S&P Global Ratings has recognized Eximbank’s improved profitability in 2024, attributed to its focus on the retail and SME customer segments. Net interest margins also expanded due to reduced funding costs following policy rate cuts and the maturity of high-cost term deposits.

As of the end of 2024, retail loans accounted for 54% of Eximbank’s total loan book. The effective utilization of over 200 branches and transaction offices nationwide, coupled with a strategic push towards digital transformation, has supported the bank’s stable growth.

Eximbank maintains its B+ rating with a stable outlook from S&P Global Ratings.

|

A notable highlight acknowledged by S&P is Eximbank’s improvement in return on assets (ROA), which increased from 1.1% in 2023 to 1.5% in 2024 due to enhanced net interest margins and lower funding costs. S&P forecasts Eximbank’s ROA to stabilize between 1.25% and 1.35% over the next 12–24 months as the government encourages banks to lower lending rates to support businesses and economic growth.

S&P also assesses Eximbank’s asset quality as well-managed, with the non-performing loan (NPL) ratio declining to 2.5% at the end of 2024. The ratio of special mention and restructured loans also decreased significantly from 5% to 3.9%, reflecting the positive outcomes of the bank’s credit risk management and bad debt resolution measures.

With a stable risk-adjusted capital (RAC) ratio of 5.2%-5.4% this year, Eximbank is recognized for its robust capitalization to support future credit growth.

S&P expects Eximbank’s credit growth to reach 16%-18%, surpassing the government’s target for the overall banking sector, which is set at 12-15%.

Notably, S&P highlights Eximbank’s flexibility in diversifying its funding sources, prioritizing low-cost funds.

The “stable” outlook for 2024 is based on S&P’s anticipation that Eximbank will maintain its efficient business strategy, effectively manage asset quality, sustain stable capitalization, and practice safe credit growth over the next 12–24 months. The bank’s restructuring efforts have laid a solid foundation, enhancing its resilience to navigate through uncertainties and pursue long-term sustainable development.

Eximbank’s representative shared that while the rating and outlook remain unchanged, S&P has acknowledged the bank’s positive strides in restructuring, enhancing corporate governance, diversifying funding sources, and promoting safe credit growth. This recognition holds particular significance as Eximbank is undergoing a comprehensive restructuring process and embarking on a transformative journey in both its operational model and developmental vision.

Moving forward, Eximbank will continue to strengthen its financial foundation, accelerate digital transformation, optimize customer experience, and expand its target customer base beyond the current focus on retail and SME segments. Simultaneously, the bank will tighten credit quality control, restructure its asset portfolio, and enhance the efficiency of its centralized debt handling model.

Recently, Eximbank announced its financial results for the first half of the year, reporting a pre-tax profit of VND 1,489 billion, reflecting a 0.97% increase compared to the same period last year. In Q2 2025, Eximbank achieved a profit of VND 657 billion. The bank’s credit growth was positive at 9.8%, with total credit outstanding reaching VND 184,663 billion, while total assets amounted to VND 256,442 billion, marking a 6.95% increase since the beginning of the year.

Currently, Eximbank is preparing for its strategic move to relocate its head office to Hanoi. This pivotal step in the bank’s restructuring process will contribute to its brand repositioning and elevated market presence. As S&P pointed out, this expansion addresses Eximbank’s limited market coverage and strengthens its business presence in Northern and Central Vietnam.

– 08:55 19/08/2025

HDBank: Among the Top 50 Listed Companies of 2025

As of August 21, 2025, Forbes Vietnam unveiled its list of Vietnam’s 50 Best Listed Companies for 2025, featuring leading enterprises across vital sectors. Among them, HDBank stands out as a prominent multi-functional retail bank, solidifying its position and pioneering role in the private sector of Vietnam’s financial and banking system.

“Eximbank Maintains B+ Rating with Stable Outlook from S&P Global Ratings”

The renowned international credit rating agency, S&P Global Ratings (S&P), has assigned a ‘B+’ long-term issuer credit rating with a ‘stable’ outlook to the Vietnam-based Export-Import Commercial Joint Stock Bank (Eximbank). This endorsement underscores Eximbank’s strengthened financial foundation, clear business strategy, and notable enhancements in asset quality, even amidst a volatile macroeconomic landscape.

“VPBank’s Deposits Soar in H1 2025: Outpacing Peer Group Growth, Surpassing Two Big4 Banks”

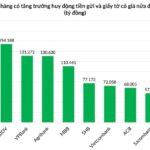

“VPBank stands out amidst a challenging landscape where many banks struggle to keep pace with credit growth, exerting pressure on liquidity. The bank has impressively outperformed several state-owned giants in terms of mobilization, showcasing its prowess in both scale and the quality of its capital sources. VPBank’s remarkable CASA growth and its ability to attract international capital have solidified its position as a leader in the industry.”

Credit Growth and the ‘Carrot’ for Select Banks

The rapid growth of credit contrasted with slower capital mobilization has put significant strain on the banking system’s liquidity. In response, the State Bank has intervened by reducing the statutory reserve ratio by 50% for four banks that are recipients of mandatory transfers from four banks under special control.