Dao Hong Duong, Director of Industry and Stock Analysis at VPBank, shared at the event

|

There are grounds for expecting new peaks

In terms of fundamental analysis, the market’s current P/E is around 15 times, slightly higher than the 10-year average, but still far from the average plus one standard deviation. It is important to emphasize that the large inflows of capital into the market over the past time were not simply waiting for a P/E of 15 times, but were expecting more in terms of profit growth.

By the end of Q2 2025, the after-tax profit of the whole floor increased sharply. Bloomberg forecasts a forward P/E of 12.8 times for 2025, implying a market EPS growth expectation of 18-20% compared to 2024. At this P/E, the market valuation remains attractive.

The difference from the 2021 period (during Covid) is that the market rose then due to fiscal and monetary support policies in the context of a declining GDP. Now, GDP is growing strongly, so the determining factor is not cash flow but profit expectations.

From a technical analysis perspective, Elliott Wave Theory suggests that a primary corrective wave (wave 2) should be equal to one-third to two-thirds of the previous upward wave. However, the recent declines (05/06 and 29/07) have not yet reached this threshold, indicating that they are secondary disturbances within the uptrend and are not sufficient to be considered a corrective wave. According to the model, a major correction is only confirmed when the VN-Index falls back to around 1,450 points, which is still quite far off.

Therefore, from both fundamental and technical perspectives, it cannot be concluded that the market has peaked. There are still grounds for expecting new peaks in the coming time.

Waiting for the Fed’s decision

According to VPBank’s expert, in the short term, some notable factors that will affect investor sentiment and market trends include exchange rate movements, especially after the State Bank intervened by selling at a 180-day maturity at a blocking rate of 26,550 VND/USD; the FTSE Russell market upgrade review at the end of September to early October; and trade balance developments, especially August and September exports. Exports are still strong, with a surplus of over $10 billion, but there are signs of slowing down in the first half of August, so further monitoring is needed.

Another extremely important factor is whether the Federal Reserve (Fed) will cut interest rates at its meeting on September 17. According to the CME FedWatch tool, the probability of a Fed rate cut is currently around 75% – a very high probability that the Fed will cut rates.

A 0.25% rate cut by the Fed would have a dual impact on the psychology of the Vietnamese market. First, investors will expect more room for domestic monetary policy in the last six months, promoting growth. Second, the exchange rate is likely to be blocked at 26,550 VND/USD, eliminating concerns about devaluation from now until the end of the year. These two factors could trigger a positive cash flow back into the market.

However, if the Fed does not cut interest rates, the trend will still be stable and not turn negative.

Diversifying your portfolio is essential

In terms of cash flow, according to Mr. Duong, the banking sector – which has seen strong inflows and led the trend recently – will continue to attract cash flow. In addition, with the launch of a series of national projects worth trillions of dong, stocks related to public investment, construction, and infrastructure will benefit in the coming time.

In the previous period, if investors chose to trade according to the trend, the efficiency often outperformed balanced allocation. Now, as the market starts to slow down in groups that have risen sharply, investors should rebalance their portfolios.

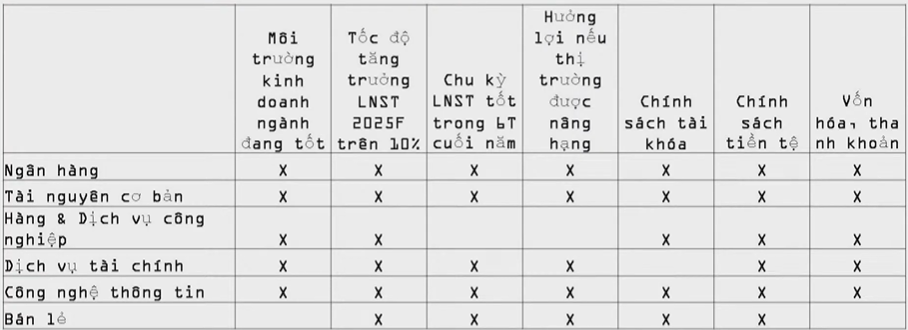

However, it is not necessary to give up trend trading, but only need to allocate more reasonably. The factors to consider when making decisions include a favorable industry business environment; after-tax profit growth rate in 2025 of over 10%; a good after-tax profit cycle in the last six months; benefit from market upgrade; fiscal and monetary policy; capitalization and liquidity.

Accordingly, the six sectors that should be prioritized in the investment portfolio in the second half of the year include banks (leading cash flow, cheap P/B); basic resources; industrial goods & services (electrical equipment, ports, maritime transport); financial services (focusing on securities, benefiting from both the market and policies); retail (dependent on the recovery of the ICT & CE industry, profit cycle falls in Q3 – 4); and information technology (2025 EPS growth of 18-20%, attractive valuation, strong benefit if upgraded).

|

6 sectors to prioritize in the portfolio in the second half of 2025

Source: VPBank

|

Huy Khai

– 19:28 25/08/2025

“NCB’s Solution to Large-Scale Travel Agencies’ Liquidity Issues”

“National Commercial Joint Stock Bank (NCB) has unveiled a range of tailored credit solutions exclusively for large enterprises in the securities and entertainment tourism industries. These innovative financial offerings are designed to empower businesses with enhanced cash flow management, bolstered competitive advantage, and the ability to seize emerging growth opportunities.”

“Tailored Financial Solutions for Tourism, Entertainment, and Securities Giants: NCB’s Promise”

“National Commercial Joint Stock Bank (NCB) has unveiled a range of tailored credit solutions exclusively for large enterprises in the securities and entertainment tourism industries. These innovative financial offerings are designed to empower businesses with enhanced cash flow management, enabling them to boost their competitive edge and seize emerging growth opportunities.”