I. MARKET ANALYSIS OF UNDERLYING SECURITIES AS OF AUGUST 27, 2025

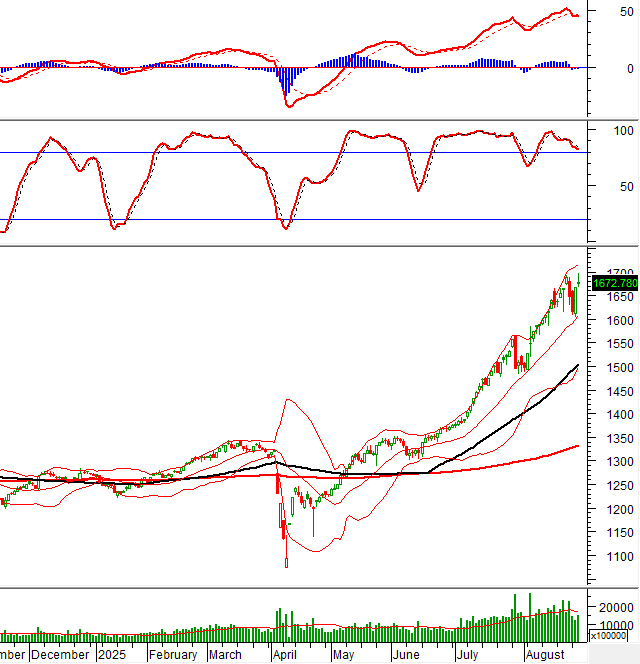

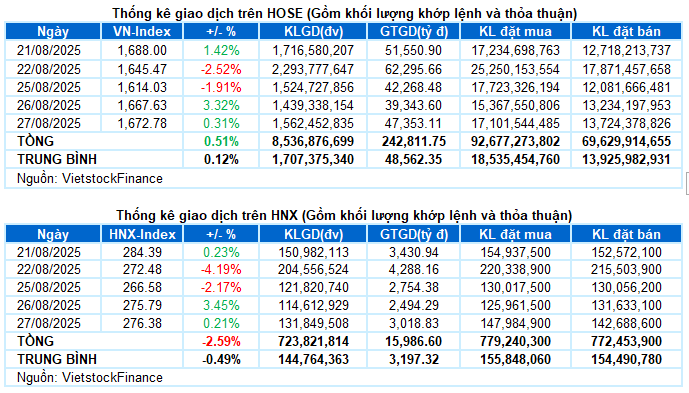

– The main indices remained in the green during the trading session on August 27. The VN-Index increased by 0.31% to reach 1,672.78 points; the HNX-Index also edged up by 0.21% from the previous session, landing at 276.38 points.

– Matching volume on the HOSE rose by 20.1%, surpassing 1.4 billion units. The HNX also witnessed an increase, recording nearly 129 million units, a 15% surge compared to the previous low.

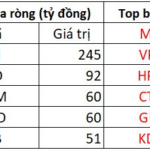

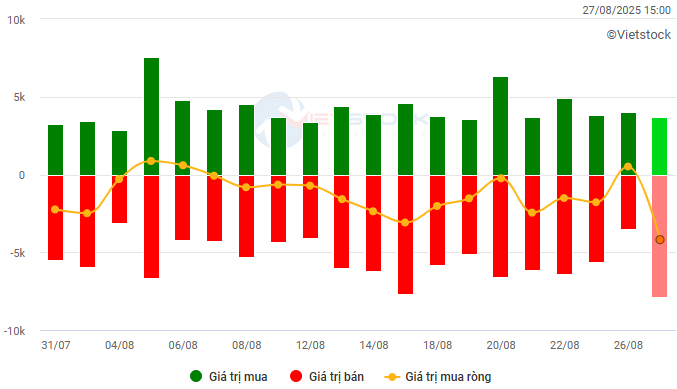

– Foreign investors net sold over VND 4,000 billion on the HOSE while net buying nearly VND 17 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM. Unit: VND billion

