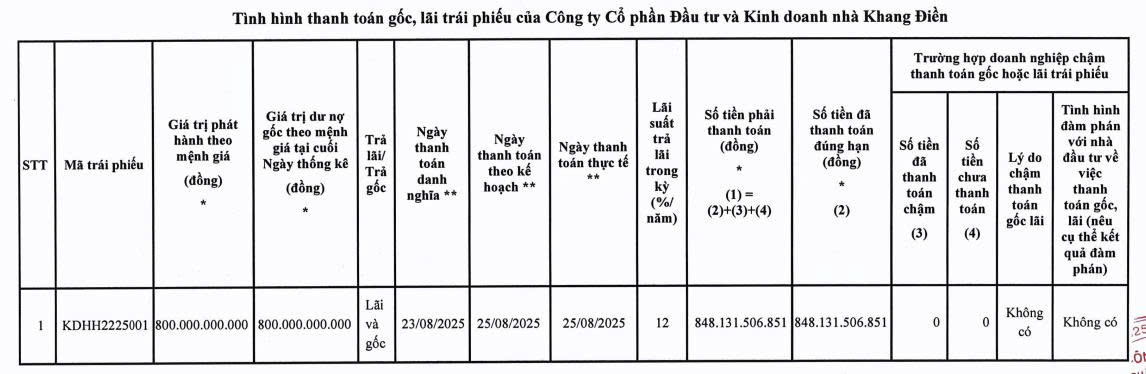

Investment and Trading JSC Khang Dien House (KDH on HoSE) has just released an announcement regarding the company’s bond principal and interest payments.

On August 25, 2025, Khang Dien House made a total payment of over VND 848 billion to settle the principal and interest of the bond code KDHH2225001, thus fully redeeming this bond issue on time.

It is known that this bond issue was offered on August 23, 2022, consisting of 800 bonds with a par value of VND 1 billion/bond and a total issuance value of VND 800 billion. With a 3-year term, the bonds matured on August 23, 2025.

After redeeming the above bond issue, Khang Dien House officially cleared its bond debt with no outstanding bond issues.

Source: KDH

In another development, VinaCapital Fund Management JSC has recently reported on the results of KDH stock purchases by Khang Dien House.

According to the report, during the trading period from July 16, 2025, to August 14, 2025, VinaCapital’s Market Access Equity Fund successfully purchased 141,000 shares out of the previously registered 500,000 shares.

After the transaction, the fund’s holdings increased from over 1.6 million shares to over 1.9 million shares of KDH (including dividend payments in shares during the registered trading period), equivalent to an increase in ownership ratio from 0.162% to 0.1738% of Khang Dien House’s capital.

Also during the above trading period, VinaCapital’s Modern Economy Equity Fund purchased 800,500 KDH shares out of the registered 1 million shares.

Before the transaction, the fund held over 1.6 million KDH shares, equivalent to an ownership ratio of 0.1622%. After the transaction and including dividend payments in shares during the registered trading period, the number of shares increased to over 2.6 million, equivalent to an ownership ratio of 0.2327% of Khang Dien House’s capital.

The reason given for the two VinaCapital funds not completing the full purchase as registered was due to market conditions not being favorable.

Another member fund of VinaCapital, the Hung Thinh VinaCapital Equity Fund, has also registered to purchase 850,000 KDH shares for portfolio restructuring purposes. The transaction is expected to take place via matching and/or negotiated trading from August 12, 2025, to September 10, 2025.

If the transaction is successful, the fund’s holdings will increase from 616,410 shares to nearly 1.5 million shares of KDH, equivalent to an increase in ownership ratio from 0.0549% to 0.1307% of the company’s capital.

“Highway Investor Reports $156 Million Profit in H1 2025”

The Hanoi Highway, a prominent BOT enterprise within the CII ecosystem, witnessed a slight uptick in profits, surpassing 156 billion VND in the first half of 2025.

“VinaCapital-VESAF Fund Targets Mid-Small Cap Equities”

In the latest update report by VinaCapital-VESAF, the fund revealed that the VN-Index witnessed an impressive 18.6% growth in the first seven months of 2025. However, approximately 60% of this growth is attributed to stock groups associated with the Vingroup conglomerate and GELEX. These two stock groups have never been among the fund’s large investment portfolios.

The VinaCapital Member Fund Seeks to Accumulate 850,000 Khang Dien House Shares

The VinaCapital Hung Thinh Stock Investment Fund has registered to purchase 850,000 KDH shares of Khang Dien House, with the aim of restructuring its investment portfolio.