According to information from the Hanoi Stock Exchange (HNX), Alphanam E&C JSC has sent a document to the State Securities Commission (SSC) and HNX announcing personnel-related changes.

On August 25, 2025, Alphanam E&C received the resignation of Mr. Nguyen Dac Tai from his position as Deputy General Director. Mr. Tai’s resignation took effect on August 26, 2025, due to personal reasons.

In terms of business performance, according to the consolidated financial statements for the second quarter of 2025, the company’s net revenue from sales and services provided exceeded VND 1,266 billion, an 18% increase compared to the same period last year.

The cost of goods sold also increased from VND 1,028 billion to nearly VND 1,191 billion, resulting in a gross profit of VND 76 billion for the second quarter of 2025, a 73% increase over the same period.

Illustrative image

During this period, financial expenses (mainly interest expenses) increased from VND 26 billion to VND 42 billion, and management expenses increased from nearly VND 8 billion to nearly VND 13 billion.

After deducting taxes and fees, the company’s post-tax profit reached nearly VND 17 billion, an increase of 138% compared to the previous year.

According to Alphanam E&C’s explanation, the consolidated operating results for the second quarter of 2025 increased compared to the same period in 2024 due to a significant expansion in project implementation, leading to outstanding revenue growth compared to the second quarter of 2024.

The increase in profit compared to the previous year was mainly attributed to the growth in sales revenue and the positive contribution of construction activities to the above-mentioned difference compared to the same period last year.

For the first six months of 2025, the company’s net revenue and net profit were VND 2,391 billion and VND 18 billion, respectively.

As of June 30, 2025, Alphanam E&C’s total assets amounted to VND 3,401 billion, an increase of VND 226 billion compared to the beginning of the year. Short-term assets accounted for the majority, standing at VND 3,294 billion. The company recorded payables to suppliers of nearly VND 1,215 billion and investments of over VND 258 billion.

According to Alphanam E&C’s six-month management report for 2025, no transactions of insider or related-party shares were recorded during the first half of this year.

As of the end of 2024, Alphanam Investment JSC held over 54.12 million AME shares, equivalent to 83% of Alphanam E&C’s capital. Another “Alphanam” enterprise, Alphanam JSC, owned 6.1% of the capital in Alphanam E&C. Mr. Nguyen Minh Nhat, a member of the Board of Directors of Alphanam E&C, held over 2.8 million AME shares, representing 4.3% of the company’s capital.

AME’s 2024 management report showed that Mr. Nguyen Minh Nhat is currently a shareholder, Chairman of the Board, and General Director of Alphanam JSC; Vice Chairman of the Board and General Director of Alphanam Investment JSC; Chairman of the Board, shareholder, and General Director of Muong Hoa Cultural Park Investment JSC.

In addition, Mr. Nhat also holds important positions in other companies within the “Alphanam” ecosystem, including Alphanam Real Estate JSC and the Board of Directors of Hanel-Alphanam Urban Development JSC.

Mr. Nguyen Minh Nhat is known as the son of Alphanam Group’s Chairman, Mr. Nguyen Tuan Hai, and Ms. Do Thi Minh Anh.

The Largest Shareholder Pledges All EVS Shares to Back EVS Securities Loan.

Mr. Tien Vu Manh, a prominent member of the Board of Directors, has demonstrated his unwavering commitment to the company by pledging his entire holdings of 16 million EVS shares, along with associated assets, as collateral for a loan taken by EVS Securities. This bold move underscores Mr. Manh’s strong belief in the company’s prospects and his willingness to personally ensure its financial stability.

“TNR Stars Thái Hòa Investors Raise $85 Million in Bond Sales in Less Than a Month”

From July 17 to August 13, 2025, Thanh Vinh Real Estate, the developer of TNR Stars Thai Hoa, issued four bond lots, successfully raising a total of VND 2,000 billion.

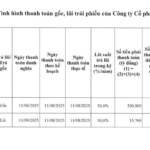

“CMC Repays Over 300 Billion VND in Principal and Interest on Bonds”

CMC has just made a significant payment of over VND 300 billion in principal and nearly VND 16 billion in interest on the CVTB2125003 bond lot.