5 times higher than the previous year, thanks to improved water flow that boosted commercial electricity production. Additionally, increased interest income and reduced loan interest expenses also contributed to the company’s strong profit growth this period.

| Business situation of VSH |

Favorable rainfall also contributed to the success of Thuy Dien Mien Trung (HOSE: CHP), which reported a net profit of 105 billion VND, 2.6 times higher than the previous year. AVC (A Vuong Hydropower) also tripled its profit to 45 billion VND compared to the same period last year due to similar reasons.

REE’s electricity segment, which includes subsidiaries such as VSH and CHP, also performed well, achieving a profit of 239 billion VND, 2.3 times higher than the previous year.

A few companies stood out, such as Buon Don Hydropower (UPCoM: BSA), which reported a net profit of 43 billion VND, 15 times higher than the previous year. This impressive growth was mainly due to favorable hydrological conditions that increased electricity production by nearly 70%. Additionally, BSA also prepaid its foreign currency loan, resulting in a recognition of revenue from exchange rate differences of 28.5 billion VND paid by the electricity purchaser.

Another notable performer was GSM (Huong Son Hydropower), which increased its profit by more than tenfold compared to the previous year due to the operation of its power plant according to the avoided cost pricing method since November 2024.

However, two companies reported profit declines: BHA and HJS. BHA experienced a 48% decrease in profit, amounting to 10 billion VND, due to reduced water flow to the reservoir. HJS reported a 31% profit decline, totaling 12 billion VND, attributed to similar reasons. Additionally, the application of temporary electricity selling prices at the Nam Mu Hydropower Plant also led to a decrease in the company’s revenue and profit.

Following an explosive Q1, the six-month picture for the hydropower group is exceptionally bright. BSA and GSM increased their profits by severalfold. VSH and CHP also achieved significant profit growth, with increases of 6.3 times and 3.2 times, respectively, compared to the previous year, amounting to 435 billion VND and 225 billion VND. Among the companies with profit declines, HJS retreated by 43%, earning 18 billion VND, while BHA incurred a net loss of approximately 300 million VND (compared to a profit of 18 billion VND in the previous year).

|

Six-month results of the hydropower group

|

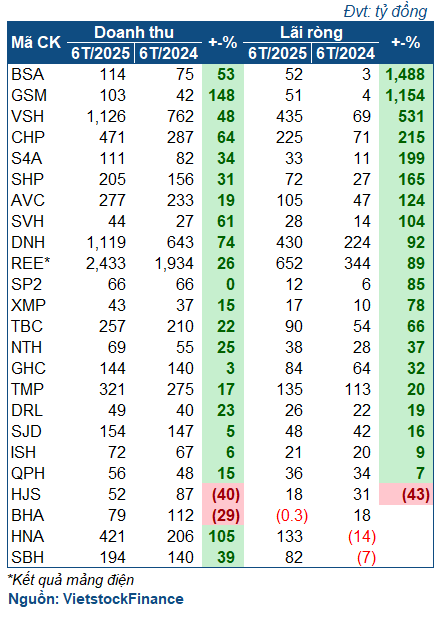

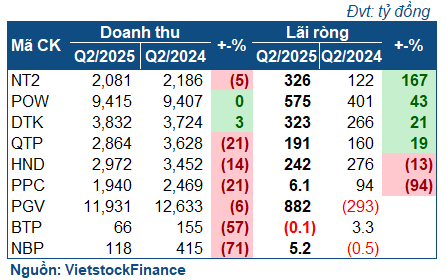

Thermal power shines with reduced production costs:

In reality, most thermal power companies recorded a significant decline in revenue in Q2 due to reduced electricity dispatch, but their profits increased thanks to lower fuel costs.

|

Q2 business results of the thermal power group

|

The most impressive performer was PGV (EVNGENCO3), which reported a profit of 882 billion VND, a strong recovery from a loss of 293 billion VND in the previous year, despite a 6% decline in revenue due to lower electricity sales. However, a 14% reduction in cost of goods sold helped PGV nearly double its gross profit compared to the previous year. Additionally, a 12% decrease in loan interest expenses also contributed to the company’s substantial profit.

NT2 (Nhon Trach 2 Thermal Power) witnessed a 5% decline in revenue but achieved a net profit of 326 billion VND, 2.7 times higher than the previous year, thanks to a more significant reduction in cost of goods sold. QTP (Quang Ninh Thermal Power) also recorded a profit of 191 billion VND, a 19% increase, despite a 21% drop in revenue due to similar reasons. POW reported flat revenue for the period but saw its profit increase to 575 billion VND, a 43% year-over-year growth, as a result of significantly lower cost of goods sold.

| Business situation of NT2 |

Q2 saw two companies with reduced profits: PPC and HND. HND experienced a 14% decline in revenue and a 13% decrease in profit, amounting to 242 billion VND. Unlike the other companies mentioned, HND‘s cost of goods sold did not decrease as significantly as its revenue. Additionally, the company’s profit was impacted by an increased tax rate of 10%, compared to 5% in the previous year.

Notably, PPC (Phả Lại Thermal Power) saw its profit plummet by 94%, reaching only 6.1 billion VND, mainly due to a significant drop in revenue that outpaced the reduction in cost of goods sold. Moreover, the company incurred substantial execution costs of over 100 billion VND, twice as high as the previous year.

