Real Estate Joint Stock Company 11 (RES 11, HNX: D11) has just announced that September 8 is the record date for paying 2021 dividends in shares to shareholders, corresponding to the ex-right date of September 5.

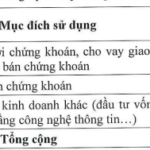

With an implementation ratio of 12% (shareholders owning 100 shares will receive 12 new shares), it is estimated that D11 will need to issue an additional 880,576 shares to pay this dividend. The issuance capital will come from over VND 8.8 billion of undistributed post-tax profits at the end of 2024 (total source of about VND 29.3 billion).

The 2021 dividend payment was approved at the 2025 Annual General Meeting of Shareholders of D11. The dividend payments for 2022 and 2023, with respective ratios of 10% and 6%, were also approved at the meeting, with the issuance capital for both years coming from undistributed post-tax profits at the end of 2024.

These plans were all approved at previous shareholder meetings, and with the finalization of the 2021 dividend entitlement, D11 is taking steps to fulfill its dividend commitments to shareholders.

D11’s investment projects include ResGreen Tower and Res11 buildings in Ho Chi Minh City.

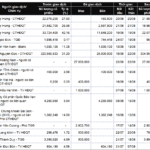

In terms of business performance, after peaking in 2021 with revenues of VND 298.5 billion and profits of over VND 45 billion, the financial picture of D11 has somewhat deteriorated in subsequent years.

In 2022, the company’s revenue and profits both halved to VND 134 billion and VND 21.8 billion, respectively. This downward trend continued into 2023, with recorded revenue of VND 34.9 billion and post-tax profits of only VND 4.7 billion. However, in 2024, revenue rebounded to VND 106 billion, but profits further declined to just VND 3.9 billion.

Nevertheless, the first half of 2025 showed improvement, with D11 recording revenue of over VND 52 billion and post-tax profits of VND 4 billion, increases of 61% and 47%, respectively, compared to the same period last year.

D11, formerly known as the 11th District Housing Development and Management Company, was established in 1989 and primarily engages in construction and real estate development, including residential and office properties. It is a subsidiary of Saigon Real Estate Corporation and has operated as a joint-stock company since 2004.

The Chairman of Ladophar seeks to offload a significant portion of his holdings as the company’s shares soar to new heights.

Mr. Pham Trung Kien, Chairman of the Board of Directors of Ladophar, a leading pharmaceutical company in Vietnam, has recently filed to sell over 1.08 million shares of the company’s stock, equivalent to 8.1% of its capital. If the transaction is successful, Mr. Kien’s ownership will decrease to 0.7%, and he will no longer be a major shareholder. The sale is intended for portfolio restructuring and will be executed through matched orders and/or put-through transactions between August 29 and September 27.