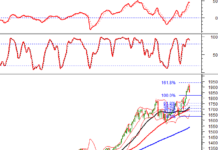

Investors experienced a tumultuous weekend trading session on the stock market, with the VN-Index plunging by as much as 58 points at one point. The market recovered to 1,645 points by the end of the session but still lost over 42 points. A slew of stocks plummeted or hit their daily limit downs, sparking investor concerns about a downward trend.

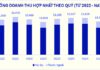

The trading volume for the weekend session reached $2.7 billion across all three exchanges, with the Ho Chi Minh Stock Exchange (HOSE) alone accounting for nearly VND 63 trillion. What’s happening with the VN-Index at present? Is this adjustment normal or abnormal in the investment strategy for this period?

Reporters from NLD (Nguyen Lao Dong) Newspaper gathered opinions from securities experts.

Mr. Dinh Minh Tri, Director of Individual Customer Analysis, Mirae Asset Securities Company:

Technical rebound is an opportunity to reduce stock holdings and mitigate risks

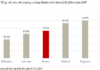

Since mid-June, the market has witnessed a strong upward wave. Over the past nine weeks, the VN-Index has risen continuously and rather heatedly, so a corrective phase is necessary.

Mr. Dinh Minh Tri

This was a typical trading session. Buying pressure had been mounting for several consecutive weeks. VPB, the ticker symbol for VPBank, for instance, had repeatedly hit the ceiling right after the market opened, pushing its price exceedingly high. It’s understandable that profit-taking occurred during the weekend session, sending the stock down to even the floor price. This is merely a necessary profit-taking phase for stocks that had soared in the previous period.

Some studies indicate that when the VN-Index surges by 50-70% in a short period, a correction of 10-20%, or even 25%, is likely to ensue. The VN-Index has now entered a corrective phase. After nine consecutive weeks of gains, a decline is inevitable.

Typically, corrective waves last one to three weeks, especially in the context of the current short-term cash flow. The VN-Index decline could extend until mid-September. By then, the market will have additional positive news, such as the anticipated strong third-quarter business results and the possibility of US interest rate cuts.

VN-Index on a “roller coaster” ride, with many stocks plunging after a strong rally

At this juncture, short-term investors should focus on risk management and reduce their holdings if necessary. During this corrective phase, stocks that experience sharp declines often witness technical rebounds, presenting opportunities to lower holdings and mitigate risks. Short-term investors need to be particularly cautious, as the market is currently very sensitive and prone to unexpected news. Without proper risk management, their portfolios could sustain losses.

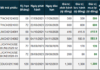

For medium and long-term investors, the upcoming period presents opportunities. Cash flow in the market remains abundant, as evidenced by the high cash balances held by investors at securities companies in Q2/21025. When the market corrects, this could be a reasonable entry point, and stock selection should emphasize fundamental factors, as these will determine the next wave.

Mr. Nguyen The Minh, Director of Individual Customer Analysis, Yuanta Vietnam Securities Company:

Bottom-fishing for stocks is not advisable yet

After the recent heated rally, it’s essential for the VN-Index to undergo a corrective phase. Last week, the market exhibited several warning signals, including surging cash flow, mounting exchange rate pressure, and foreign investors’ net selling in the past ten sessions. Margin ratios are currently quite high. Since Q2, the margin ratio relative to market capitalization has exceeded 5%, indicating substantial margin pressure. Consequently, many securities companies have hit their margin limits.

Mr. Nguyen The Minh

Considering the current differentiation, the market breadth has narrowed. Midcap and small-cap stocks suffered heavy selling in the last two sessions, while large-cap stocks rose primarily due to banks. The market’s performance is not genuinely healthy, indicating that corrective pressure is inevitable.

Is this normal corrective pressure likely to persist? In my view, there’s a high probability that the market will correct by about 7-10%. Another noteworthy aspect is the market’s valuation, particularly for banks, which has climbed significantly.

The price-to-book ratio (P/B) for this sector has reached two times, and historically, when P/B reaches this level, corrective pressure tends to emerge. If bank stocks undergo a correction, it will undoubtedly impact the overall index.

VN-Index dipped to its intraday low of 1,632 points before rebounding towards the session’s end

Investors who use margin should reduce their leverage to a low level and strive for a balanced portfolio, with equities accounting for around 50-60% of their assets. Despite the VN-Index’s robust gains in the last two to three sessions, many investors’ portfolios might not have increased proportionately because the rally was primarily driven by banks, while other stocks declined sharply. Therefore, it’s prudent to consider selling stocks with meager profits to safeguard against a deeper market downturn.

Purchasing new stocks is inadvisable at this juncture due to the elevated risk, especially for midcap and small-cap stocks. The indices for these stock categories have confirmed a downward trend, so bottom-fishing is not recommended during a steep market correction.

Looking ahead, the VN-Index’s decline is likely short-lived, and the medium and long-term outlook remains bullish.

“Shareholders Receive First Dividend Payout After a 14-Year Wait”

Despite incurring losses of nearly VND 44 billion in the first half of the year, Vietnam Maritime Transport Joint Stock Company (stock code: VOS) distributed VND 154 billion in dividends to its shareholders. Notably, this marks the first time since 2011 that VOS shareholders have received dividends.

Expert Opinion: A 5% or More Rate Hike Isn’t a Negative Signal

The experts at LCTV predict that the market is undergoing a short-term technical correction rather than a trend reversal.

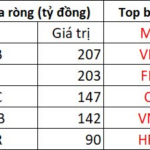

The Foreign Sell-Off Cools, Yet a Bank Stock Still Takes a 500 Billion Dong Hit

In the afternoon trading session, foreign investors net bought SHB and VIX stocks the most in the market, with a value of over 200 billion VND each.