Sugar Prices Hit Rock Bottom, Profits Melt Away

Vietnam’s sugar industry is facing significant challenges as domestic sugar prices have dropped from around VND 19,300/kg at the beginning of 2025 to VND 18,400-18,900/kg in mid-2025, which is significantly lower than the prices in the Philippines, Indonesia, and China. This trend goes against the global sugar market, which has seen only slight decreases or stable prices.

Despite a slight increase of about 10% in mid-2025 due to a slight rise in consumption and a reduction in sugarcane planting areas, domestic prices remain low due to the dual pressure of oversupply and illicit sugar imports. These factors have led to slow consumption, high inventory levels, and shrinking profit margins for most businesses.

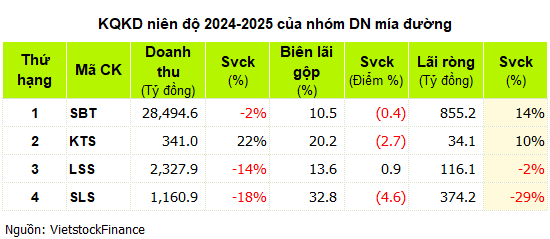

The seasonal cycle peculiarity leads most listed sugar companies to choose a fiscal year from July 1 of the previous year to June 30 of the following year. The fourth quarter of the 2024-2025 fiscal year (corresponding to Q2/2025) of Kon Tum Sugar Joint Stock Company (KTS) witnessed an 82% drop in net profit to less than VND 4 billion, with a 15% decrease in revenue to below VND 101 billion and a gross profit margin contraction from 25.3% to 16.8%. The company attributed this to oversupply and illicit sugar in the domestic market, which led to a significant decrease in selling prices and a decline in consumption.

Son La Sugar Joint Stock Company (SLS) recorded a 59% decrease in net profit to VND 96.5 billion, although its gross profit margin remained the highest in the industry at 27.8%, a decrease of 14.6 percentage points. Revenue also fell by 33% to VND 371 billion. Double the financial income could not offset the decline in core business results, while management expenses increased by 240 times compared to the same period. SLS stated that oversupply, weak demand, and illicit trade were the main reasons for the drop in selling prices.

|

A Picture of Two Halves

TTC AgriS (SBT) continued to lead the industry in terms of scale, with revenue of VND 6,846 billion in the fourth quarter, a decrease of 28%. Although the gross profit margin narrowed to 8.4%, net profit still increased by 4% to VND 203 billion due to reduced management and sales expenses and financial income support.

Lasuco (LSS) stood out with the highest profit growth in the industry, achieving a net profit of VND 58 billion, an increase of 91%, despite a 26% decrease in revenue to VND 664 billion. This result was attributed to better cost control, which pushed the gross profit margin up to 18.7% (an increase of 5.9 percentage points), along with reduced fixed costs similar to TTC AgriS.

Quang Ngai Sugar Joint Stock Company (QNS), which follows a January 1 to December 31 fiscal year, has also reflected the market pressure in the first half of the year. Revenue from the sugar segment reached below VND 1,690 billion, a decrease of 23%, and the gross profit margin fell from 31.7% in the same period last year to 23.1%. Consumption volume decreased despite a 16% increase in production due to weak demand and competition from liquid sugar and products of unknown origin. Net profit for the first half of the year fell by 23% to VND 938 billion, falling below the VND 1,000 billion mark for the first time in two years.

Rising Inventories

As of the end of June 2025, inventory levels have increased significantly for most sugar companies compared to the beginning of the fiscal year (early July 2024). Lasuco’s inventory increased by 56% to nearly VND 1,686 billion, mainly due to finished goods (accounting for 93%); KTS increased by 67% to VND 252 billion (finished goods accounting for 87%); SLS increased by 17% to VND 511.5 billion (finished goods accounting for 76%).

TTC AgriS was an exception, with a slight decrease in inventory of 9% to VND 3,590 billion, but finished goods increased by 18% to VND 1,816 billion (accounting for 50%), while raw materials decreased by 33%, maintaining the largest scale in the industry.

Quang Ngai Sugar Joint Stock Company’s inventory nearly doubled from the beginning of 2025 to VND 2,568 billion, with finished goods increasing by more than six times at the beginning of the year, accounting for 84% of the proportion.

Prospects and Conditions for Recovery

The sugarcane supply chain is seasonal and vulnerable to price fluctuations. Export markets do not offset domestic pressure as international prices have only slightly decreased. Policies have not been strong enough to stop illicit sugar imports, which continue to put pressure on prices.

In the second half of 2025, if illicit sugar imports are not controlled, the supply of cheap, unregulated goods will persist, making it difficult for domestic sugar prices to recover sustainably amid oversupply and fierce competition.

Mr. Nguyen Van Loc, Chairman of the Vietnam Sugarcane and Sugar Association (VSSA), warned that if border control is not tightened and illicit trade is not eradicated, all support policies and industry recovery efforts will be in vain, as illicit trade directly impacts the market, pulling down prices and reducing production efficiency.

Controlling illicit sugar is a prerequisite for the industry’s stability. To maintain profitability, businesses need to optimize costs, manage inventory, and expand output through exports or downstream products.

The Rice Industry’s Profit Phase Enters a Period of Selection

The second quarter of 2025 witnessed a stark differentiation in the rice industry as the market entered a phase of filtration. While revenue declines, stockpiles mount, and cash flow endures pressure, some businesses have managed to sustain profit growth through agile operations, prudent cost management, and financial transparency.

“Illicit Tax-Evading Schemes Boost Textile Profits in Q2”

The strategy to boost orders ahead of the US’s 46% tariff implementation proved a remarkable success for Vietnam’s textile industry in Q2 2025. While the subsequent reduction to a 20% tariff provided some relief and potential for growth in Q3 and Q4, it also presented a conundrum for long-term strategic planning.

What’s Happening with FPT: Foreigners Sell for 12 Straight Sessions, Record High Room of 140 Million Shares Despite High Profit Growth

Despite the stock market’s relentless surge to new highs, FPT stock has lagged, falling 20% from its mid-January peak.

Unlocking the Export Potential of Vietnam’s Tropical Fruits: BIG Ventures into Agricultural Business with a Focus on Dollar-Valued Produce

To seize the ever-growing opportunities in the agricultural export market, especially for the “king of fruits” – durian, Big Invest Group JSC (UPCoM: BIG) has swiftly expanded its business into the agricultural produce sector. Along with the establishment of two specialized agricultural produce companies, BIG also forged a strong partnership with a leading durian exporter to China in the Southern region.