The VN-Index, the main stock market indicator, continued its upward momentum and even surged strongly towards the end of the August 21 session, driven by a consensus among bank stocks. At the close, the VN-Index gained 23.64 points to reach a new peak of 1,688 points. The matching value on HoSE remained high at nearly VND 48,800 billion.

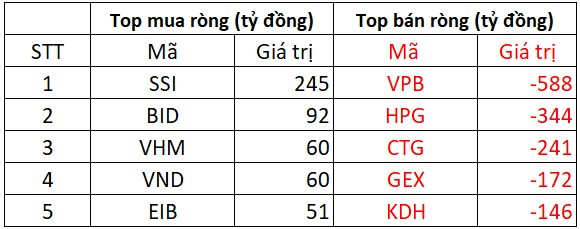

However, foreign transactions were a downside, with a strong net sell-off of VND 2,498 billion. Specifically:

On HoSE, foreign investors net sold approximately VND 2,417 billion

On the buying side, SSI was the most net bought stock in the market with a value of VND 245 billion, followed by BID with VND 92 billion. Foreign investors also net bought VND 60 billion worth of VHM and VND shares today.

In contrast, VPB, a bank stock, was the most net sold code with VND 588 billion; HPG also witnessed a net sell-off of VND 344 billion. CTG, GEX, and KDH were among the top net sold codes today, with net selling values of VND 241 billion, 172 billion, and 146 billion, respectively.

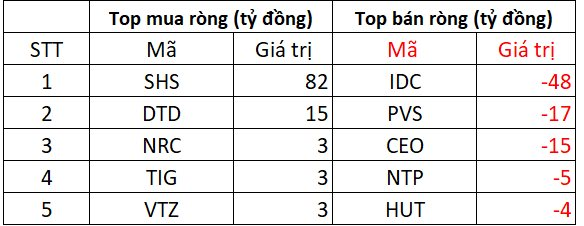

On HNX, foreign investors net bought approximately VND 3 billion

SHS continued to be the most net bought stock with a value of up to VND 82 billion, followed by DTD with a net buying value of VND 15 billion. Additionally, NRC, TIG, and VTZ also received net buying of VND 3 billion each.

On the opposite side, IDC, PVS, and CEO were among the top net sold stocks on HNX, with values ranging from VND 15 billion to VND 48 billion. Similarly, NTP and HUT also experienced net selling of around VND 4-5 billion.

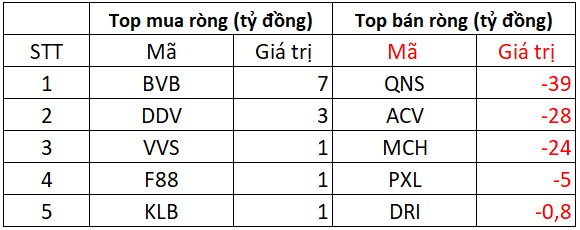

On UPCOM, foreign investors net sold over VND 84 billion

In terms of net buying, BVB and DDV were the top two codes with net buying values of VND 3-7 billion. Following them were VVS, F88, and KLB, which were net bought at around VND 1 billion each.

Conversely, QNS experienced a net sell-off of VND 39 billion, while ACV and MCH also witnessed net selling of VND 24-28 billion. Additionally, PXL was net sold at around VND 5 billion.

Market Pulse, August 25: VN-Index Plunges Over 31 Points, VIC and VHM Stage a Comeback

The trading session ended on a gloomy note, with the VN-Index shedding 31.44 points (-1.91%), settling at 1,614.03. Likewise, the HNX-Index witnessed a decline of 5.9 points (-2.17%), closing at 266.58. The market breadth tilted towards decliners, as 488 stocks closed in the red compared to 265 advancers. The VN30 basket echoed a similar sentiment, with 23 stocks losing ground, 5 gaining, and 2 remaining unchanged.

Market Beat: Indecision Creeps In, Market Polarizes

The investor sentiment remains cautious, resulting in lackluster trading volumes and a tug-of-war between the major indices around the reference levels. As of 10:30 am, the VN-Index hovered near the reference level, trading around 1,646 points. The HNX-Index exhibited a similar back-and-forth pattern, managing to maintain a slight gain and trading at around 273 points.

The Stock Market’s Best-Kept Secret: Banking on Big Gains

Last week, from August 18 to 22, 2025, a slew of bank stocks witnessed an impressive surge, with gains exceeding 10%. This significant upward trend underscores the robust performance and resilience of the banking sector, highlighting its potential for investors seeking lucrative opportunities in the financial realm.