Technical Signals for the VN-Index

During the trading session on the morning of August 27, 2025, the VN-Index witnessed a positive upward trend. However, the Long Upper Shadow candle pattern indicates significant selling pressure.

The previous peak of 1,680-1,693 points will act as a key short-term resistance. Due to the ADX value being greater than 25, indicating a strong market trend, the writer believes there is a high likelihood of surpassing this level.

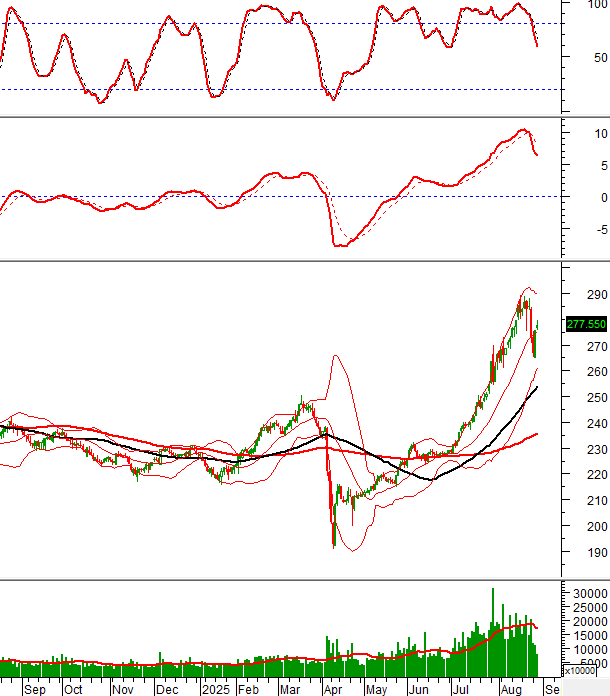

Technical Signals for the HNX-Index

On the morning of August 27, 2025, the HNX-Index witnessed a slight increase and surpassed the Middle line of the Bollinger Bands.

The MACD and Stochastic Oscillator indicators continued to decline after generating sell signals. Nonetheless, the positive signal of crossing above the Middle line has helped alleviate the pessimism and short-term adjustment risk.

Trading volume has remained well below the 20-day average in recent sessions, making it unlikely to expect significant short-term fluctuations.

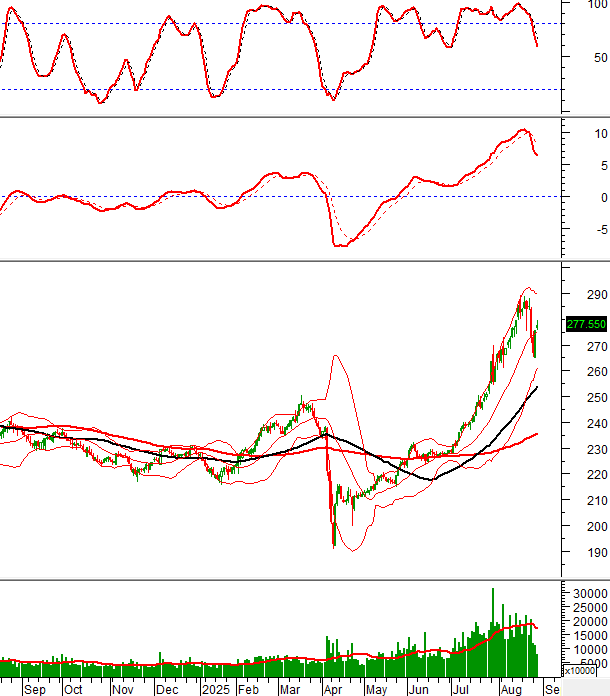

DBC – Vietnam Dabaco Group JSC

On the morning of August 27, 2025, the DBC stock price continued to test the 26,000-27,500 range (equivalent to the previous peak surpassed in October 2024 and March 2025). This will serve as the primary short-term support for DBC.

The MACD indicator continues to weaken and falls below the zero line after generating a sell signal in mid-August 2025. This suggests that the short-term adjustment and volatility are still present.

The alternating appearance of green and red candles indicates investor indecision. However, buying in the 26,000-27,500 range is still supported by the confirmed long-term upward trend.

VCB – Vietnam Joint Stock Commercial Bank for Industry and Trade

On the morning of August 27, 2025, the VCB stock price surged, accompanied by a record-high trading volume, reflecting growing optimism amid supportive fundamental news.

The previous peak of March 2025 (66,500-68,500 range) has been completely breached. According to technical analysis theory, this range will now switch from resistance to strong support in the coming period.

Additionally, with the price hugging the Upper Band of the Bollinger Bands, it may continue to soar if the bands expand.

(*) Note: The analysis in this article is based on real-time data up to the end of the morning session. Therefore, the signals and conclusions are for reference only and may change when the afternoon session concludes.

Technical Analysis Department, Vietstock Consulting

– 12:34 27/08/2025

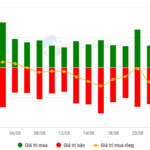

Market Pulse, August 27: Stumbles Under Foreign Investors’ Selling Spree

The VN-Index experienced a back-and-forth session, hovering around the 1,675-point mark throughout the afternoon. Despite significant support from the market heavyweight VCB, which surged to its daily limit, the index couldn’t sustain its gains and ended the trading day on a rather lackluster note. The selling pressure from foreign investors weighed heavily on the market, eroding much of the early gains.

Vietstock Daily: Summit Showdown

The VN-Index pared its gains towards the end of the trading session on August 27th, forming a Long Upper Shadow candle. This indicates that profit-taking pressures remain robust at the previous peak of 1,680-1,693 points. Additionally, with the Stochastic Oscillator indicator continuing to weaken after issuing a sell signal, it suggests that the index is likely to encounter further volatility in the upcoming sessions.

The New Wave of Banking: Leading Expectations and Managing Margins

The post-COVID-19 era has witnessed a record-breaking rally for bank stocks, but this impressive performance belies a more nuanced story. This surge is underpinned by a combination of factors, including heightened expectations and the influx of margin financing into the financial sector. While this has provided a much-needed boost to the market, it also presents challenges, as the margin contraction highlights a delicate balance that could impact the market’s trajectory.

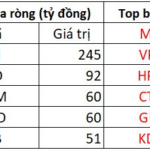

The Powerhouse That Swept Up $1.2 Billion in Vietnamese Stocks as VN-Index Soared Over 42 Points

The VCB witnessed an overwhelming net buy with 2.41 trillion VND, followed by HPG at 159 billion VND.