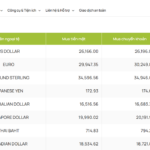

The State Bank of Vietnam (SBV) on August 25 announced the central exchange rate at 25,291 VND/USD, down seven dong compared to the previous week’s closing level. Previously, the central exchange rate had increased by 49 dong during the week and set a record high of 25,298 VND/USD.

With a fluctuation band of 5%, the ceiling and floor rates applied by commercial banks for the day are 24,026 VND/USD and 26,556 VND/USD, respectively.

As previously informed, the SBV started selling foreign currencies with a term of 180 days and the right to cancel the contract early on August 25, at a rate of 26,550 VND/USD. However, this transaction is only applicable to credit institutions with a negative foreign currency status. The maximum foreign currency sold to each bank in each transaction is limited to balance their foreign currency status. For term transactions from $100 million, credit institutions are allowed to cancel up to three times. If the term transaction is less than $100 million, the cancellation limit is twice.

According to analysts, the SBV’s provision of foreign currency sales contracts with the right to cancel early aims to establish a firm threshold for the interbank exchange rate at around 26,550 VND/USD. It also helps to eliminate market expectations of further ceiling adjustments, thereby cooling down the exchange rate in the short term. This move is expected to push the demand for USD in the banking system towards the end of 2025 and early 2026, a period when foreign currency supply will increase due to remittances and the potential for the Federal Reserve (Fed) to cut interest rates.

In fact, following the downward trend on the last trading day of the previous week, USD prices at banks decreased unanimously and fell below 26,500 VND/USD in the morning session.

At 10:00 am, Vietcombank, the bank with the largest foreign exchange transaction volume in the system, listed the USD buying and selling rates at 26,090 – 26,480 VND/USD, a decrease of 40 dong in both buying and selling rates compared to the previous week’s closing level.

VietinBank lowered its selling rate to 26,485 VND and increased its buying rate to 26,125 VND, with the buying and selling rates at 26,125 – 26,485 VND/USD. BIDV decreased the buying rate by 100 dong and the selling rate by 82 dong.

Other major banks, including Techcombank, ACB, MB, Eximbank, and Sacombank, also unanimously lowered their USD selling rates to below 26,500 VND/USD.

In the interbank market, the exchange rate closed at 26,330 VND/USD on August 25, a significant decrease of 103 dong compared to the closing level on August 22.

In the black market, the USD surged to a record high. At 10:00 am, the buying and selling rates were quoted at 26,650 – 26,750 VND/USD, with the buying rate increasing by 130 dong and the selling rate by 150 dong compared to the previous Friday’s survey.

Internationally, the US Dollar Index (DXY), which measures the strength of the greenback against other major currencies, hovered around 97.9 points. The US dollar tended to weaken against other major currencies after the Fed Chairman signaled a possible interest rate cut in September 2025.

Speaking to international economists and policymakers at the Jackson Hole conference, Fed Chairman Jerome Powell acknowledged that the US labor market was in a “strange balance” – a balance not derived from stable economic health but from a clear weakening of both labor supply and demand.

“This suggests that the risk of recession is rising, and if it does materialize, it could happen faster,” Powell emphasized. He also warned that new tariffs could create prolonged upward pressure on prices, leading to more challenging inflation dynamics.

Powell stated that current unemployment rate indicators remain stable, allowing the Fed to “cautiously proceed” with policy changes. However, he emphasized that interest rates are currently in the “restrictive zone,” meaning they are already high enough to impact growth. Therefore, any policy adjustments would need to be carefully considered, focusing on upcoming employment and price data.

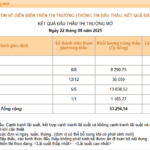

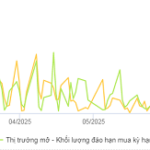

The Central Bank’s U-turn: A Modest Net Inflow in the Open Market

The State Bank of Vietnam (SBV) shifted its focus to a mild net withdrawal from the open market during the week of August 11-18, marking a change in direction after a month of consecutive net injections.