At the current price of VND 14,800/share, Mr. Kien could recoup nearly VND 16 billion, about 15% higher than the purchase price at the end of March 2025 (around VND 13,000/share).

This move comes as LDP is about to hit its fourth consecutive ceiling, after surging 8.8% in the morning session of August 26, 2025. However, the market price is still much lower than the peak of over VND 50,000/share in 2022.

| LDP’s stock price unexpectedly surges to the ceiling for multiple sessions |

Mr. Ph

|

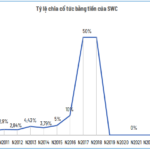

LDP’s price hike coincides with Ladophar’s implementation of receiving payment for privately placed shares from August 22 to September 30, 2025. Previously, Ladophar’s Board of Directors approved the plan to offer 13.64 million shares to professional securities investors at VND 11,000/share. If successful, the company will raise approximately VND 150 billion, increasing its charter capital from VND 133 billion to over VND 263 billion, while the holding ratio of its parent company, Louis Holdings, will decrease from 51% to 24.6%.

The list of investors includes Dynamic Investment Fund (VIF) registering to buy 4.25 million shares, expected to hold 16.1% of capital after the offering; HD Fund Management Joint Stock Company purchasing 4 million shares, equivalent to 15.2%; and APC Holdings buying 5.39 million shares, accounting for 20.5%. All three are domestic organizations that did not previously own any shares in Ladophar.

Dynamic Investment Fund, formerly known as FPT Capital Investment Fund, was established in 2020 and is a member fund of FPT Investment Fund Management Joint Stock Company (FPT Capital). Meanwhile, APC Holdings, formerly known as International Coal Joint Stock Company, was established in 2015 with a charter capital of VND 50 billion.

According to the plan, nearly VND 66 billion from the proceeds will be allocated to the project of building a medicinal plant extraction factory using supercritical CO2 technology, VND 58.5 billion will be used to repay debts and bonds, and the remainder will be used to purchase production equipment.

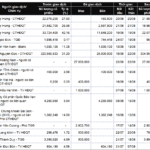

Ladophar has not increased its capital since 2020. In the past five years, the company incurred losses in three years, with accumulated losses of over VND 51 billion by the end of June 2025. Revenue plummeted to a low of VND 162 billion in 2021 and has shown slight signs of recovery in recent years.

| Ladophar continues to incur accumulated losses |

Which fund registered to buy Ladophar’s additional shares?

Ladophar’s half-year revenue estimated at 5-year high, pre-tax profit exceeds VND 2 billion

What makes GKM willing to spend VND 80 billion to acquire APC Holdings’ shares?

– 14:11 26/08/2025

The Rush to IPO: Is the Stock Market About to Welcome a ‘Mega Listing’?

The stock market is witnessing a resurgence of initial public offerings (IPOs) and the listing of equitized enterprises. This wave is expected to bring a fresh influx of quality listings.

What Do Experts Say About the Stock Market’s “Rollercoaster” Session, With a Turnover of $2.7 Billion?

The stock market, after rallying for almost four consecutive months, has finally taken a much-needed breather. But is this a cause for concern or simply a healthy correction?