**VOSCO Announces 11% Cash Dividend for 2024: A Turnaround for Shareholders After Years of No Payouts**

*Fig: Illustration image*

Vietnam Ocean Shipping Joint Stock Company (Vosco) has announced a positive development for its shareholders. On August 24, 2025, the company’s Board of Directors resolved to distribute a cash dividend for the year 2024, marking a significant turnaround for investors.

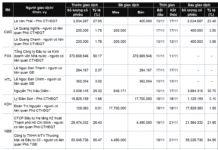

The dividend will be paid at a rate of 11%, meaning that for every 1 share owned, shareholders will receive VND 1,100. The record date for this payout is set for September 12, 2025, with the payment date scheduled for October 10, 2025.

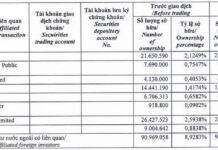

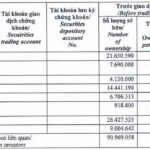

With approximately 140 million VOS shares currently in circulation, Vosco is expected to distribute approximately VND 154 billion in this dividend payout. Of this, the Vietnam National Shipping Lines (VIMC), which holds a 51% stake in Vosco (equivalent to 71.4 million VOS shares), is anticipated to receive over VND 78 billion.

Notably, this dividend distribution marks a breakthrough for Vosco shareholders, who have not received any payouts since 2010. Back then, the company had declared an 8% cash dividend for the year 2010, translating to VND 800 per share.

Turning to Vosco’s financial performance, the company’s audited consolidated financial statements for the first half of 2025 paint a mixed picture. Revenue for this period stood at nearly VND 1,298 billion, reflecting a significant decrease of 56.3% compared to the same period in 2024. After accounting for cost of goods sold, Vosco reported a gross loss of nearly VND 1.7 billion.

However, the company’s financial income for the period showed a positive trend, increasing by 10.3% year-over-year to reach over VND 35.2 billion. On the other hand, financial expenses also surged by 206.3% to VND 14.7 billion.

In terms of operating expenses, selling expenses decreased by 12.2% to VND 30.3 billion, while general and administrative expenses saw a reduction from VND 42.3 billion to VND 31.2 billion.

Ultimately, for the six-month period ending June 30, 2025, Vosco reported a net loss of nearly VND 43.6 billion, contrasting the net profit of nearly VND 358.4 billion recorded in the previous year.

As of June 30, 2025, Vosco’s total assets stood at nearly VND 3,472.8 billion, representing a 20.1% increase since the beginning of the year. Fixed assets accounted for VND 1,164.4 billion, or 33.5% of total assets, while cash and cash equivalents exceeded VND 587.6 billion. Short-term financial investments were valued at VND 554 billion.

On the liabilities side, as of the same date, Vosco’s total liabilities amounted to over VND 1,705.3 billion, an increase of 89% compared to the start of the year. Borrowings and finance lease obligations stood at VND 589.4 billion, making up 34.6% of total liabilities, while current and non-current payables totaled VND 895.2 billion, or 52.5% of total liabilities.