I. MARKET DEVELOPMENT OF WARRANTS

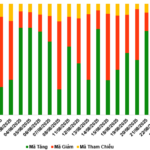

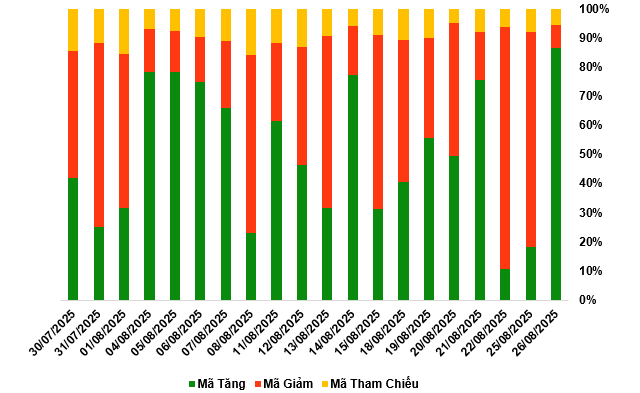

As of the close of the trading session on August 26, 2025, the market witnessed 224 advancing codes, 21 declining codes, and 14 reference codes.

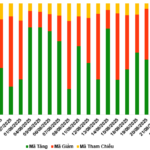

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

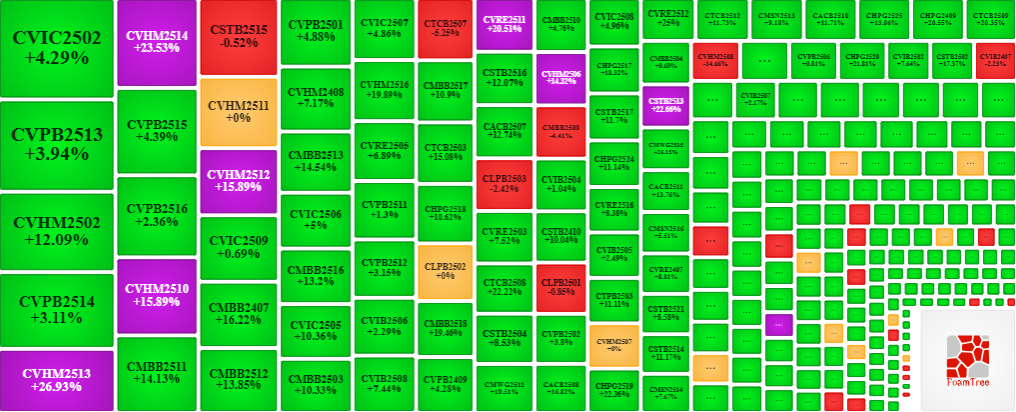

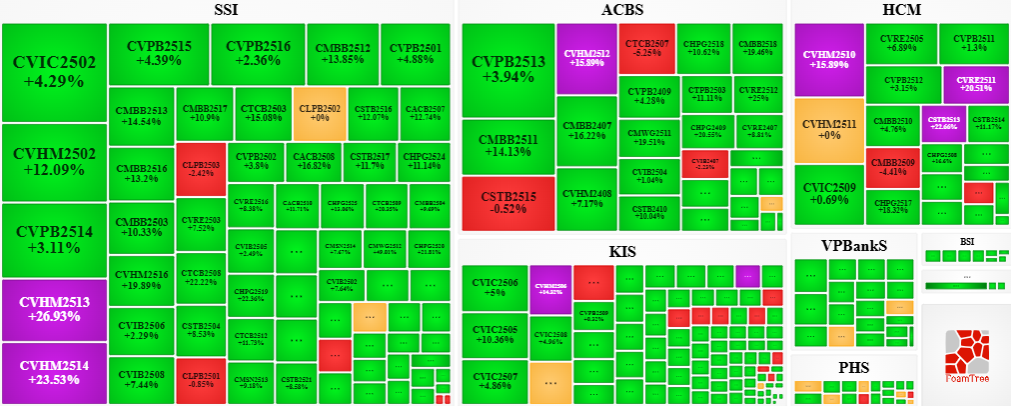

During the trading session on August 26, 2025, buyers dominated the market, causing most of the warrant codes to increase in price. Specifically, the large codes in the group that increased in price were CVPB2513, CMBB2511, CVHM2514, and CVIC2509.

Source: VietstockFinance

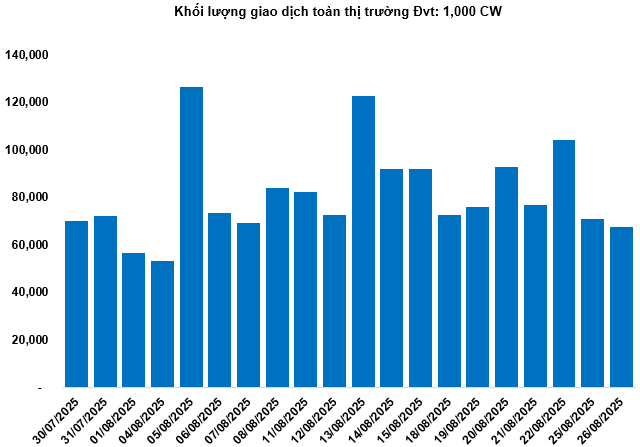

The total market volume in the August 26 session reached 67.57 million CW, down 4.71%; the value of transactions reached VND 156.22 billion, down 13.82% compared to the previous session. Of which, CHPG2406 was the code leading the market in volume with 3.55 million CW; CTPB2502 led in transaction value with VND 6.2 billion.

