Comprehensive Financial Solutions for the Journey of Knowledge

As the new academic year approaches, the joy and excitement of children are always accompanied by the worries of parents. This is the time when parents want to invest the best in their children, especially for families with children attending elementary, middle, and high school or preparing to enter college. In addition, many parents also need to prepare finances to cover tuition fees for their children to study at test preparation, language, or IT centers.

Mr. Nguyen Van L. (Bac Giang) is currently worrying about enrolling his eldest son at a university in Hanoi. Besides tuition and dormitory fees, Mr. L. is also considering buying an electric motorbike for his son’s convenience in moving within Hanoi.

“My son got into a good school, and our whole family is happy. I just want to be able to afford the tuition so that my son can focus on his studies without having to work part-time all the time,” shared Mr. L. “But to be honest, the cost is not small, including tuition, living expenses, transportation, and study equipment. It’s too difficult for my family to save such a large amount in a short period.”

Ms. Tran Thi M. (Ho Chi Minh City) is also concerned about the tuition fee as she enrolls her 11th-grade son in an English course at a center to prepare for an international certificate exam. “My son wants to take the test to prepare for his future study abroad application. I fully support him, but the cost of studying at a reputable center is quite high, and they require one-time payment. This is indeed a large sum of money for our family,” shared Ms. M. “My husband and I have to worry about both the regular school fees and the additional language course fees, which is quite a burden.”

Understanding these concerns, BVBank offers an exclusive promotion program for tuition fee payment loans with an attractive interest rate of only 0.58%/month, dedicated to parents of students from grade 1 to grade 12 and college, vocational college, or university students. Besides school tuition fees, this loan package is also applicable to courses at test preparation centers, language centers, and IT centers.

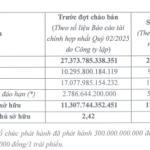

With simple documentation and quick procedures, the loan can be approved on the same day, helping families timely prepare their children’s financial needs for the new school year. Especially, this unsecured loan product offers a credit limit of up to VND 300 million, a maximum term of 60 months, and a preferential interest rate of only 7%/year, providing flexibility for customers in budgeting.

In addition, the monthly repayment method helps parents and students divide the financial burden into smaller, more manageable portions, instead of having to pay a large sum at once. This product is not only a timely financial support but also accompanies families, ensuring that every student has the opportunity to access the best education and prepare a solid foundation for their future.

Besides unsecured loans, parents and students can also choose to open a BVBank credit card to pay tuition fees in installments with a 0% interest rate and a flexible term of 3-12 months.

Ready for the New Academic Year with BVBank

The journey of knowledge for each student does not stop at tuition fees. It also includes a whole range of necessary equipment: from a laptop for studying and researching to a safe and convenient means of transportation every day. These are all worthy investments, helping students gain confidence and take firm steps on their path of knowledge.

Accompanying parents in equipping their children, BVBank offers flexible financial solutions. With the Green Consumer Loan package, customers can easily own an electric vehicle – a convenient, economical, and environmentally friendly means of transportation – thanks to a credit limit of up to VND 300 million, a maximum term of 60 months, and an interest rate of only 0.58%/year.

“BVBank provides a variety of flexible loan packages, so I can not only pay my son’s tuition but also buy him an electric vehicle for safe and convenient daily commuting. The procedures are simple, the disbursement is timely, and the interest rate is reasonable, so I feel quite secure,” shared Mr. L.

In parallel, BVBank also supports parents and students in purchasing laptops, phones, or modern learning equipment through credit cards. The 0% interest installment payment program at many reputable systems such as The Gioi Di Dong, Dien May Xanh, CellphoneS, Tiki, FPT Shop, and Shopdunk makes investing in learning tools more accessible. With transactions from VND 3 million, customers can choose to pay in installments over 3, 6, 9, or 12 months, while still enjoying the usual benefits of bonus points and cash-back.

Not stopping at domestic study support, BVBank also accompanies parents on their children’s journey of studying abroad with international money transfer services that are fast, safe, and cost-optimized. From tuition fees to regular living expenses, all expenses are comprehensively covered thanks to fee waivers/reductions according to transaction levels, competitive exchange rates, and the SWIFT system, which ensures absolute safety.

The Great Teacher Shortage: PM Calls for Review to Address 100,000 Deficit

The Ministry of Home Affairs, in collaboration with the Ministry of Education and Training and local authorities, is conducting a comprehensive review of teacher recruitment processes for the period 2022-2026. This review aims to propose supplementary staffing allocations up to 2030, ensuring a robust and sustainable education system.

“VPI Leverages Chairman’s Stock to Raise $250 Million in Bond Offering?”

Real Estate Development Corporation, Van Phu (HOSE: VPI), successfully issued a VND 250 billion bond, with the code VPI12502. The bond has a term of 36 months and will mature on August 15, 2028, with a fixed interest rate of 10% per annum.

Global Trade Forum 2025: Unlocking Strategies, Empowering Businesses

The 2025 Trade Forum, organized by VietinBank, offers a dynamic platform for businesses to enhance their competitive edge in the global market. Through insightful policy updates, trend analyses, and strategic insights, the forum equips enterprises with the knowledge and understanding needed to navigate the complex world of international trade.