As part of its restructuring plan, Viglacera has transferred the operations, functions, and tasks of its Construction Company to the Infrastructure Investment and Development Company. Similarly, the operations, functions, and tasks of the Mechanical Construction Company have been transferred to the Infrastructure and Urban Investment and Development Company.

This strategic move aims to innovate the organizational structure and operations of the Infrastructure Investment and Development Company and the Infrastructure and Urban Investment and Development Company post-transfer. The deadline for implementing this new model for these two companies is set for December 31, 2025.

Regarding its other subsidiaries, Viglacera Joint Stock Company and Viglacera Ceramic Joint Stock Company, the company plans to maintain the current capital structure for now and will divest from these companies at an appropriate time in the future.

On August 21, VGC approved an investment in VIHOCE Tien Duong Joint Stock Company, a newly established enterprise with a registered capital of 1,500 billion VND, in which VGC holds a 55% stake, equivalent to 825 billion VND.

As of the end of June, Viglacera had 22 direct subsidiaries, 6 indirect subsidiaries, 1 joint venture, and 8 associated companies.

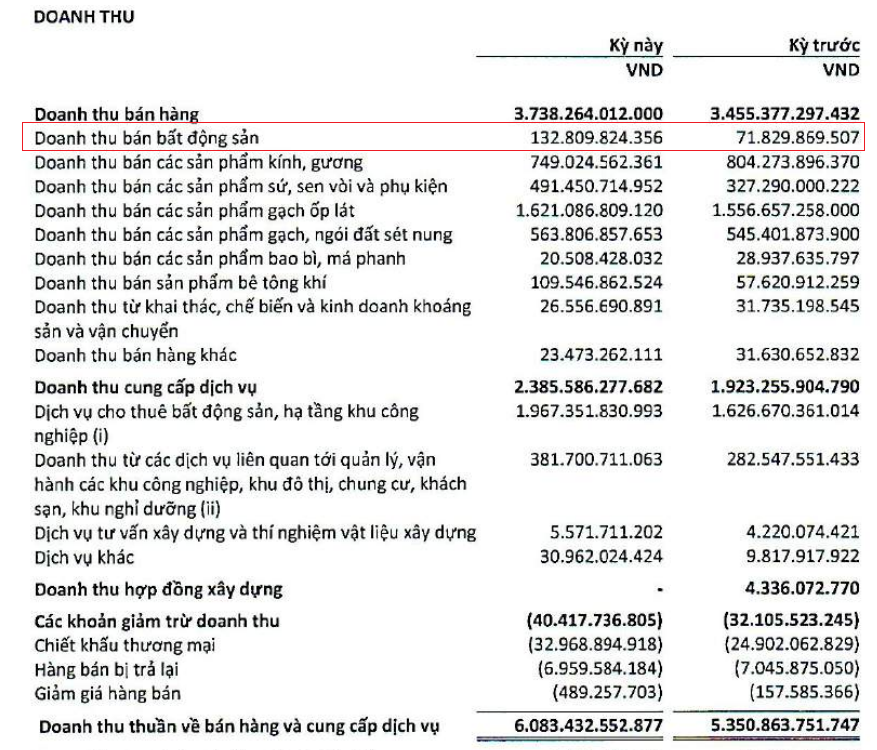

The company recently announced its audited semi-annual financial statements for 2025, reporting a consolidated revenue of over 6,083 billion VND, a 14% increase year-on-year. Notably, its real estate segment contributed nearly 133 billion VND, an impressive 85% increase, albeit accounting for only 2% of the total revenue. The company’s pre-tax profit reached 1,142 billion VND, with a net profit of 759 billion VND, doubling the figures from the previous year.

|

Revenue Structure for the First Half of 2025 of VGC

Source: VGC

|

This impressive performance is attributed to the increased profits from its industrial infrastructure leasing business, improved efficiency in the building materials segment, and higher reversal of financial investment provisions compared to the previous year.

Looking ahead, Viglacera has set ambitious targets for 2025, aiming for a consolidated revenue of 14,437 billion VND and a pre-tax profit of 1,743 billion VND, representing a 21% and 7% year-on-year growth, respectively. With its strong performance in the first half, the company has already achieved 42% and 66% of these targets.

| VGC’s Net Profit for the First Half-Year from 2016 to 2025 |

– 09:41, August 23, 2025

The Ultimate Guide to Choosing the Best Property Investment: Unlock Exclusive Benefits of Up to 12.5%

Happy One Central offers investors a unique opportunity to reap immediate benefits. With our commitment to leaseback, complimentary furniture packages, and waived management fees, investors can enjoy peace of mind and a steady income stream from day one of ownership, eliminating the typical wait for project completion.