After a relatively quiet period of around five years, the IPO and listing market is witnessing a resurgence with significant deals involving Vinpearl, Taseco Land, and F88.

The successful HoSE debut of Vinpearl (coded VPL) on May 13, with a valuation of $6 billion, swiftly propelled the company into the league of the largest capitalized firms on the exchange.

This was followed by the HoSE listing approval for Taseco Land’s TAL shares on June 27. More recently, the listing of F88 Joint Stock Investment Company (coded F88) on the UPCoM market resulted in the highest share price on Vietnam’s stock exchanges.

Additionally, several plans are underway by securities companies such as TCBS and VPBankS, with recent speculations involving VPS. The World Mobile Group also intends to conduct an IPO and list its phone and electronics chain.

The recent annual general meetings of shareholders have also highlighted notable plans by a group of banks. VietBank, Kienlongbank, BVBank, and Saigonbank aim to transfer their stock listings to the HoSE.

The market is witnessing the return of significant deals.

Previously, the separation of the IPO and listing processes resulted in time delays, hindering investors from immediate trading and reducing the appeal of such transactions. The State Securities Commission of Vietnam (SSC) has proposed amendments to Decree 155/2020/NĐ-CP to integrate the IPO and listing procedures, enabling investors to trade shares more promptly.

Consequently, when submitting an IPO registration dossier, the issuing organization must also submit a listing registration dossier for the stock exchange’s consideration. The time frame for listing after an IPO has been shortened to 30 days, compared to a minimum of 90 days previously, allowing shares to be traded immediately post-IPO. This new regulation, if implemented, will reduce the overall timeline by 60 days compared to the previous process.

Mr. Bui Hoang Hai, Vice Chairman of the SSC, stated that the regulations and conditions related to IPOs are already comprehensive and well-established, including requirements for profitable operations and audited financial reports. However, the SSC is considering adjustments to enhance the attractiveness of IPO activities.

According to Mr. Hai, post-IPO shares are considered “unlisted,” limiting the investment capacity of domestic and foreign funds in such shares. Consequently, many IPOs fail to attract investment fund participation.

“The SSC has studied and proposed amendments to the legal framework related to investment funds, including considerations to enable investment funds to increase their investment limits in unlisted shares,” added Mr. Hai.

Currently, companies intending to conduct an IPO must be profitable for two consecutive years and must not have cumulative losses. This requirement is considered a significant barrier for technology startups, which often incur high initial investment costs.

Mr. Pham Luu Hung, Chief Economist and Director of the Analysis and Investment Advisory Center at SSI Securities Corporation, suggested relaxing the listing conditions. Adjusting the profitability requirement of two consecutive years and eliminating the cumulative loss criterion would provide technology, startup, and innovative enterprises with improved access to the capital market.

In addition to IPOs, the market anticipates an increase in stock supply through state capital divestment. Many listed companies have a high state ownership ratio. Regarding state capital divestment, Mr. Bui Hoang Hai mentioned that this is a policy direction of the Government. Many large enterprises, including banks, still have high state ownership ratios.

“These are important enterprises, but it is not necessary to maintain high state ownership ratios. We will work on solutions to promote the efficient introduction of high-quality state-owned shares to the market,” said Mr. Hai.

According to Dragon Capital, the total value of IPO deals in Vietnam during 2027-2028 could reach up to $47.5 billion, with the consumer sector alone contributing approximately $12.8 billion, driven by strong domestic demand and population growth.

“Chairman Hoang Mai Chung Receives Prestigious Accolade: Top 10 ASEAN Leaders Award 2025.”

At the 6th ASEAN Economic Forum in Singapore, Mr. Hoang Mai Chung, Chairman of Meey Group, was recognized as one of the Top 10 ASEAN Leaders in 2025. This award not only celebrates his personal achievements but also stands as a testament to his strategic vision and ambition to globalize Vietnamese PropTech.

“Foreign Block Sells Off Nearly VND 2.5 Trillion as VN-Index Hits New Peak”

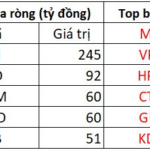

The SSI stock witnessed a significant net foreign purchase on the afternoon of the trade, with a value of 245 billion VND, making it the most actively bought stock by foreign investors in the entire market.

The Foreign Sell-Off Cools, Yet a Bank Stock Still Takes a 500 Billion Dong Hit

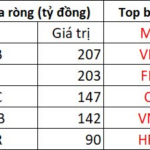

In the afternoon trading session, foreign investors net bought SHB and VIX stocks the most in the market, with a value of over 200 billion VND each.