In her heartfelt letter sent out at the end of the week, Ms. Nguyen Trinh Thuy Trang, Deputy General Director of Operations at Coteccons, shared that the 2025 financial year’s results were not just numbers but a vibrant testament to the “OwnIt” action culture. According to Ms. Trang, Coteccons proactively overcame a challenging year through the dedication and sense of responsibility of each member of the organization.

For the 2025 financial year, Coteccons recorded a revenue of VND 24,867 billion, a 12.5% increase from the previous year, and achieved 99.5% of its plan. Notably, BU1 exceeded its plan by 12%, BU2 by 15%, and BU3 achieved 81%.

Along with positive business results, the performance evaluation system showed that the proportion of excellent (O) performers accounted for 5-6%, and the high-efficiency (HE) group reached nearly 30%. The top performers were rewarded with up to six months’ salary, while the outstanding HE group received 4.5 months’ worth of bonuses. Ms. Trang referred to this as a well-deserved recognition for those who exceeded expectations.

In her letter, Ms. Trang emphasized fairness and transparency in the evaluation process. She believes that fairness should not be based on sentiment but on a systematic and data-driven approach. The publication of evaluation ratios by groups, from excellent to needing improvement, is part of the effort to build a culture of transparency and trust. For those in the needing improvement (NI) group, Coteccons does not exclude but encourages direct dialogue with management to reflect and bring about change.

Ms. Nguyen Trinh Thuy Trang, Deputy General Director of Operations at Coteccons.

In the 2025 financial year, Coteccons secured a bidding value of over VND 29,100 billion, a 32% increase from 2024. The backlog at the end of the fourth quarter stood at VND 35,353 billion, the highest in recent years.

In the fourth quarter, Coteccons continued to expand its project portfolio with new developments, including Gamuda Land’s Eaton Park Phase 3; Ecopark Central Park Vinh (design and construction package for HH2 apartments in Subdivision 1A-2); MIK’s new urban area in Xuan Canh, Dong Hoi, and Mai Lam, Dong Anh; Nam Phuong Hotel Block (MEP package) in Phu Quoc; Hon Thom Resort Complex in Phu Quoc (MEP package); and Masterise Home’s The Global City CT07.

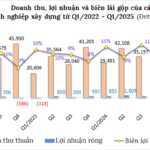

The company’s consolidated revenue for the fourth quarter was VND 8,351 billion, a 26.6% increase from the previous year. The cumulative 12-month revenue reached VND 24,867 billion, an 18.2% increase from the 2024 financial year. Gross profit for the fourth quarter was VND 216 billion, and for the full year, it was VND 778 billion, a 9.2% increase from the previous year. The gross profit margin for the fourth quarter was 2.58%, and the cumulative margin for the year was 3.13%.

Net profit for the fourth quarter was VND 196 billion, almost triple that of the same period last year. For the full year, net profit reached VND 454 billion, a 46.6% increase from the previous year.

The Construction Industry’s Profit Crunch: Burdened by Outstanding Debts

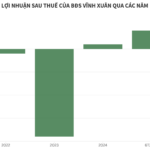

The Q2 2025 financial results paint a varied picture of the construction industry. While some businesses are thriving with exponential profit growth, others are mired in a cycle of losses and mounting debt. This quarter’s performance reveals a sector with a diverse range of fortunes, highlighting the complex and dynamic nature of the construction industry.

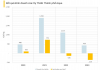

The Ultimate Guide to HFIC’s Successful Equity Offering: Raising Nearly VND 800 Billion

The Ho Chi Minh City Finance Investment State-owned Company (HFIC) is looking to offload its remaining 116.3 million subscription rights of Ho Chi Minh City Securities Corporation (HSC) shares. With a set price of VND 6,875 per subscription right, the state-owned company aims to generate over VND 799 billion from this sale.