The trading session on August 27th concluded with the VN-Index climbing by 5.15 points (+0.31%), reaching 1,672.78 points. The HNX-Index, on the other hand, inched up slightly by 0.21% to close at 283.87 points. The market breadth witnessed 430 advancing stocks (including 33 stocks that hit the ceiling price) and 329 declining ones (with 12 stocks falling to the floor price).

Liquidity on the HOSE and HNX surged by 23% and 21%, respectively, compared to the previous session, with a total trading value of over VND 47 trillion on the HOSE and VND 3 trillion on the HNX.

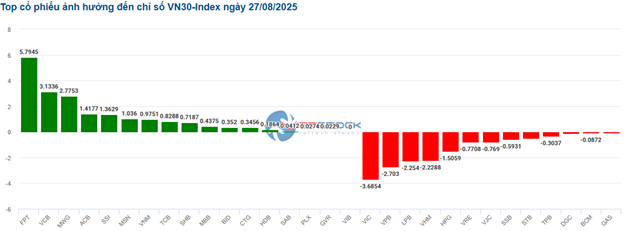

In terms of influence, the outstanding performance of the “elder brother” VCB contributed over 9 points to the VN-Index‘s gain, while FPT and BID added another 3.7 points. Conversely, VIC, VPB, and LPB acted as the biggest drags on the market’s upward momentum, deducting a total of 6 points from the index.

| Top 10 stocks with the most significant impact on the VN-Index on August 27, 2025 (in points) |

The rally was not as unanimous across sectors, with some differentiation emerging. On the positive side, the strong performance of FPT (+5%) and CMG (+2.27%) helped the information technology sector maintain its leading position until the end of the session.

Meanwhile, the financial sector witnessed a notable cooldown. Apart from VCB, which remained firmly in positive territory, most other stocks in the sector trimmed their gains towards the end of the session, with several even posting significant losses of over 2%, including VPB, TPB, LPB, NAB, OCB, DSC, MBS, and VDS.

In the real estate sector, DXG and IJC surged to hit the ceiling price, but the sector was still under pressure due to losses in heavyweights like VIC (-2.58%), VHM (-0.57%), VRE (-2.24%), KBC (-1.63%), BCM (-1.59%), and others. Additionally, the energy, utilities, and materials sectors were dominated by red hues.

Notably, foreign investors exerted significant selling pressure, offloading nearly VND 4.2 trillion across all three exchanges, marking the strongest selling session in over four months. Since the beginning of August, the total net selling value has reached nearly VND 24 trillion, making it the month with the strongest net selling since the beginning of the year. Today’s session saw intense selling in large-cap stocks such as HPG (VND 958 billion), VPB (VND 531 billion), CTG (VND 403 billion), and VCB (VND 391 billion).

| Foreign investors’ buying and selling activities |

Morning Session: Foreign Selling Pressure Mounts, Market Gains Trimmed

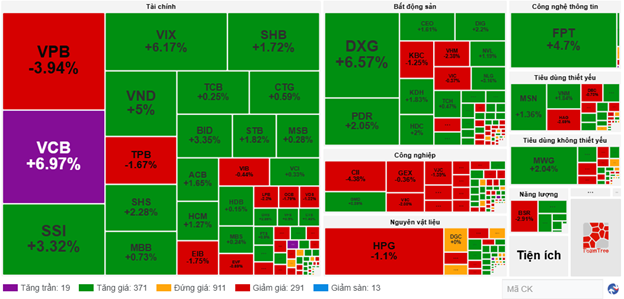

The VN-Index continued to fluctuate around the 1,680-point threshold during the latter part of the morning session. After reaching a high of over 27 points, the index pared its gains to 9.7 points (+0.58%), closing the morning session at 1,677.33 points. The HNX-Index also rose by 0.64% to reach 277.55 points. The market breadth showed 390 advancing stocks, 204 declining stocks, and 911 stocks trading sideways.

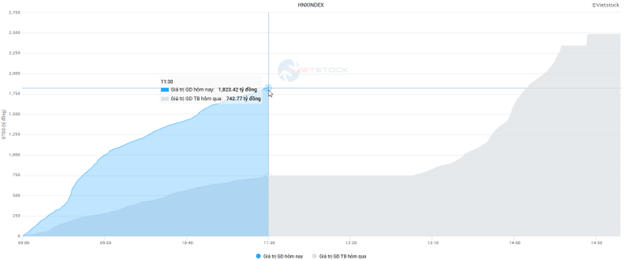

Increased trading activity in large-cap stocks boosted market liquidity in the morning session. Trading volume on the HOSE exceeded 951 million shares, equivalent to a value of over VND 29 trillion, surging by 104% compared to the same period in the previous session. The HNX also recorded a volume of over 79 million shares, valued at VND 1.8 trillion.

