Century Fiber Corporation (ticker: STK) has just approved a resolution by its Board of Directors to distribute a stock dividend for the year 2024.

As per the plan, Century Fiber will issue approximately 43.5 million new shares, equivalent to a 45% ratio (shareholders owning 100 shares will receive an additional 45 shares).

Following the issuance, the chartered capital is expected to increase to approximately VND 1,400 billion. The issuance capital will be sourced from undistributed post-tax profits according to the 2024 audited financial statements. The issuance is scheduled to take place in 2025, after obtaining approval from the State Securities Commission.

In addition to the stock dividend, the company had previously approved a private placement of 13.5 million shares at a minimum price of VND 27,500/share, expecting to raise at least VND 371 billion. However, during the implementation in July 2025, no investors registered to purchase. As a result, the company ended the offering without issuing any new shares.

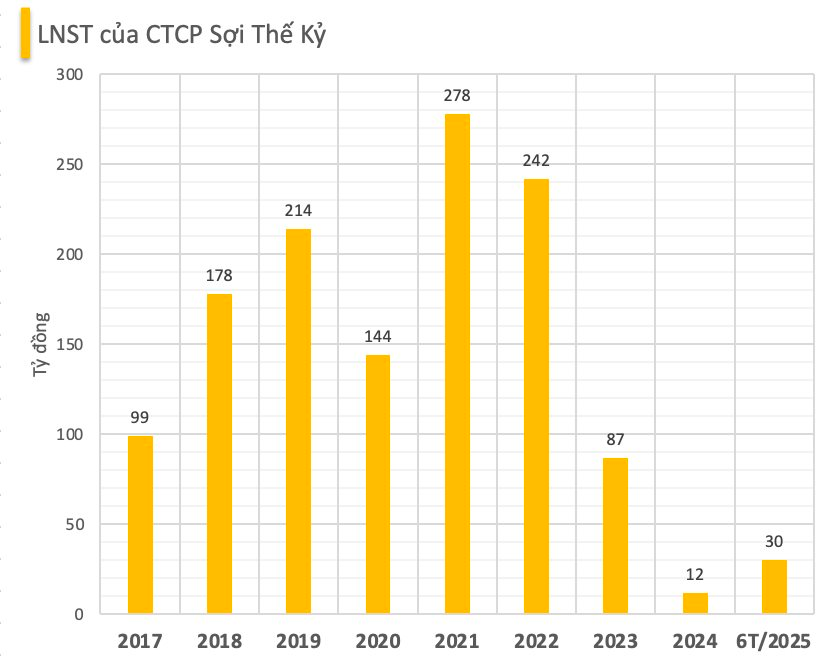

Century Fiber’s business performance in 2024 was lackluster, with a 15% decline in net revenue to VND 1,210 billion and an 86% plunge in post-tax profit to over VND 12 billion. The company maintained VND 675 billion in undistributed post-tax profits as of the end of the year.

For 2025, the management has set ambitious growth targets, aiming for a breakthrough with a revenue of VND 3,270 billion (a 270% increase) and a profit of VND 310 billion (25 times higher than the previous year). If achieved, this would be the highest level in the company’s operating history.

The primary growth driver is expected to be the Unitex Phase 1 factory (with a capacity of 36,000 tons/year), increasing the total system capacity to 99,000 tons/year, 50% higher than the current level.

According to the semi-annual financial report, Century Fiber recorded a 25% year-on-year increase in net revenue to VND 710 billion. Despite the impact of foreign exchange losses, the company still made a post-tax profit of VND 30 billion, a significant improvement compared to the loss of VND 55 billion in the same period in 2024.

Moving forward, Century Fiber plans to continue expanding its production through the Unitex factory and the Fiber-Textile-Garment Alliance, while aiming to increase the proportion of recycled fiber to 60-70% of total output.

“Phu My Fertilizer Increases Charter Capital to Nearly VND 6,800 Billion After Bonus Share Issuance”

On August 8, 2025, Dam Phu My successfully distributed over 288.56 million bonus shares to its 15,335 shareholders, effectively increasing its charter capital to nearly VND 6,800 billion.

“Lizen Seeks to Raise $100 Million via Equity Offering at a 15% Discount to Expand Global Footprint.”

Lizen is set to offer a strategic investment opportunity with a private placement of 100 million shares, priced at a 15% discount to the market rate. With this move, the company aims to raise 1,000 billion VND to fuel its ambitious growth strategy. The funds will be utilized to retire debt, invest in state-of-the-art equipment, expand its global footprint, and venture into large-scale PPP projects. This proactive approach positions Lizen for significant advancement, as it fortifies its financial standing and seizes opportunities for expansion and innovation.