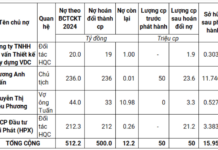

Aqua City Corporation (Aqua City) recently submitted a report on bond interest and principal payments for the first half of 2025 to the Hanoi Stock Exchange (HNX).

According to the report, the developer of Aqua City made timely interest payments totaling 24 billion VND for the bond codes TPACH2125001, 24 billion VND for TPACH2124002, 29 billion VND for TPACH2024003, and over 24 billion VND for TPACH2025004.

On January 15, 2025, the issuer repurchased 298 billion VND of the TPACH2025004 bond code, out of a total issuance value of 800 billion VND, reducing the outstanding value to 502 billion VND.

By the principal payment date of June 23, 2025, Aqua City had paid 100 million VND out of a total of 502 billion VND. The remaining 501.9 billion VND was paid on July 1, 2025, fully repaying this bond lot.

As of July 1, 2025, the developer of Aqua City had outstanding bonds totaling 1,600 billion VND, including: 500 billion VND of TPACH2125001 bonds issued on September 17, 2021, 500 billion VND of TPACH2124002 bonds also issued on September 17, 2021, and 600 billion VND of TPACH2024003 bonds issued in June 2020.

The above three bond lots have had their maturities extended, along with adjustments to interest rates and secured assets.

Aerial view of Aqua City project

Aqua City Corporation is a subsidiary of Novaland Group (Novaland, code: NVL) and the developer of the mega Aqua City project in Bien Hoa City, Dong Nai Province.

Aqua City is a pivotal and crucial project for Novaland. It spans over 1,000 hectares, 1.5 times the size of Ho Chi Minh City’s District 1. The total investment amounts to approximately 8 billion USD.

The project enjoys a prime location along the Dong Nai River and is envisioned to become a large-scale satellite city in the east of Ho Chi Minh City.

In terms of financial performance, Aqua City reported a net profit of nearly 547 billion VND in 2024, a significant increase from the loss of over 359 billion VND in 2023.

As of the end of 2024, the company’s owner’s equity stood at nearly 1,678 billion VND, a 48.5% increase compared to the previous year.

Total liabilities were at 10,972 billion VND, including other payables of over 8,536 billion VND.

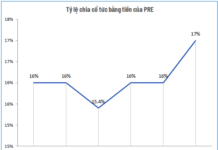

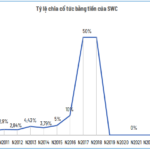

“SWC Finalizes Cash Dividend with a Payout of VND 3,500 per Share”

Southern Waterways Joint Stock Company (UPCoM: SWC) will finalise the list of shareholders eligible for the 2024 cash dividend payout at a rate of 35% (equivalent to VND 3,500 per share). The ex-dividend date is set for August 28, and payments will be made starting from September 15.

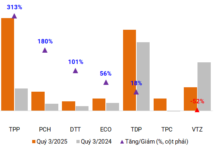

A Leading Airline Enterprise Finalizes the Payment Date for its 2024 Remaining Dividend of VND 285 Billion, Preparing for Long Thanh Airport Operations

With 94 million shares outstanding, the company is expected to dish out VND 284.5 billion in dividends for this payout.