As a result, CMI shares are only allowed to be traded on Fridays of each week. This restriction is due to the reviewed semi-annual financial statements for 2025 indicating negative equity, while the 2024 audited financial statements were disqualified by the auditors. These cases fall under the trading restrictions set by the HNX.

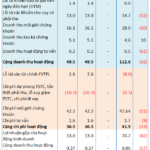

In the first half of 2025, CMISTONE achieved revenue of over VND 21 billion, double that of the same period last year and the highest since 2017 for the same duration. However, with interest expenses of more than VND 4.5 billion, along with depreciation of assets and discontinued projects, the Company incurred a post-tax loss of VND 10.6 billion. As of the end of June, the accumulated loss exceeded VND 285 billion, with negative equity of nearly VND 122 billion.

| CMISTONE continues to incur business losses |

In the reviewed report, the auditors emphasized several uncertainties, raising doubts about CMISTONE and its subsidiary’s ability to continue as a going concern. In addition to short-term debt exceeding short-term assets, the Enterprise is also subject to enforcement measures by the Hanoi Tax Department, including the suspension of invoice use due to overdue tax debts of over VND 15 billion. Additionally, CMISTONE is involved in a credit lawsuit with Agribank, as its subsidiary violated a loan contract worth nearly VND 92 billion.

According to explanations from the Enterprise, due to frequent changes in their head office location, loss of accounting records, personnel changes, and poor coordination with suppliers and customers, they were unable to provide complete documentation to the auditors. This prevented the auditors from obtaining sufficient evidence to express an opinion on the financial statements.

CMISTONE, formerly known as Cavico Minerals and Industry, was established in 2007 and was a member of Cavico Vietnam. The CMI stock was listed on the HNX in 2010 but was delisted and moved to the UPCoM in 2019 due to late submission of financial statements for three consecutive years.

The Company currently operates in the field of artificial stone production but has faced capital shortages and intense competition from cheap imported products, particularly stone tiles from China, for many years.

In terms of remediation, CMISTONE plans to continue reducing production costs, expanding its consumer market, and promoting its brand.

CMISTONE is facing significant challenges in the artificial stone business – Image: CMISTONE

|

– 16:43 26/08/2025

The Golden Boy’s Successful Venture: A Tale of 27 Million HAG Shares

Mr. Doan Hoang Nam, the son of HAGL’s Chairman, Doan Nguyen Duc, has just successfully purchased 27 million HAG shares through a private agreement. This acquisition gives Nam a significant 2.55% stake in the company’s charter capital.

The Stock Code Soars Over 80% Despite the Company Being Repeatedly “Named and Shamed” and Fined.

“TST Joint Stock Company, a leading telecommunications technical services provider, has seen an impressive surge in its stock price (TST) on the UPCoM exchange. Over the past two months, TST stock has skyrocketed by over 80%, outperforming the market and catching the eye of investors.”