Technical Signals for the VN-Index

During the morning trading session on August 25, 2025, the VN-Index witnessed a decline and formed a Big Black Candle pattern, indicating a rather pessimistic sentiment among investors.

Additionally, the MACD indicator has triggered a sell signal. If there is no improvement in the afternoon session, a negative scenario is likely to unfold in the upcoming sessions.

Technical Signals for the HNX-Index

In the morning session of August 25, 2025, the HNX-Index declined and formed an Inverted Hammer candlestick pattern, reflecting investors’ pessimistic sentiment.

Furthermore, the HNX-Index remains below the Middle line of the Bollinger Bands, while the Stochastic Oscillator has fallen out of the overbought region after triggering a sell signal. This suggests that the short-term downside risk is present.

ANV – Nam Viet Joint Stock Company

On the morning of August 25, 2025, ANV’s stock price surged and formed a Big White Candle pattern, indicating investors’ optimistic sentiment.

However, the Stochastic Oscillator has fallen out of the overbought region after triggering a sell signal, suggesting that the short-term downward adjustment trend is still present.

Additionally, the MACD continues to decline after triggering a sell signal, further adding to the short-term pessimism.

BMP – Binh Minh Plastic Joint Stock Company

During the morning of August 25, 2025, BMP’s stock price rose, forming a Rising Window candlestick pattern with trading volume expected to exceed the average by the end of the session, reflecting investors’ optimism.

Moreover, the Stochastic Oscillator continues to rise after triggering a buy signal in the oversold region. If the indicator surpasses this region in the upcoming sessions, a recovery trend is likely to emerge.

(*) Note: The analysis in this article is based on real-time data up to the end of the morning session. Therefore, the signals and conclusions are for reference only and may change when the afternoon session ends.

Technical Analysis Department, Vietstock Consulting

– 12:05, August 25, 2025

Market Beat: Indecision Creeps In, Market Polarizes

The investor sentiment remains cautious, resulting in lackluster trading volumes and a tug-of-war between the major indices around the reference levels. As of 10:30 am, the VN-Index hovered near the reference level, trading around 1,646 points. The HNX-Index exhibited a similar back-and-forth pattern, managing to maintain a slight gain and trading at around 273 points.

The Stock Market’s Best-Kept Secret: Banking on Big Gains

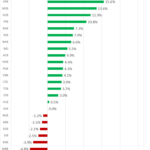

Last week, from August 18 to 22, 2025, a slew of bank stocks witnessed an impressive surge, with gains exceeding 10%. This significant upward trend underscores the robust performance and resilience of the banking sector, highlighting its potential for investors seeking lucrative opportunities in the financial realm.

What Do Experts Say About the Stock Market’s “Rollercoaster” Session, With a Turnover of $2.7 Billion?

The stock market, after rallying for almost four consecutive months, has finally taken a much-needed breather. But is this a cause for concern or simply a healthy correction?

“Shareholders Receive First Dividend Payout After a 14-Year Wait”

Despite incurring losses of nearly VND 44 billion in the first half of the year, Vietnam Maritime Transport Joint Stock Company (stock code: VOS) distributed VND 154 billion in dividends to its shareholders. Notably, this marks the first time since 2011 that VOS shareholders have received dividends.