Agribank, as the leading state-owned commercial bank in investing in agriculture and rural areas, is asserting its pioneering position by not only providing capital but also paving the way for Vietnamese carbon credits to reach international markets.

From biomass wood credit to carbon opportunities

Vietnam is the first country in the East Asia-Pacific region to receive a payment of $51.5 million for reducing carbon emissions based on results from the World Bank’s Forest Carbon Partnership Facility (FCPF). This benefits 70,555 forest owners and 1,356 communities living near forests in six provinces, distributed according to a transparent plan, ensuring fairness and the participation of multiple stakeholders. This demonstrates how the “intangible asset” of carbon credits can become a sustainable source of income for both communities and the nation.

With 14.7 million hectares of forest, a tropical climate, and rapid plant growth, Vietnam is presented with a unique opportunity: from a country with potential, it can rise to become a leading provider of carbon credits in the region. But to turn this potential into reality, a prerequisite is long-term and sustainable capital, helping businesses invest in technology, infrastructure, and meet stringent international standards for certification and data transparency.

In this context, Agribank has pioneered accompanying businesses. Signing credit contracts with Van Lang Yufukuya Company and Lam Thanh Hung Company in Thanh Hoa not only provides financial resources but also boosts businesses’ confidence in boldly pursuing green projects, contributing to building a carbon economy.

Located in the Nghi Son Economic Zone, Van Lang Yufukuya Co., Ltd. specializes in producing wood chips and wood pellets, which are in high demand in Japan, South Korea, and Europe for biomass energy production. Since 2020, Agribank has accompanied this company with a credit limit of VND 200 billion, of which VND 161 billion has been disbursed. Timely disbursement helps Van Lang maintain its supply chain of raw materials, ensure export progress, and have additional resources to expand its market and upgrade its biomass wood processing line.

Notably, Van Lang only purchases raw materials from units with FSC (Forest Stewardship Council) certification and makes direct payments for each imported batch. This not only meets the market’s transparency and sustainability requirements but also affirms its long-term development orientation associated with international standards.

Unlike Van Lang, Lam Thanh Hung Company, headquartered in Tuong Linh, focuses on producing wood chips and glued laminated timber. The company was granted a credit limit of VND 80 billion by Agribank and has fully disbursed it. This capital has helped the company expand its production and enhance its competitiveness in the international market.

What sets Lam Thanh Hung apart is its management of 700 hectares of forest in four communes: Cong Lien, Cong Chinh, Tuong Son, and Tuong Linh (Nong Cong district, Thanh Hoa province). This area is rented from 258 households, and the company has made full rental payments to the households and continues to make direct payments to them with each imported batch of raw materials. This model ensures a stable supply and generates income for the local community, building a mechanism for fair benefit-sharing, an essential aspect of sustainable development.

At first glance, the loans for Van Lang and Lam Thanh Hung seem like traditional wood production credit. But in essence, they are crucial links in the carbon value chain. From planting forests for raw materials, processing biomass wood to exporting, each activity contributes to CO₂ absorption and creates emission reductions that can be measured, reported, and verified (MRV). When meeting international standards, these emission reductions will be certified as carbon credits and can be sold in voluntary or mandatory markets.

Thus, Agribank’s credit not only helps maintain production activities but also serves as a “lever” for Vietnamese businesses to enter the global carbon market worth hundreds of billions of dollars. This proves how commercial banks can become a “link” between traditional agricultural economics and the green economy of the future.

Mr. Lang Van In, Chairman of Van Lang Yufukuya’s Members’ Council, shows Agribank officers around the company’s production model.

Mr. Lang Van In, Chairman of the Members’ Council of Van Lang Yufukuya Company, shared, “The loan from Agribank is the key to helping us invest in a biomass wood processing line and develop a forest plantation project. Despite favorable policies with Decree 06/2022/ND-CP and Decision 888/QD-TTg, we still face challenges: high MRV monitoring costs, complex international certification procedures, and pressure for data transparency. Without Agribank’s support, we would not have come this far.”

