CafeF’s recent announcement of Vietnam’s top tax-contributing banks included Agribank, highlighting its impressive financial performance and social responsibility. With a strong showing in the last three years, Agribank has demonstrated its superior management and adaptability in a dynamic economic landscape.

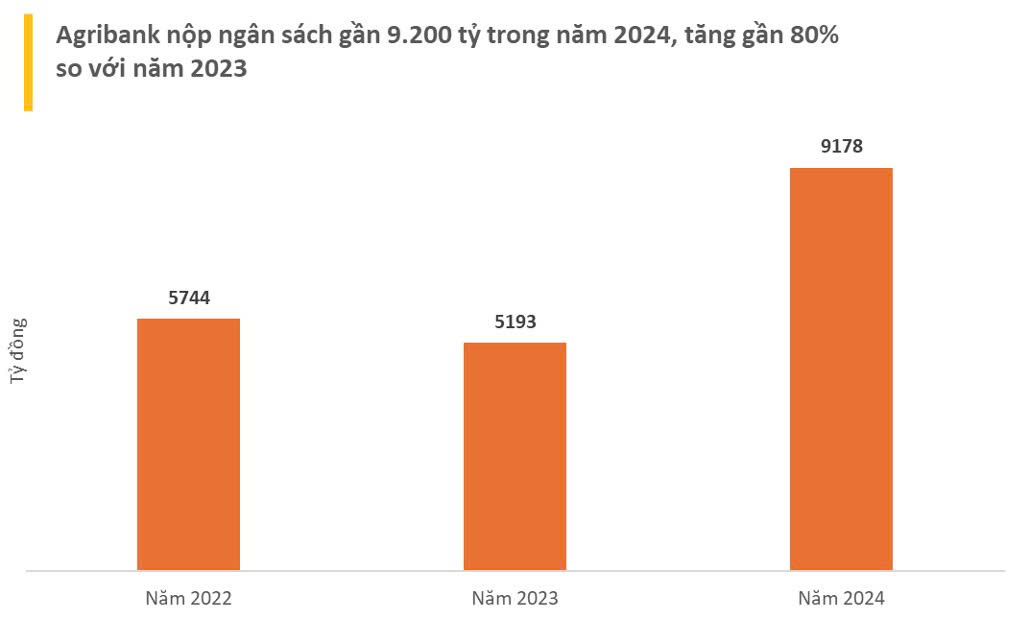

Agribank’s tax contributions exceed VND 20,000 billion over the last three years. According to the latest financial data, the bank made remarkable contributions to state finances. In 2023, Agribank paid nearly VND 5,193 billion in taxes, and this amount surged to VND 9,178 billion in 2024, representing a growth rate of almost 77%. For 2025, Agribank is projected to maintain this strong growth trajectory, with estimated tax contributions surpassing VND 10,000 billion, solidifying its position as one of the country’s top tax-contributing commercial banks.

From 2022 to 2024, Agribank’s cumulative tax contributions exceeded VND 20,100 billion. This figure not only reflects the bank’s operational scale but also demonstrates its strong commitment to supporting the country’s development.

These achievements are a result of Agribank’s sustainable business strategy, focusing on supporting key sectors of the economy, particularly agriculture, rural areas, and farmers. By continuously modernizing its technology and enhancing its governance capabilities, the bank has optimized its operational efficiency and increased its contributions to the national budget.

Amid economic challenges in 2024, including financial market fluctuations, inflationary pressures, and geopolitical conflicts, Agribank demonstrated its leadership as a leading bank with outstanding business results. As of December 31, 2024, Agribank’s total assets exceeded VND 2.2 million billion, an increase of VND 200,000 billion (+10%). Its capital mobilization surpassed VND 2 million billion, growing by over VND 140,000 billion (+7.5%). Credit balance reached over VND 1.72 million billion, an increase of more than VND 170,000 billion (+11%). The bank successfully maintained its non-performing loan ratio at 1.56%, reflecting its robust risk management.

Despite market challenges, Agribank’s pre-tax profit for 2024 exceeded VND 27,500 billion, a 7.5% increase from the previous year. By optimizing operating costs and reducing credit risk provisions, the bank maintained its return on assets (ROA) at 1.03% and return on equity (ROE) at 19.67%, retaining its leading position in the banking system.

