On August 19 and 21, 2025, a notable investment fund offloaded a total of 450,000 SFI shares in off-exchange deals, as per VietstockFinance’s data. This move comes amidst a period of volatility for the stock, which has been trading between VND 25,000 and VND 28,000 per share in recent months. Furthermore, SFI’s share price has been range-bound since a decline in 2022, reflecting the lackluster performance of its parent company, SAFI.

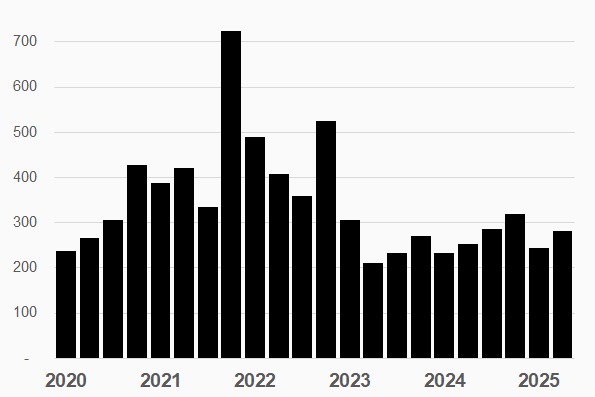

SAFI, a logistics services provider based in Ho Chi Minh City, reported consolidated revenue of VND 526 billion and net profit of VND 44 billion for the first half of 2025. While these figures represent a 9% and 14% year-on-year increase, respectively, they fall short of the company’s performance during the more favorable period from 2021 to 2022.

|

SAFI’s Consolidated Revenue by Quarter

Unit: VND billion

Source: VietstockFinance

|

– 10:04 26/08/2025

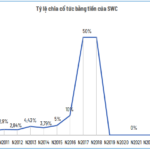

“SWC Finalizes Cash Dividend with a Payout of VND 3,500 per Share”

Southern Waterways Joint Stock Company (UPCoM: SWC) will finalise the list of shareholders eligible for the 2024 cash dividend payout at a rate of 35% (equivalent to VND 3,500 per share). The ex-dividend date is set for August 28, and payments will be made starting from September 15.

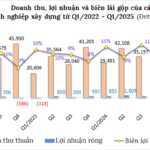

The Construction Industry’s Profit Crunch: Burdened by Outstanding Debts

The Q2 2025 financial results paint a varied picture of the construction industry. While some businesses are thriving with exponential profit growth, others are mired in a cycle of losses and mounting debt. This quarter’s performance reveals a sector with a diverse range of fortunes, highlighting the complex and dynamic nature of the construction industry.

The Ultimate Guide to HFIC’s Successful Equity Offering: Raising Nearly VND 800 Billion

The Ho Chi Minh City Finance Investment State-owned Company (HFIC) is looking to offload its remaining 116.3 million subscription rights of Ho Chi Minh City Securities Corporation (HSC) shares. With a set price of VND 6,875 per subscription right, the state-owned company aims to generate over VND 799 billion from this sale.