In the resolution dated August 12, the VPI Board of Directors approved the use of VPI shares owned by Chairman of the Board, To Nhu Toan, as collateral for an upcoming bond issue of VND 250 billion, most likely the VPI12502 lot.

Also in this resolution, VPI, as the owner, agreed to contribute an additional VND 250 billion to increase the capital of Ltd. Investment Van Phu – Giang Vo (a wholly-owned subsidiary of VPI).

Earlier, in May 2025, VPI issued bonds with the code VPI12501 worth VND 150 billion, with a term of 3 years, maturing on 05/09/2028. The interest rate for the first two periods was 10.5%, and for the subsequent periods, it was calculated as the reference rate plus 4.5%/year. Interest is paid every six months from the issuance date. The collateral for this bond issue is 6.52 million VPI shares owned by Mr. Toan.

According to the Hanoi Stock Exchange (HNX), VPI has two other bond lots issued in 2024, with codes VPIH2426001 (VND 150 billion, term of 24 months, maturing on 06/27/2026) and VPIH2427002 (VND 250 billion, term of 36 months, maturing on 12/31/2027). These bonds are secured by 14 million VPI shares and 9.6 million VPI shares of third parties, respectively.

The VPIH2426001 bond has an interest rate of 11%/year for the first two interest periods, and then it is calculated as the reference rate plus 4%/year. The VPIH2427002 bond also has an interest rate of 11%/year but for the first four interest periods, with the remaining periods calculated as the reference rate plus 4.5%/year.

Also in 2024, Van Phu – Giang Vo contributed an additional VND 650 billion to Union Success Vietnam JSC (another subsidiary of VPI) to increase its ownership from 82.9% to 93.7%.

In addition to the four bond lots on the HNX system, VPI‘s consolidated financial statements for Q2 2025 also showed another bond lot with an outstanding balance of nearly VND 646 billion as of June 30, 2025, maturing in January 2027. The interest rate for this bond is 11% for the first two interest periods and the reference rate plus 4%/year for the subsequent periods. This bond is secured by the ownership area on floors 1, 2, 3, 4, 21, and 22 of the mixed-use and residential project at 138B Giang Vo, Hanoi, along with 19.8 million VPI shares of a third party.

Mixed-use and residential project at 138B Giảng Võ (Grandeur Palace – Giảng Võ)

|

The mixed-use and residential project at 138B Giang Vo, known commercially as Grandeur Palace – Giang Vo, is developed by Van Phu – Giang Vo with a scale of 9,031m2 and a total investment of VND 2,441 billion.

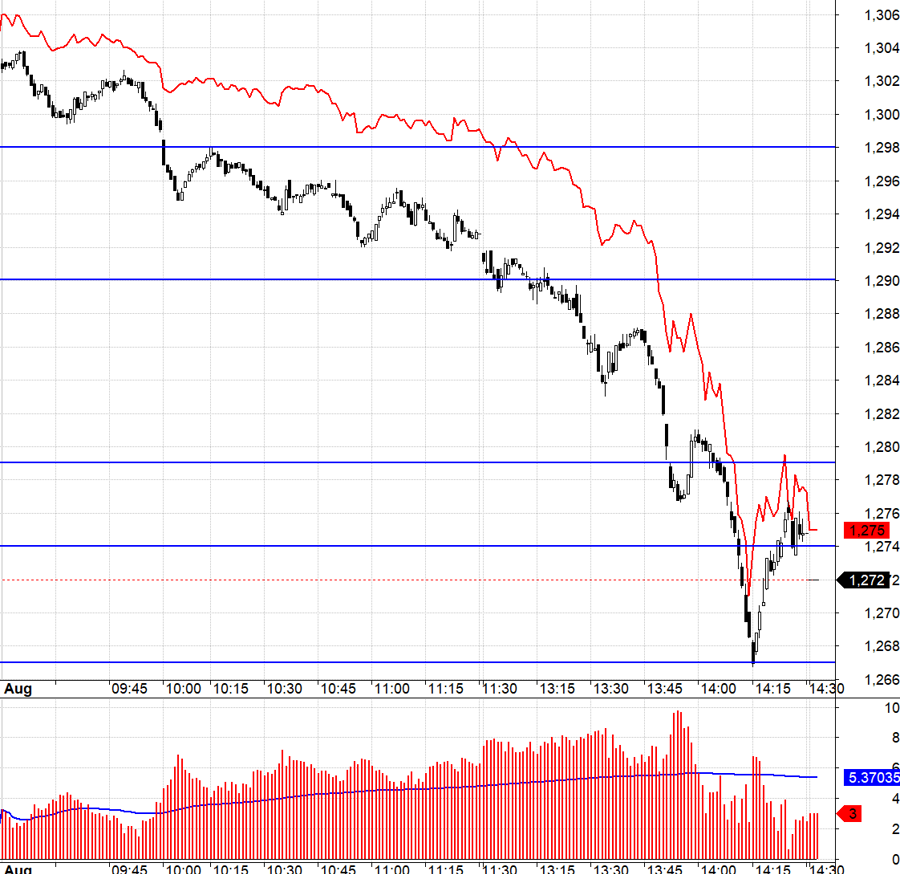

| Movement of VPI shares since the beginning of the year |

– 17:13 25/08/2025

What Do Rising Bank Bad Debts Tell Us?

The mounting bad debt in Vietnam’s banking sector, which has risen to a worrisome level of over VND 294,000 billion since the beginning of the year, poses a significant concern for the country’s economy. To address this issue, a multifaceted approach is necessary. This includes regulating and controlling credit in the economy, expediting the resolution of bad debts, and continuing the restructuring of weak banks to fortify and promote a robust and healthy banking system.

“Major Bank Auctions Off $7 Million Debt of Real Estate Tycoon in Quang Ninh Province”

The BIDV is auctioning off a combined debt of VND 173 billion from the Ha Long Port Business Joint Stock Company and the Southeast Asia Logistics Joint Stock Company.

The Largest Shareholder Pledges All EVS Shares to Back EVS Securities Loan.

Mr. Tien Vu Manh, a prominent member of the Board of Directors, has demonstrated his unwavering commitment to the company by pledging his entire holdings of 16 million EVS shares, along with associated assets, as collateral for a loan taken by EVS Securities. This bold move underscores Mr. Manh’s strong belief in the company’s prospects and his willingness to personally ensure its financial stability.