As a leading bank in the “Three Rural” sector, Agribank has launched numerous preferential credit programs and “green credit” initiatives to support clean agriculture, renewable energy, and environmental protection projects. These programs not only provide affordable capital to individuals and businesses but also promote the development of a green and sustainable economy.

Agribank actively participates in national target programs, such as new rural development, sustainable poverty reduction, and economic growth in remote areas. The bank has provided financing for high-tech agricultural projects, including farming and agricultural product processing in Lam Dong, large-scale livestock farming in Binh Phuoc, and sustainable aquaculture in Ca Mau. These projects have not only improved incomes but also transformed the face of Vietnam’s rural areas, moving towards modern, efficient, and environmentally friendly agriculture.

Sustainable Development and Social Responsibility Leadership

A key factor in Agribank’s sustained growth and optimized performance is its comprehensive digital transformation strategy. The bank has implemented modern technology solutions, such as AutoBank CDM (automatic transaction machines) in rural and island areas, enhancing financial inclusion by bringing advanced financial services to people outside of traditional bank branches.

Additionally, Agribank has developed cashless payment platforms and digital banking services, facilitating cross-border payments and promoting the export of Vietnamese agricultural products. These efforts not only enhance customer experience but also contribute to bridging the digital divide, fostering financial inclusion, and supporting rural economic development.

Agribank has been a pioneer in implementing a sustainable development strategy (ESG – Environmental, Social, Governance). The bank published its 2024 Sustainability Report, adhering to international standards, showcasing its strong commitment to sustainable development goals and its vision to become a “Net Zero Bank” by 2050. By financing renewable energy projects, such as wind and solar power, and supporting small and medium-sized enterprises in adopting green technologies, Agribank has made significant strides in its sustainability journey.

Looking ahead, Agribank aims to continue executing its Strategy for Development until 2030, with a vision to become one of the leading commercial banks in Southeast Asia. The bank will focus on three main pillars: operational modernization, sustainable development, and support for the “Three Rural” sector. Preferential credit programs will be expanded, emphasizing high-tech agriculture, green economy, and circular economy, with a net-zero emission target by 2050.

Agribank remains committed to its pioneering role in implementing the government’s monetary policies, contributing to macroeconomic stability, inflation control, and economic growth. The bank will continue to stand by businesses and individuals, especially in the agriculture and rural sectors.

With its exceptional tax contributions and significant role in socio-economic development, Agribank has been, and will continue to be, a valuable contributor to the community.

CafeF Lists 2025 marks the return of two prestigious honor rolls:

PRIVATE 100 – Top private enterprises with tax contributions of VND 100 billion or more

VNTAX 200 – Top enterprises with tax contributions of VND 200 billion or more in the fiscal year

This list is compiled by CafeF from publicly available sources or verifiable data, reflecting the actual tax payments made by enterprises, including taxes, fees, and other mandatory contributions. By aggregating transparent and accurate data, CafeF not only acknowledges the financial contributions of these enterprises but also emphasizes their social responsibility and economic significance.

Notable enterprises in the 2025 list, showcasing their tax contributions for the 2024 fiscal year, include Agribank, ACB, AIA, BIM Group, Coteccons, HDBank, LOF, Masan Group, MoMo, OCB, PNJ, SHB, Tasco, DOJI Group, Nam Long Group, Hoa Sen Group, TCBS, Techcombank, TPBank, Vingroup, VPBank, Vinamilk, VNG Group, VPS, and VIMID.

Taking Stern Action Against Exploitative Practices During the Implementation of Decree 178.

The Government Steering Committee urges heads of agencies and units to uphold their responsibilities and accurately identify individuals subject to the provisions of Decree 178 (as amended and supplemented by Decree 67). This involves a careful consideration of staff streamlining, enhancing the quality of the workforce, and ensuring timely implementation. It is imperative to avoid any instances of shirking responsibility or exploiting these policies.

The New Heart of Ho Chi Minh City: Saigon Marina International Financial Centre Opens Its Doors

Ho Chi Minh City unveils the iconic Saigon Marina IFC, a transformative development that underscores Vietnam’s ascent as a prominent financial hub in the region. This landmark project serves as a testament to the country’s thriving economy and its ambition to become a key player in the global financial landscape.