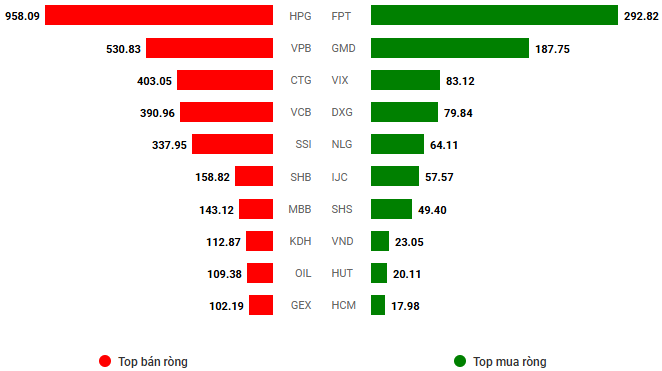

Net trading value by stock. Unit: VND billion

– The positive sentiment from the strong recovery in the previous session boosted the market’s opening on August 27. The VN-Index quickly advanced to challenge the 1,695-point threshold within the first hour of trading. However, profit-taking pressure at higher levels persisted, narrowing the gains. Despite significant support from the large-cap ticker VCB, the upward momentum was insufficient to counter the net selling pressure from foreign investors. The VN-Index fluctuated around the 1,675-point level in the afternoon session and closed at 1,672.78 points, up slightly by 0.31% from the previous session.

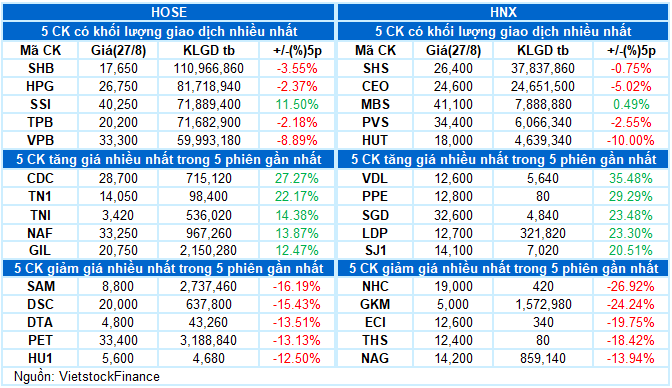

– In terms of impact, VCB was the leading stock, contributing 9.4 points to the VN-Index. This was followed by FPT and BID, which added over 3.7 points combined. On the other hand, VIC was the most negative stock, causing the index to lose 3 points.

– The VN30-Index closed just below the reference level, settling at 1,848.55 points. The basket had a relatively balanced performance, with 14 gainers and 16 losers. Among the gainers, VCB stood out with a substantial increase, while FPT, SSI, and BID also recorded growth ranging from 2% to 5%. Conversely, LPB and TPB were the worst performers, declining by over 3%.

Sectors exhibited clear differentiation. Information Technology led the gains, driven mainly by the industry’s two largest stocks, FPT (+5%) and CMG (+2.27%).

The Financials sector witnessed several stocks surging, including VCB (hitting the ceiling price), BID (+2.39%), ACB (+1.1%), SSI (+2.68%), STB (+1.09%), VND (+3.48%), and VIX (+5.74%). However, red ticks also appeared intermittently, with notable mentions including TCB (-1.02%), LPB (-3.74%), VPB (-2.92%), VIB (-1.76%), TPB (-3.58%), and NAB (-3.05%).

On the flip side, Energy was the worst-performing sector, declining by 1.33%, mainly due to tickers such as BSR (-3.46%), OIL (-0.86%), VTO (-0.83%), PVC (-0.87%), CST (-1.33%), and PVB (-1.06%).

The VN-Index narrowed its gains towards the end of the session and formed a Long Upper Shadow candle. This pattern indicates persistent profit-taking pressure at the previous high of 1,680-1,693 points. Additionally, the Stochastic Oscillator indicator continued to weaken after generating a sell signal, suggesting that the index may face further volatility in the upcoming sessions.

