Accelerating Investment: Injecting Capital into Vietnam’s Infrastructure and Economy

On August 19, 250 projects with a total investment of approximately VND1.28 quadrillion were inaugurated and commenced across Vietnam. Of these, 129 are state-funded projects, accounting for VND478,000 billion, or 37% of the total investment. The remaining 121 projects are funded by other sources, contributing VND802,000 billion, or 63% of the total.

Mr. Le Anh Tuan, Deputy Minister of Construction, emphasized that these 250 projects are expected to contribute over 18% to the country’s Gross Domestic Product (GDP) this year and over 20% in the following years.

“The state-funded projects will create a strategic infrastructure framework, attracting and leading private investment,” said Deputy Minister Le Anh Tuan.

In addition to public investment, there are also projects funded by private sector investment, including foreign direct investment (FDI). Out of the 250 projects, five are FDI projects with a total investment of VND54,000 billion. This showcases the government’s significant efforts in mobilizing social resources for investment, production, and business, especially in building strategic infrastructure.

According to the Ministry of Finance, to achieve the growth target of 8.3-8.5% this year, total social investment must increase by 11-12% compared to the previous year. This includes mobilizing and implementing social investment capital in the last six months, targeting approximately VND2.8 quadrillion.

The State Bank of Vietnam estimates that to attain the high growth target, credit must increase by 16% this year, with about VND2.5 quadrillion injected into the economy. Recently, the bank announced a credit package of VND500,000 billion from 21 banks for science, technology, innovation, digital transformation, and strategic infrastructure (including transportation, power, and digital infrastructure).

Massive investment in transportation infrastructure.

In practice, many banks have provided loans for projects in science, technology, innovation, digital transformation, and strategic infrastructure, such as the Long Thanh Airport, Nhon Trach 3 and 4 Power Plants, and the Laos Cai-Vinh Yen transmission line. They have also financed BOT projects, power production, and transmission projects. Most recently, the bank has participated in financing a portion of the 500KV transmission line project.

Mr. Hoang Minh Ngoc, Deputy General Director of Agribank, stated, “Having assets or a credit guarantee is just one of the conditions; banks usually lend based on the customer’s credibility. For example, for the VND500,000 billion package, businesses only need to prove their eligibility to obtain the loan.”

Caution on Inflation Risks

To achieve the 8.5% growth target for this year while maintaining inflation control, macroeconomic stability, and economic balances, monetary policy plays a crucial role.

The banking sector must increase capital supply to the economy, requiring policymakers to navigate the challenge of directing capital to priority sectors and managing interest rate competition among banks as credit demand surges.

So far this year, the interest rate for deposits has remained stable, and lending rates have even decreased by 0.4% compared to the end of last year. Inflation is also under control.

However, inflationary pressures are mounting, and increasing the money supply will further intensify these pressures. Additionally, exchange rates are facing dual pressure from economic factors and market sentiment.

Economist Ngo Tri Long affirmed to Tien Phong newspaper that injecting substantial capital into the economy aims to boost economic development. This capital is channeled into infrastructure projects that stimulate economic growth and create positive spillover effects.

Nonetheless, Mr. Long cautioned that the initial success in controlling inflation during the first six months resulted from the effective coordination of monetary, fiscal, trade, and price management policies. However, the path ahead remains uncertain, and maintaining the CPI target of 4-4.5% for the whole year demands consistent and flexible governance, enhanced forecasting capabilities, and proactive policy responses.

Specifically, the State Bank of Vietnam should maintain stable basic interest rates, with credit growth focused on and revolving around the 16% target. Credit flow should be directed towards export and production sectors that are essential for GDP growth, avoiding sectors that could trigger price hikes.

Fiscal policy should provide controlled support, especially refraining from significant tax and fee adjustments to prevent cost-push inflationary pressures on end consumers. Public investment (with a disbursement rate of 36% as of June) should be directed towards infrastructure and internal capacity building, increasing medium-term supply without abruptly creating short-term demand pressure.

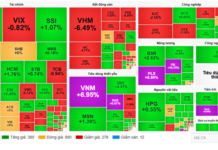

The VN-Index Plunges

The VN-Index witnessed a significant decline of 2.5% or 42.53 points on August 22nd, marking the most substantial drop since the beginning of August.

The Future of Ho Chi Minh City’s Infrastructure Post-Merger

“At a recent seminar, Dr. Pham Tran Hai, a prominent researcher at the Ho Chi Minh City Institute for Development Studies (HIDS), shared insightful thoughts on the city’s development trajectory post-merger. The focus, he emphasized, should be on two critical aspects: fostering the economic and social growth of the newly expanded Ho Chi Minh City, and strategically planning population distribution in tandem with infrastructure development.”

The Ultimate Guide to Choosing the Best Property Investment: Unlock Exclusive Benefits of Up to 12.5%

Happy One Central offers investors a unique opportunity to reap immediate benefits. With our commitment to leaseback, complimentary furniture packages, and waived management fees, investors can enjoy peace of mind and a steady income stream from day one of ownership, eliminating the typical wait for project completion.