If the transaction is completed, Tan Thanh Do’s ownership ratio will increase from 15.21% to 18.35%, raising its holding from 14.55 million to 17.55 million shares. With the market price hovering around VND 21,000/share, the expected expenditure is about VND 63 billion, thereby pushing the total ownership of the group related to Chairman Tran Ngoc Dan to nearly 60%.

This move follows a series of purchases since the beginning of July, when Tan Thanh Do completed an agreement to acquire 6.5 million shares, increasing its stake from 8.42% to 15.21%. Market data shows that the company spent approximately VND 140 billion on this deal, equivalent to an average of VND 21,500/share.

The share price of CTF remains in a low range after a decline of about 30% at the end of last year, contrary to the upward trend of the VN-Index.

| CTF’s share price remains low despite a strong rise in the broader market |

Tan Thanh Do has strong connections with CTF in terms of both personnel and transactions. Mr. Tran Lam and Mr. Tran Long, the two sons of Chairman Tran Ngoc Dan, hold leadership roles in Tan Thanh Do and are also members of the Board of Directors of CTF, owning 8.4% and 7.16% of the shares, respectively. Mrs. Ngo Thi Hanh, Mr. Dan’s wife, also increased her ownership to 9.79% after purchasing an additional 4.7 million shares in July this year.

Apart from the chairman’s family, his two brothers-in-law, Mr. Nguyen Van Thanh and Mr. Pham Anh Hung (Chairman of Tan Thanh Do), also registered to increase their ownership but were able to acquire less than their desired amount; they currently hold 2.68% and 4.12% of CTF’s capital, respectively.

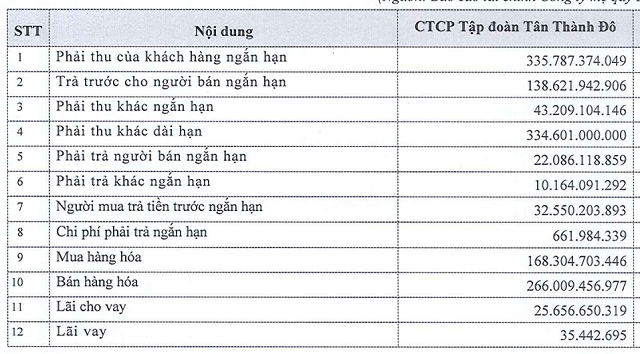

In terms of business operations, there are numerous related transactions between CTF and Tan Thanh Do. As of the second quarter, CTF‘s short-term receivables from Tan Thanh Do amounted to VND 335 billion, in addition to other receivables totaling over VND 378 billion, both short and long-term.

Tan Thanh Do once held the position of parent company of CTF with a ownership of 58.33% in 2017, which later decreased to 13.26% in 2020 and 8.42% before the recent large acquisition in July 2025.

Tan Thanh Do and CTF have engaged in significant transactions in their business operations. Source: CTF

|

Chairman’s wife aims to become a major shareholder

Company related to chairman’s family intends to purchase 6.5 million shares

– 10:34 26/08/2025

The Fat Race Chairman: Another 14.7 Million Shares Sold Off

In just three sessions from August 19 to 21, DFF Chairman Le Duy Hung witnessed the forced sale of over 14.7 million shares by his brokerage, leading to a significant drop in his ownership stake from 42.16% to 23.73%. This development comes as the company extends its losing streak to an eighth consecutive quarter.

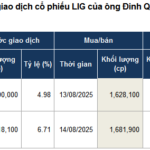

The Major Shareholder of LIG Continues to Increase Ownership

“In a move that further consolidates his position as a major shareholder of Licogi 13 Joint Stock Company (HNX: LIG), Mr. Dinh Quang Chien has acquired an additional 1.7 million shares. This recent purchase brings his total ownership stake in the company to an impressive 8.49%.”