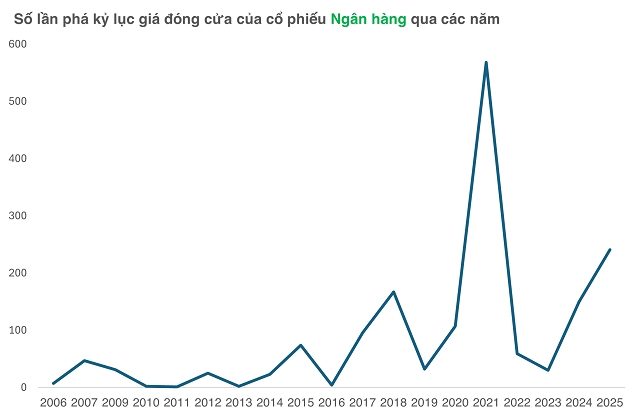

Bank stocks break records for the second-highest number of times in history

Despite the VN-Index experiencing strong profit-taking sessions, bank stocks have produced extremely impressive statistics.

As of August 25, bank stocks have broken closing price records a staggering 241 times, spanning 16 out of 27 codes.

This means that nearly 60% of bank stocks have witnessed this record-breaking phenomenon. Notably, the total number of record-breaking instances in the first nine months of 2025 is not only the highest since the post-COVID-19 era but also the second-highest in the history of bank stock waves in the Vietnamese stock market.

While the upward trend in the first half of the year mainly focused on large-cap banks, the wave spread to Mid Cap banks such as EIB, VIB, TPB, and MSB in the third quarter of 2025.

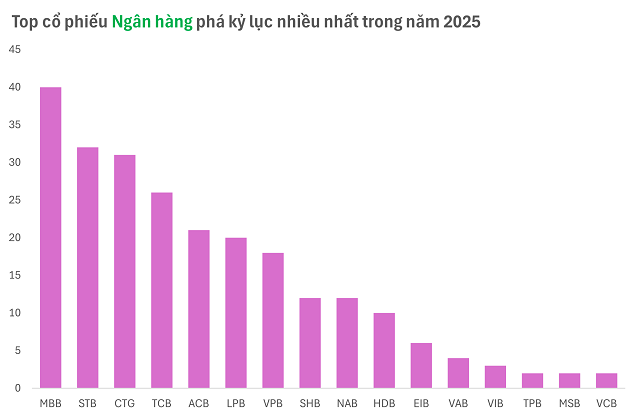

In order, MBB is currently holding the “king” position for record-breaking in 2025 and throughout the entire historical statistics. Since the beginning of the year, MBB (40 times) has seen a nearly 60% increase. Following closely is STB with 32 record-breaking sessions, surging by 44%. Additionally, codes such as CTG, TCB, and ACB have also joined the list of peak performers, playing a crucial role in pushing the VN-Index towards the 1,700-point mark in August.

Evidently, this year’s bank stock wave is not only broad in scale but also intense in momentum, making this sector the focal point and main driving force of the entire market.

Expectations vs. Reality: Margin “Contraction”

Even though bank stock prices have soared, their business performance and financial strength vary significantly.

The 2025 half-year report by VIS Rating reveals that large banks and state-owned banks (SOB) are witnessing substantial improvements due to reduced bad debt, lower credit costs, and better loan recovery. Some codes, including CTG, MBB, and VPB, are further supported by legal advancements in real estate projects.

|

On the other hand, smaller banks face challenges such as high funding costs due to intense competition, large risk provisions, and limited liquidity. Banks like PGB, VAB, BVB, and SGB remain among those with the highest non-performing loan formation rates in the industry.

Investors believe that the recovery of the real estate market, along with credit policies, will gradually enhance asset quality in the second half. Simultaneously, the requirement to transition to Basel III norms forces banks to raise capital and expand their scale, creating new expectations for the industry’s stocks.

However, it’s important to note that the market’s expectations are currently built on the backdrop of continuously rising margin debt levels.

Mr. Nguyen The Minh, a market analyst, commented: “The recent sharp declines have highlighted the market’s dependence on the banking sector. While margin debt may not be a direct risk, the concentration of investments in financial stocks remains a challenge for the overall market.”

According to Mr. Minh, it’s understandable that financial stocks attract investment flows during this phase as they are the leaders. However, for the market to develop sustainably, there needs to be a spillover effect to other sectors. Banks have demonstrated their allure and pivotal role, but a robust and investor-attractive market requires the accompaniment of other industries.

In retrospect, the 2025 bank stock wave is one of the most remarkable price-appreciation phases since the COVID-19 era, both in terms of scale and frequency of peak formations. This surge not only reflects the business performance but also showcases the market’s faith and anticipation of long-term changes, particularly in capital augmentation and the adoption of Basel III norms.

The banking sector has been and is likely to remain the pervasive industry wave in the Vietnamese stock market. However, to sustain market allure, the dispersion of investment flows to other sectors is crucial. This presents both opportunities and challenges for the next phase.

– 13:19 26/08/2025

“Foreign Block Sells Off Nearly VND 2.5 Trillion as VN-Index Hits New Peak”

The SSI stock witnessed a significant net foreign purchase on the afternoon of the trade, with a value of 245 billion VND, making it the most actively bought stock by foreign investors in the entire market.

Market Pulse, August 25: VN-Index Plunges Over 31 Points, VIC and VHM Stage a Comeback

The trading session ended on a gloomy note, with the VN-Index shedding 31.44 points (-1.91%), settling at 1,614.03. Likewise, the HNX-Index witnessed a decline of 5.9 points (-2.17%), closing at 266.58. The market breadth tilted towards decliners, as 488 stocks closed in the red compared to 265 advancers. The VN30 basket echoed a similar sentiment, with 23 stocks losing ground, 5 gaining, and 2 remaining unchanged.

“Technical Analysis for August 25: Navigating a Volatile Market”

The VN-Index and HNX-Index witnessed a downward trend, accompanied by the emergence of less-than-favorable candle patterns during the morning session. If technical factors do not show signs of improvement in the afternoon, the risk of a downward adjustment looms large.