Source: VietstockFinance

|

In terms of influence, VCB was the most positive contributor, adding over 9 points to the VN-Index. It was followed by BID and FPT, which contributed a total of 4.3 points to the overall index. On the other hand, VPB and VHM were the most negative influencers, each deducting 2.3 points from the index.

Sector-wise, green dominated most sectors. The information technology sector temporarily led the market with a remarkable gain of 4.42%, mainly driven by the strong performance of two large-cap stocks in the group: FPT (+4.7%) and CMG (+2.77%).

The media and financial sectors also witnessed several bright spots, with notable trading activities in stocks such as VGI (+1.77%), FOX (+1.2%), CTR (+2.2%); BID (+3.35%), ACB (+1.65%), SSI (+3.32%), SHB (+1.72%), VND (+5%), VIX (+6.17%), and VCB hitting the ceiling price.

On the contrary, utilities lagged behind the market, with selling pressure concentrated in stocks like GAS (-0.58%), POW (-0.93%), HNA (-1.77%), HND (-0.84%), and DNH hitting the floor price.

Source: VietstockFinance

|

Foreign investors turned net sellers, offloading stocks worth over VND 2.6 trillion across all three exchanges. The selling pressure was concentrated in HPG, with a net selling value of VND 540.71 billion. Notably, VCB also faced strong selling pressure, with a net selling value of VND 275.76 billion despite trading at the ceiling price. On the buying side, FPT led the net buying list with a value of VND 238.25 billion.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of August 27, 2025 |

10:30 am: Signs of Cooling Off

As of 10:30 am, the market maintained its upward trajectory, although the momentum showed signs of easing. The VN-Index climbed by over 11 points, trading above the 1,678-point level. The HNX-Index rose by 1.35 points to reach 277 points. The financial and information technology sectors continued to be the main drivers of the market’s gains.

The breadth of the VN30-Index basket was relatively balanced between gainers and losers. Notably, FPT, VCB, and MWG contributed positively to the VN30 index, adding 5.8 points, 3.1 points, and 2.8 points, respectively. Conversely, VIC was the biggest drag, deducting 3.7 points from the index.

Source: VietstockFinance

|

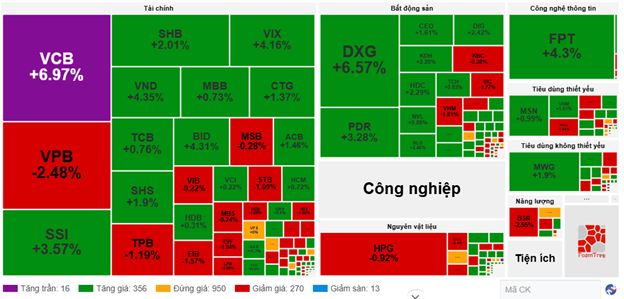

Green dominated most sectors, with the information technology sector leading the market with a gain of 4.23%. This was mainly driven by the strong performance of large-cap stocks within the group, including FPT (+4.3%) and CMG (+3.02%).

The financial sector also stood out, with many stocks posting strong gains, such as BID (+4.31%), ACB (+1.46%), SSI (+3.57%), SHB (+2.3%), VND (+4.35%), and VCB hitting the ceiling price. However, some stocks in this sector faced selling pressure, including VPB, which fell by 3.64%, STB (-1.45%), LPB (-2.2%), and SSB (-2.52%).

In contrast, the energy sector painted a mixed picture, with selling pressure slightly outweighing buying interest. Specifically, selling was concentrated in BSR (-3.1%), PVD (-0.7%), VTO (-0.83%), and PVC (-0.87%).

Compared to the opening, buyers continued to hold the upper hand, with 372 stocks advancing and 283 stocks declining.

Source: VietstockFinance

|

Opening: Active Participation from Investors

Following the impressive recovery in the previous session, the market entered today’s morning session with high expectations. Right from the opening bell, green dominated the market. As of 9:30 am, the VN-Index climbed above the 1,680-point threshold, while the HNX-Index traded around the 278-point level.

VCB, BID, and FPT were the main drivers of the VN-Index‘s rally in the early morning session, contributing a total of over 7 points to the index’s gain. On the flip side, selling pressure in VIC and VPB dragged the index down by 2.5 points.

The media and information technology sectors were the early leaders, thanks to strong buying interest in large-cap stocks such as FPT (+3.3%), CMG (+2.52%); VGI (+2.04%), FOX (+1.95%), and SGT (+1.63%).

Conversely, the real estate sector struggled to gain traction due to losses in heavyweights like VIC (-1.77%), VRE (-1.28%), BCM (-2.03%), and TCH (-1.64%).

Notably, in the context of the government’s recent issuance of Decree 232/2025/ND-CP, which abolishes the monopoly on gold bullion production and allows qualified enterprises and banks to participate, the market is closely watching the performance of large banks such as VCB (+5.42%), BID (+3.35%), CTG (+1.95%), and the only listed company among the gold businesses expected to have the potential to participate in gold bullion production, PNJ (+2.4%).

– 15:30 27/08/2025