In its latest announcement, the Ho Chi Minh City Stock Exchange (HOSE) decided to remove the stocks of Hoang Anh Gia Lai Joint Stock Company (code: HAG) from the warning list starting August 26, 2025. This decision was made as the company has addressed the issues that led to the stock being placed under warning, in accordance with regulations.

Previously, HAG had been under warning by HOSE since October 2022 due to post-tax losses in 2021. In its recently published reviewed semi-annual financial statement for 2025, as of June 30, 2025, HAGL had eliminated its accumulated losses, with cumulative profits reaching VND 409 billion. The resolution of these losses has helped HAG escape the warning list.

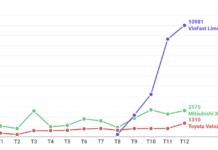

Following the news of this development, Hoang Anh Gia Lai’s stock quickly attracted interest from investors. On the morning of August 25, 2025, the HAG share price surged to the ceiling with heavy buying pressure, reaching VND 17,200 per share. This was the highest price for HAG since August 2015, with relatively high trading volume of nearly 25 million units and a buying queue of nearly 10 million units at the ceiling price.

Since the beginning of 2025, the HAG share price has increased by 43%, and Hoang Anh Gia Lai’s market capitalization has also risen by nearly VND 5,500 billion to approximately VND 18,200 billion.

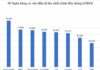

In terms of business performance, for the first six months of the year, Hoang Anh Gia Lai recorded VND 3,709 billion in net revenue, a 34% increase compared to the same period last year. As a result, the company’s reviewed net profit reached nearly VND 834 billion, a 74% increase year-over-year.

However, in the reviewed semi-annual financial statement for 2025, Ernst & Young Vietnam noted that HAG’s short-term debt exceeded its short-term assets by more than VND 2,767 billion. This indicates a potential risk to the company’s ability to continue operating as a going concern. HAG has also violated some bond commitments and has not repaid the principal and interest of overdue bonds.

In response to this issue, HAG explained that its cash flow in the next 12 months is expected to come from the liquidation of a portion of its financial investments, the recovery of loans to partners, as well as private bond issuances, bank credit, and debt restructuring plans.

The company is working with lenders to adjust the terms of the violations and seek shareholder approval for a plan to convert part of the debt into equity. They affirmed that the financial statements are prepared on a going concern basis, with cash flow supported by banana and durian exports.

Breaking the Losing Streak: Foreign Block Snaps 13 Consecutive Selling Sessions with Near 1,000 Billion Dong Purchase on HoSE

Foreign investors surprised the market with a net buy-in of nearly VND 742 billion, ending a 13-session long selling streak.

The Son of Vietnamese Tycoon ‘Bầu Đức’ Seeks to Invest an Additional 400 Billion VND in HAG Shares, Even Before His Previous Purchase Has Cleared.

“Doan Hoang Nam has just announced his intention to purchase an additional 25 million shares of Hoang Anh Gia Lai, bringing his ownership stake in the company to 4.92%. This significant acquisition underscores Mr. Nam’s confidence in the company’s prospects and his commitment to its long-term growth.”

“HOSE Issues Urgent Alert to Investors Regarding Fake Documents”

The Ho Chi Minh Stock Exchange (HOSE) has issued a warning about fraudulent documents circulating that entice investors with enticing fixed investment package schemes. These documents are a deceptive ruse designed to lure unsuspecting investors into risky ventures.