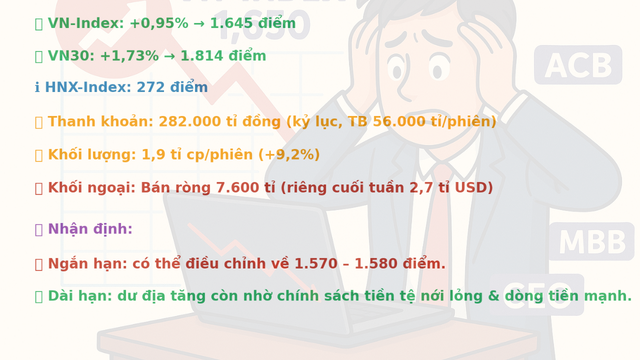

In the latest trading session (August 22), the stock market unexpectedly “plunged,” with the VN-Index losing over 42.53 points as a plethora of large-cap stocks witnessed steep declines, even hitting floor prices. Nonetheless, for the week, the index still managed a 0.95% gain, closing at 1,645 points. The VN30 also rose 1.73% to 1,814 points, while the HNX-Index ended at 272 points.

A notable bright spot was the market’s surging liquidity, setting a new record with a total trading value of VND 282 trillion for the week, equivalent to an average of nearly VND 56 trillion per session. The matching volume on HoSE also increased by more than 9% compared to the previous week, averaging 1.9 billion shares per session.

In contrast, foreign investors continued to heavily offload Vietnamese stocks, with a net sell value of over VND 7,600 billion on HoSE. The selling pressure during the week, especially in the last session, pushed liquidity to a staggering VND 2.7 trillion.

Many investors are concerned about whether this downward trend is merely a short-term correction or a prelude to a deeper decline.

Stock Market Summary and Forecast for the Week Ahead

According to analysts from SHS Securities Joint Stock Company, after a streak of sharp increases, the market is signaling a potential peak formation. The VN-Index may face corrective pressure towards the 1,600-point level. “Speculative activities have intensified, pushing many stocks into risky zones. Following this heated phase, short-term positions will weaken, and the market will need to refocus on fundamental valuations and Q3 earnings expectations,” the report stated.

VN-Index witnessed a sharp drop in the last session but managed to stay above the psychological level of 1,600 points

Mr. Nguyen Thai Hoc, an analyst from Pinetree Securities Company, shared a similar sentiment, noting that the concentration of funds in large-cap stocks to prop up the index has left many investors holding small and mid-cap stocks with little to no gains, or even losses. In the short term, he expects the VN-Index to retreat to the support zone of 1,570-1,580 points before finding new upward momentum.

“After a nearly four-month hot streak, a 5% or more correction is normal. This is not a negative signal but rather a necessary market balance. The next week will see stronger differentiation, with many small and mid-cap stocks that have fallen deeply having a chance to recover, while the banking and blue-chip sectors that have risen sharply will continue to face selling pressure,” Mr. Hoc added.

Stock Market Forecast: Will the Market Rise Beyond All Expectations?

On August 23, Mr. La Giang Trung, CEO of Passion Investment, shared on his personal page that the key factors to monitor are not the index’s fluctuations of a few dozen points but the money flow and market liquidity.

“With the US Federal Reserve signaling an interest rate cut in September 2025 and the State Bank of Vietnam continuing its monetary easing policies to support economic growth, the market still has ample room to grow. Liquidity has already doubled or tripled compared to the 2020-2021 period, and valuations are only halfway through their journey. The VN-Index can certainly surpass all scenarios that investors can imagine,” he asserted.

Mr. La Giang Trung is a veteran of the stock market, and his forecasts have often proven to be highly accurate. For instance, in 2022, he was among the few experts who predicted the VN-Index could plummet from the 1,500-point level to the 900-point range as the Fed tightened its monetary policy to curb inflation, which indeed transpired.

Towards the end of 2022, he assessed that the worst was over and anticipated a recovery phase throughout 2023-2024.

What Should Investors Do?

Overall, according to analysts, the sharp decline in the latest session indicates that the market is entering a “trial by fire” phase after a prolonged upward trend. Differentiation among stocks will become more pronounced: banking, securities, and large-cap stocks may face profit-taking pressure, while many small and mid-cap stocks, especially those that haven’t risen significantly, could be poised for a rebound.

The positive sign is the record-high market liquidity, indicating that money is still flowing into the market and has not entirely withdrawn. This provides a basis for believing that the current correction is technical in nature, allowing the market to accumulate energy for a new upward cycle.

For short-term investors, this is a crucial moment for risk management, avoiding chasing after stocks that have already surged, and gradually taking profits on positions that have met expectations. Conversely, medium and long-term investors can view this corrective phase as an opportunity to restructure their portfolios, prioritizing companies with solid fundamentals that benefit from the monetary policy easing trend.

In summary, the VN-Index remains above the psychological threshold of 1,600 points. If liquidity continues to be abundant and macroeconomic policies remain supportive, the formation of new price levels in Q3-Q4 cannot be ruled out.

The Bank Stock: Why the Sudden Turnaround?

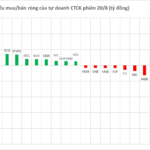

The proprietary trading arms of securities companies were net buyers to the tune of VND77 billion on the Ho Chi Minh Stock Exchange (HoSE).

The Foreign Block’s Continued Sell-Off: Over $1.5 Billion as VN-Index Dips from Peak, Which Stocks Took the Biggest Hit?

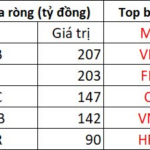

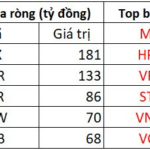

In the afternoon trading session, foreign investors heavily net bought VIX and PDR stocks across the market, with respective values of VND 181 billion and VND 133 billion.