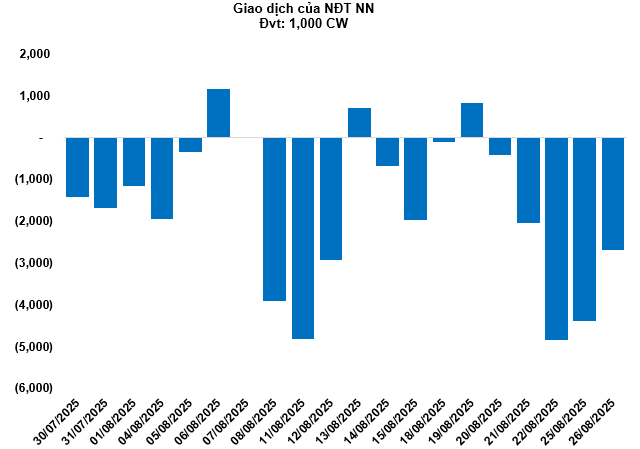

Foreigners continued to sell a net in the session of August 26, with a total net selling volume of 2.69 million CW. Of which, CMSN2508 and CHPG2512 were the two codes that were net sold the most.

Securities companies SSI, ACBS, HCM, KIS, and VPBank are currently the organizations with the most warrant codes in the market.

Source: VietstockFinance

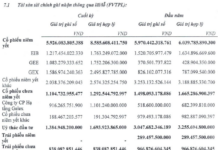

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

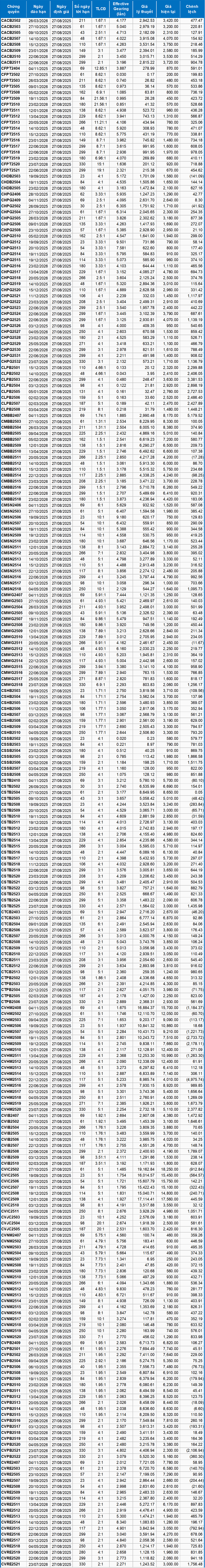

Based on the valuation method suitable for the starting point of August 27, 2025, the reasonable prices of the warrants currently traded in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the risk-free bill rate (government bill rate) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above valuation, CVHM2515 and CVHM2508 are currently the two warrant codes with the most attractive valuations.

The higher the effective gearing ratio of the warrant codes, the greater the increase/decrease with the underlying securities. Currently, CVNM2512 and CHPG2512 are the two warrant codes with the highest effective gearing ratio in the market.

Department of Economic Analysis & Market Strategy, Vietstock Consulting Department

– 18:58 26/08/2025

“Foreign Block Sells Off Nearly VND 2.5 Trillion as VN-Index Hits New Peak”

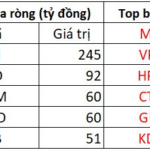

The SSI stock witnessed a significant net foreign purchase on the afternoon of the trade, with a value of 245 billion VND, making it the most actively bought stock by foreign investors in the entire market.

The Warrant Market Week of August 25-29, 2025: Ablaze with the Underlying Market

The trading session on August 22, 2025, concluded with a mixed performance across the market. Amidst a sea of 243 stocks, 28 emerged victorious with upward trends, while 215 succumbed to downward pressures. The remaining 16 stocks remained unchanged, serving as a stalwart anchor in this tempestuous market climate. Foreign investors maintained their cautious stance, offloading a net sell-off of 4.84 million covered warrants.

Foreign Investors Dump Two Blue-chip Stocks Worth Billions in Week of August 18-22, Contrasting the Heavy Buying of Securities Stocks

The foreign sector continued to aggressively sell off stocks, with net selling in the trillions of dong, and the value increasing towards the end of the week.

The Derivatives Market on August 19, 2025: A Tug of War

The trading session on August 18, 2025, concluded with a mixed performance across the market. Out of all the stocks traded, there were 105 gainers, 126 losers, and 28 stocks that remained unchanged. Foreign investors continued their net-selling trend, offloading a total of 98,500 CW worth of shares.