Agribank’s capital not only helps businesses maintain production but also serves as a stepping stone for them to enter the green economy, where value comes not only from wood products but also from reduced emissions. As a result, biomass wood credit is not just about nurturing the forestry industry but also opening the “gateway” for Vietnamese businesses to exploit profits from carbon credits, an intangible but increasingly valuable asset.

From Lam Thanh Hung’s perspective, the company representative also emphasized, “Capital support not only helps us maintain our forest plantation and processing chain but also opens up access to the potential carbon credit market in Japan, the EU, and South Korea. We believe that carbon credits will become a sustainable source of income alongside traditional wood products, thus creating a solid financial foundation.”

A vote of confidence gradually affirms its position in the global carbon value chain

Clearly, Agribank’s timely capital provision has enabled businesses to meet international standards, stabilize production, and maintain their reputation with foreign partners. Thanks to this backing, not only Van Lang Yufukuya and Lam Thanh Hung but also Vietnamese wood businesses have the opportunity to expand not only their export markets but also enter the international “playground” of carbon credits – a market worth over $900 billion by 2024 and continues to grow.

While businesses “create” carbon credits, banks act as a “link” to bring these products to market. As the leading financial institution in agriculture and rural areas, Agribank understands better than anyone the potential of Vietnam’s forests in the global carbon value chain.

Agribank’s financing for businesses not only contributes to promoting clean production but also directly supports the country’s Net Zero 2050 goal. This is also an opportunity for Agribank to expand its credit portfolio into the field of carbon finance – a promising area that helps increase income from service fees, guarantees, international payments, and enhances the image of a green and sustainable bank.

Agribank officers appraising the forest plantation project of the enterprise

Particularly, when businesses have stable additional income from carbon credits, banks also benefit from improved debt repayment ability, reducing credit risks. This is a “win-win” relationship in which Agribank fulfills its social responsibility while enhancing its competitive advantage in the financial market.

Not limited to credit, carbon credit projects require modern monitoring, reporting, and verification (MRV) systems, digitized and transparent data. This is the “gateway” for Agribank to promote its digital transformation strategy, providing cross-border payment solutions, cash flow management, and digital banking services to customers. Thus, a green credit loan also opens up many other modern financial services, closely linking businesses with banks.

From the perspective of the credit buyer, initial assessments show that transactions from Vietnam are increasingly well-received. A representative shared, “The credits we purchase from Vietnamese businesses meet all legal, technical, and environmental value requirements. These are high-quality credits that can be traded or used immediately in emission reduction commitments. More importantly, it helps affirm the credibility of both the seller and the buyer in the international market.”

The forests of Vietnamese farmers have brought the first benefits when exporting carbon to the market

This proves that not only businesses and banks benefit, but the international market also appreciates Vietnam’s efforts. Each successful transaction brings not only revenue but also a “vote of confidence” that helps Vietnam gradually affirm its position in the global carbon value chain.

Prime Minister Directs Expedited Submission of Special Mechanisms for International Integration to the National Assembly.

“The Prime Minister has urged for the swift completion of a resolution by the National Assembly regarding special mechanisms and policies for international integration. This resolution aims to address bottlenecks in institutions and policies, paving the way for seamless integration and progressive policy changes.”

Activating the Whole Sector: Prioritizing Dam Safety and Essential Supplies for Typhoon Response

Amid the extremely perilous situation posed by Typhoon No. 5, with its intense strength and wide-reaching impact, the Ministry of Industry and Trade sprang into action. On August 23 and 24, 2025, the Ministry issued two urgent dispatches, mobilizing the entire industry to implement swift and decisive disaster response measures with the utmost urgency and proactivity.

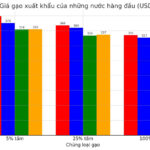

The World’s Most Expensive Rice is in Vietnam

The Vietnamese rice industry continues to dominate global markets with its premium-quality fragrant rice. With the highest prices among the top four rice exporters, Vietnam’s rice sector is thriving and leading the way.