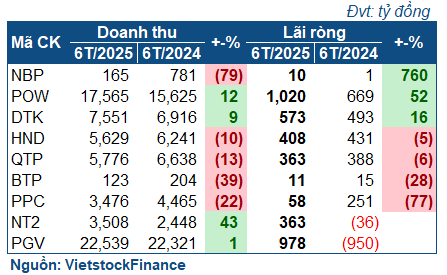

Unlike Q2, the cumulative picture for the thermal power group showed diversification. POW and DTK reported profit increases, amounting to over 1,000 billion VND and 573 billion VND, respectively, representing growth of 52% and 16%. PGV and NT2 also recovered strongly from losses in the previous year. On the other hand, HND, QTP, BTP, and PPC experienced profit declines, with PPC suffering the most significant drop of 77%, resulting in a net profit of only 58 billion VND for the first six months.

|

Six-month results of the thermal power group

|

Renewable energy extends its growth trajectory:

Building on the momentum from Q1, renewable energy companies continued their strong performance in Q2. Leading the way was GEG, which achieved a remarkable 28% increase in revenue and a profit of 166 billion VND, nearly eight times higher than the previous year. This outstanding performance can be attributed to the application of the official selling price for the Tan Phu Dong 1 wind farm (TPD1) and the recognition of financial revenue of nearly 120 billion VND from the profit generated by the transfer of ownership in an associated company, Truong Phu Hydropower.

|

Q2 results of the renewable energy group

|

Following closely is HDG. While HDG incurred a net loss in Q2, its electricity segment demonstrated robust growth, with a 34% increase in revenue and a 74% surge in gross profit compared to the previous year, totaling 313 billion VND. However, it is important to note that HDG‘s electricity segment includes hydropower, which benefited from favorable hydrological conditions in Q2. Similarly, TTA reported a slight profit increase, with a portfolio comprising small hydropower plants and solar energy projects.

In contrast, the electricity segment of PC1 experienced a 24% decline, resulting in a net profit of 167 billion VND. However, this decrease was primarily due to unfavorable hydrological conditions at the company’s hydropower plants compared to the previous year.

BGE – the energy company of Bamboo Capital (HOSE: BCG) – witnessed a staggering 96% drop in profit, amounting to only 9 billion VND, despite a mere 2% decline in revenue. This significant decrease was a result of increased provisions for investments.

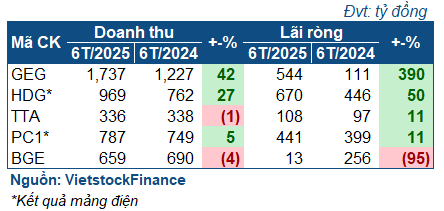

The cumulative picture for this group is quite positive. GEG, with two consecutive profitable quarters, reported a net profit of 544 billion VND in the first half of the year, five times higher than the previous year. HDG‘s electricity segment achieved a gross profit of 670 billion VND, representing a 50% increase. PC1‘s electricity segment also grew by 11%, resulting in a net profit of 441 billion VND. Conversely, BGE experienced a 95% drop in its six-month results, totaling only 13 billion VND, due to the impact of increased provisions for investments.

|

Six-month results of the renewable energy group

|

Policy developments as a pivotal factor for the energy sector:

According to MBS Securities, several crucial documents pertaining to the energy sector were approved and issued in the first half of 2025, aiming to address policy bottlenecks. Notably, the adjusted Power Development Plan 8 (PDP8), the Law on Bidding, and the price frameworks for various energy sources. These developments are expected to usher in a new cycle of investment after a period of stagnation.

Looking ahead, MBS forecasts that renewable energy will continue to be the biggest beneficiary of these policy changes, particularly with the official transition to a competitive bidding mechanism and the introduction of price frameworks for this sector. For solar energy, the new price framework is more diverse, taking into account energy storage systems and specific regional considerations. However, the ceiling price for ground-mounted solar power projects remains unchanged from the transitional framework, prompting a cautious approach from investors. According to IRENA, investment costs for solar energy have decreased by 33% since the FIT1 phase in 2020-2024, lagging behind the 50% decline in selling prices. While there is still significant room for development due to rapidly falling investment costs and increasing panel efficiency, the upcoming phase is likely to favor companies with strong capabilities in cost optimization and project efficiency.

Regarding wind energy, the new price framework is considered sufficiently attractive, with on-shore wind power prices 14%-23% higher than the transitional framework and near-shore wind power prices 9% higher. Several localities have shown interest in wind power projects through competitive bidding processes, and companies with expansion plans in this sector are expected to reap significant benefits.

For hydropower, the National Center for Hydro-Meteorological Forecasting predicts a neutral phase with the highest probability (55%-90%). From July to September 2025, rainfall across the country is expected to remain at the average level, with higher rainfall in the Central region. From October to November 2025, the Central and Central Highlands regions are forecast to receive 10%-25% more rainfall than the long-term average, returning to average levels in the final month of the year. Consequently, hydropower companies are unlikely to sustain their high growth trajectory in the second half.

In terms of coal-fired power, MBS anticipates that dispatch levels for coal-fired power plants will remain high, similar to 2024, and this source is expected to play a crucial role in the medium term.

– 09:00 25/08/2025

Inauguration of the 1,500 Billion VND Hai Anh Wind Power Plant

The Hai Anh Wind Power Plant project is a landmark initiative, proudly standing in the communes of Huong Phung and Lao Bao in Quang Tri Province. This ambitious undertaking represents a Group B energy project, ranked as a second-tier venture with an impressive 40 MW capacity. With a substantial investment of 1,500 billion VND, this onshore wind farm is a pioneering effort, being the first of its kind to partake in the Joint Crediting Mechanism (JCM) – a testament to the strong collaboration between the governments of Vietnam and Japan.

“KN Holdings and Samsung C&T Collaborate on Floating Solar Project”

“KN Holdings is proud to announce its collaboration with Samsung C&T to develop three floating solar power projects, totaling an impressive 864 MW of expected capacity. This partnership aims to provide clean energy to large power consumers, showcasing a commitment to sustainability and innovation in the energy sector.”