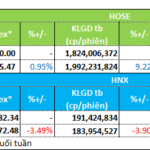

Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 1.44 billion shares, equivalent to a value of more than 40 trillion dong; HNX-Index reached over 117 million shares, equivalent to a value of more than 2.62 trillion dong.

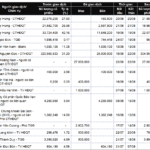

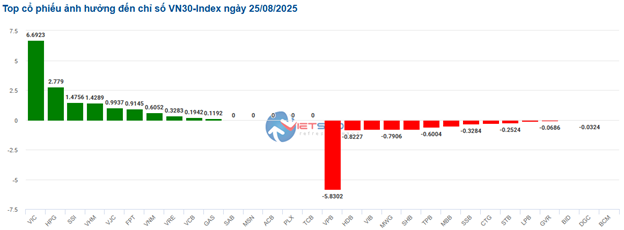

VN-Index opened the afternoon session with an unfavourable development as the tug-of-war continued and sellers gradually gained the upper hand, causing the index to plunge and close in the red. In terms of impact, VPB, BID, TCB, and CTG were the codes that negatively affected the VN-Index the most, with a decrease of 12.5 points. On the other hand, VIC, SSI, GAS, and VJC remained in the green and contributed more than 7.9 points to the overall index.

| Top 10 stocks with the most significant impact on the VN-Index on 25/08/2025 (in points) |

Similarly, the HNX-Index also witnessed a rather pessimistic performance, with the index being negatively influenced by NVB (-9.04%), SHS (-4.38%), BAB (-6.04%), and KSV (-2.48%)…

|

Source: VietstockFinance

|

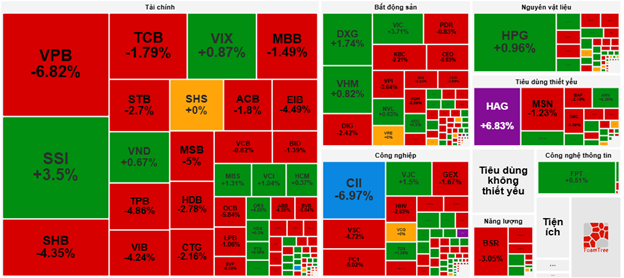

At the close, red dominated most industry groups. The financial sector witnessed the most significant decline in the market, falling by 3.95%, mainly due to VCB (-1.55%), BID (-5.2%), VPB (-6.82%), and TCB (-3.72%). This was followed by the energy and materials sectors, which decreased by 3.65% and 1.18%, respectively. Conversely, the real estate industry was the only sector to remain in the green, rising by 1.2%, mainly driven by VIC (+5.56%), VHM (+0.31%), DXG (+1.49%), and NVL (+0.94%).

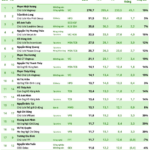

In terms of foreign trading, they continued to sell a net amount of more than 1,749 billion dong on the HOSE exchange, focusing on HPG (586.03 billion), VPB (433.81 billion), STB (244.56 billion), and VHM (230.02 billion). On the HNX exchange, foreigners sold a net amount of more than 24 billion dong, focusing on CEO (28.33 billion), MBS (16.67 billion), IDC (12.44 billion), and NVB (5.64 billion).

| Foreign Trading Buy – Sell Net |

Morning Session: Bleak Liquidity as Red Takes Over

The main indices were all in the red at the end of the morning session. By midday break, the VN-Index fell 0.81% to 1,632.11 points, while the HNX-Index dropped to 271.62 points, down 0.32%. The number of declining stocks gradually increased, with 375 stocks falling and 316 rising.

Investors became more cautious after the strong fluctuations of the previous week. The trading volume on the HOSE in the morning reached over 18 trillion dong, a decrease of 41.5% compared to the previous session. HNX recorded a volume of over 50 million units, equivalent to 1.1 trillion dong.

Source: VietstockFinance

|

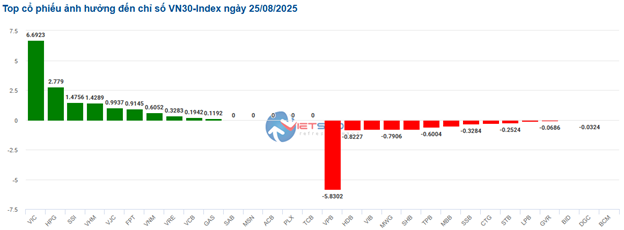

In terms of impact on the VN-Index, VPB was the biggest drag, taking away 4.3 points from the index. On the other hand, VIC was a notable bright spot, contributing positively to the index.

Red dominated many industry groups, with the financial sector witnessing the most significant decline, especially banking stocks such as BID (-1.39%), TCB (-1.79%), CTG (-2.16%), STB (-2.7%), HDB (-2.78%), VIB (-4.24%), and VPB (-6.82%).

Additionally, the energy and non-essential consumer goods sectors also witnessed notable corrections of over 1%, as selling pressure dominated large-cap stocks in these sectors, including BSR (-3.05%), PVS (-0.88%), OIL (-3.36%); VPL (-0.99%), MWG (-1.71%), FRT (-1.3%), DGW (-1.43%), HUT (-2.89%), and HHS (-3.26%).