II. TREND AND PRICE MOVEMENT ANALYSIS

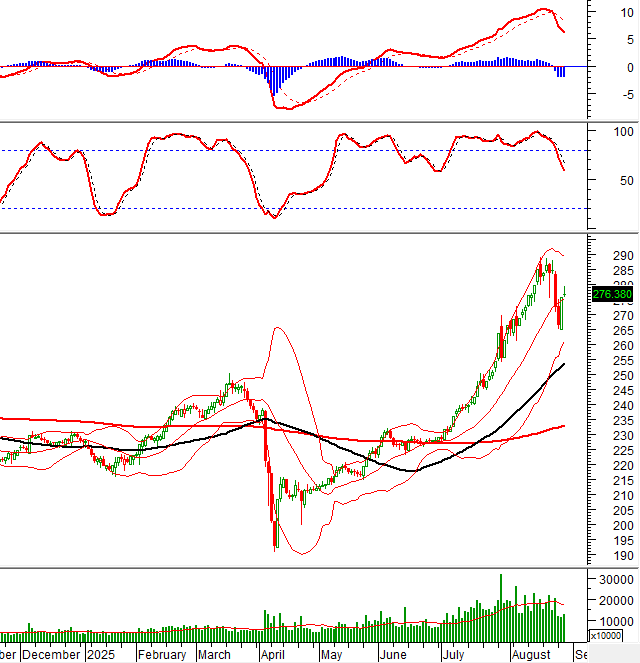

VN-Index – Long Upper Shadow candle appears

The VN-Index narrowed its gains towards the end of the session, forming a Long Upper Shadow candle. This pattern indicates strong profit-taking pressure at the previous high of 1,680-1,693 points.

Additionally, the Stochastic Oscillator indicator continued to weaken after generating a sell signal, suggesting potential volatility for the index in the near term.

HNX-Index – Trading volume remains below the 20-session average

The HNX-Index trimmed its gains, with trading volume staying below the 20-session average, indicating investors’ cautious sentiment.

Currently, the Stochastic Oscillator and MACD indicators are trending downward after generating sell signals, suggesting potential challenges for the index’s short-term outlook.

Analysis of Money Flow

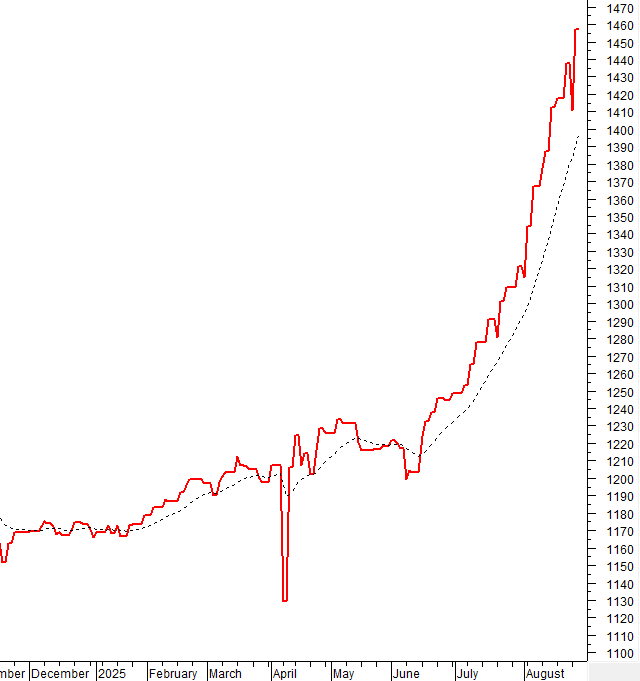

Movement of smart money: The Negative Volume Index indicator of the VN-Index is above the EMA 20-day. If this status persists in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Foreign capital flow: Foreign investors net sold strongly in the session on August 27. If foreign investors maintain this action in the coming sessions, the situation may turn more pessimistic.

III. MARKET STATISTICS AS OF AUGUST 27, 2025

– 17:16 27/08/2025

The New Wave of Banking: Leading Expectations and Managing Margins

The post-COVID-19 era has witnessed a record-breaking rally for bank stocks, but this impressive performance belies a more nuanced story. This surge is underpinned by a combination of factors, including heightened expectations and the influx of margin financing into the financial sector. While this has provided a much-needed boost to the market, it also presents challenges, as the margin contraction highlights a delicate balance that could impact the market’s trajectory.

“Foreign Block Sells Off Nearly VND 2.5 Trillion as VN-Index Hits New Peak”

The SSI stock witnessed a significant net foreign purchase on the afternoon of the trade, with a value of 245 billion VND, making it the most actively bought stock by foreign investors in the entire market.

Market Pulse, August 25: VN-Index Plunges Over 31 Points, VIC and VHM Stage a Comeback

The trading session ended on a gloomy note, with the VN-Index shedding 31.44 points (-1.91%), settling at 1,614.03. Likewise, the HNX-Index witnessed a decline of 5.9 points (-2.17%), closing at 266.58. The market breadth tilted towards decliners, as 488 stocks closed in the red compared to 265 advancers. The VN30 basket echoed a similar sentiment, with 23 stocks losing ground, 5 gaining, and 2 remaining unchanged.