On the other hand, real estate temporarily led the market with a 1.1% increase, thanks mainly to gains in VIC (+3.71%), VHM (+0.82%), SSH (+0.66%), and DXG (+1.74%). However, many stocks in this sector faced strong profit-taking pressure, including BCM (-1.2%), KBC (-2.21%), VPI (-3.64%), DIG (-2.42%), TCH (-3.65%), and SJS (-4.31%).

Source: VietstockFinance

|

Foreigners continued to net sell, with a value of more than 1.6 trillion dong on the three exchanges. The selling pressure was concentrated mainly on VPB, with a net sell value of 363.66 billion dong. In contrast, SSI led the net buy side with a value of 144.44 billion dong.

| Top 10 stocks that foreigners bought and sold the most in the morning session of 25/08/2025 |

10:30 am: Investor Indecision Leads to Market Polarization

Investors remained indecisive, resulting in stagnant trading volume, and the main indices fluctuated around the reference level. As of 10:30 am, the VN-Index hovered near the reference level, trading around 1,646 points. The HNX-Index also witnessed a tug-of-war and maintained a slight increase, trading around 273 points.

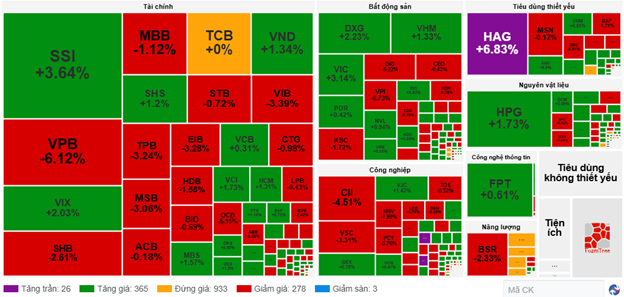

The breadth of the VN30-Index basket was quite polarized, with 10 gainers, 15 losers, and 5 unchanged stocks. Specifically, on the gaining side, VIC and HPG were the two codes that contributed the most to the index’s gain, adding nearly 10 points. Conversely, the selling pressure was concentrated in VPB, which decreased by 5.8 points.

Source: VietstockFinance

|

Green prevailed in most industry groups, with the real estate sector recording a strong performance, leading the market with a gain of 1.57%. Buying pressure was concentrated in stocks such as VHM, which rose by 2.34%, VIC by 6.54%, NVL by 5.8%, and VRE by 0.35%…

Following closely was the materials sector, which also contributed significantly to the market’s gain, with notable increases in stocks such as HPG (+1.92%), DCM (+2.49%), DPM (+2.28%), HT1 (+2.81%), and PRT (+8.18%).

Meanwhile, the financial sector continued to witness polarization, with selling pressure slightly outweighing buying interest. Specifically, red dominated stocks such as VPB, which fell by 6.12%, SHB by 2.61%, TPB by 3.24%, VIB by 3.39%, and MSB by 3.06%. On the other hand, green prevailed in SSI, which rose by 3.64%, VIX by 2.03%, VND by 1.34%, SHS by 1.2%, and MBS by 1.57%.

Compared to the opening, the buying side continued to dominate, with 365 gainers and 278 losers.

Source: VietstockFinance

|

Opening: Positive Start to the Week

After the profit-taking pressure at the end of the previous week, the stock market started the new week on a positive note. As of 9:30 am, the VN-Index had gained over 6 points to reach 1,654.3 points, while the HNX-Index traded around 274 points.

Last Friday (August 22), in a speech ahead of the Federal Reserve’s annual symposium, Chairman Jerome Powell signaled that the Fed could cut interest rates in September amid challenges posed by rising inflation risks and a weakening job market. This news immediately boosted investor sentiment, driving US stocks higher.

This morning, green returned to the Vietnamese stock market after a sharp decline last Friday. VIC, HPG, and VCB were the leading stocks that drove the VN-Index higher in the early session, contributing a total of 3.5 points to the index. Conversely, VPB and LPB caused the index to lose more than 3 points.

FPT‘s positive performance (+2.22%) helped the information technology sector lead the gainers among industry groups. Additionally, the real estate sector also contributed significantly to the overall index, with many stocks rising over 1%, including VIC, VHM, KBC, NVL, PDR, KDH, DXG, IDC, DIG, HDC,…

In contrast, the financial sector gradually turned negative as many stocks faced strong selling pressure at the beginning of the session, including VPB (-3.06%), TPB (-3.7%), LPB (-3.19%), MSB (-1.67%), OCB (-3.09%),…

– 15:19 25/08/2025

Stock Trading Leadership: Selling Pressure Intensifies

“Executive Insider Trading Summary: Week of August 18-22, 2025. A review of this week’s transactions reveals a notable trend; executives and insiders are selling more stocks than they are buying, indicating a cautious sentiment in the market.”

Market Beat: Indecision Creeps In, Market Polarizes

The investor sentiment remains cautious, resulting in lackluster trading volumes and a tug-of-war between the major indices around the reference levels. As of 10:30 am, the VN-Index hovered near the reference level, trading around 1,646 points. The HNX-Index exhibited a similar back-and-forth pattern, managing to maintain a slight gain and trading at around 273 points.