The decision to merge provinces has created administrative units with areas ranging from 2,500 to 24,000 square kilometers and populations of 1.6 to 14 million people, transforming many urban cores into super-centers of infrastructure, administration, and commerce. This means that branches that once led in an old province will now have a much smaller market share in the new provinces, as peripheral transaction offices inadvertently fall into the newly emerged central towns. If banks continue to set business targets, rewards, or personnel rotations based on the old provincial boundaries, they will face challenges in determining the right scale and, consequently, formulating inappropriate strategies. The issue is not just about losing market share but also missing out on covering newly formed residential areas and industrial zones, where CASA ratios and foreign currency credit demands are twice the national average.

Moreover, the wave of branch openings and closures is accelerating due to soaring operating costs and the boom in online transactions. Since the beginning of 2025, many large joint-stock banks have had to close nine transaction offices in two key cities due to a significant reduction in cash transactions compared to the pre-pandemic period, while rental costs continue to rise. This signals that the flow of money now depends more on mobile applications, automation, and large-scale transaction centers rather than the density of traditional counters. Additionally, with the formation of super provinces, the geographical distance between the new administrative center and the communes can be up to 100 kilometers, forcing banks to adjust their branch placement strategies within the provincial area.

Re-evaluating the scale of the potential market

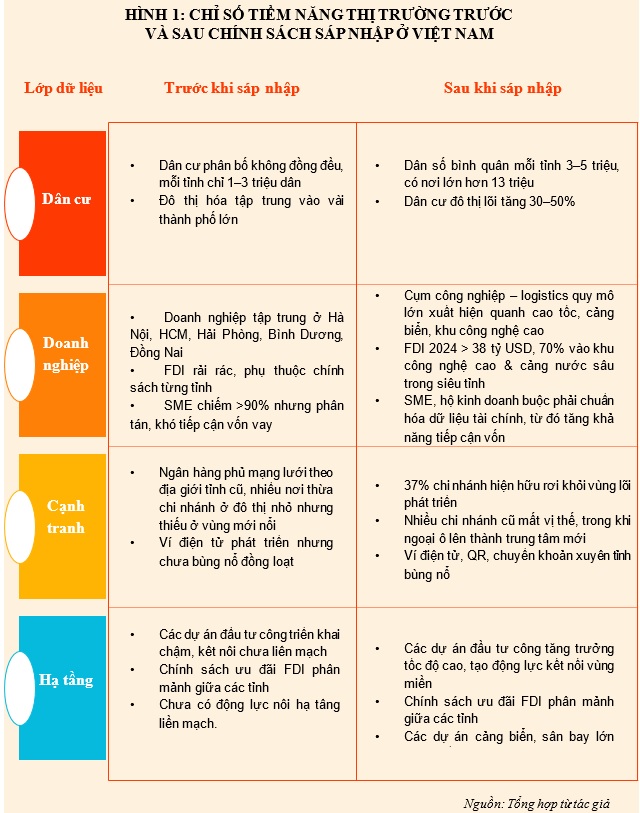

After the merger, the average area of a province increased by almost three times, with Hanoi, the central city, having a population of over 8 million and contributing about 16% of the country’s GDP. Meanwhile, the acceleration of expressway projects will reduce travel time between logistics centers, prompting foreign investors to relocate factories closer to seaports and new supply chains. Comparing the old and new administrative maps reveals that many existing branches are moving away from the core development areas, while areas that used to be suburbs now have the potential to become central towns. The uneven development between regions is predicted to increase income disparities between new urban centers and peripheral areas, causing a concentration of demand for complex financial products (credit cards, insurance, personal investments) in the new urban centers. The bank’s goal cannot be to cover as densely as possible but to develop strategies focused on areas before the population and businesses flock in if they want to capture the CASA and foreign currency payment pie.

To seize these opportunities, banks should develop reports assessing the potential of the market (TPS – Target Potential Score), revolving around four layers of data updated periodically every six months.

- The first layer is Population: recording the scale, population growth rate, average income, and median age of the population.

- The second layer is Enterprises: statistics on the number of enterprises, FDI capital, and the proportion of small and medium-sized enterprises.

- The third layer is Competition: measuring the density of branches, market share of competitor banks, and digital channels.

- The fourth layer is Infrastructure & Policies: evaluating expressways, logistics, and tax incentives.

Each province is assigned a TPS score of up to 100 points, and regions scoring 80 points or higher are colored red on the heat map, indicating a hot zone for urgent investment. For example, the super provinces formed with competitive advantages such as connections to raw material and industrial zones or provinces specializing in production linked to provinces with good infrastructure will have positive changes in their market attractiveness scores. If banks miss even one evaluation cycle, they will miss out on credit lines such as equipment imports, L/C guarantees, and foreign currency payments for thousands of accompanying engineers.

The changing macroeconomic environment has altered the position of branches, which, in turn, requires a shift in resource investment. Notably, a branch with an outstanding performance of VND 5,000 billion in Province A may experience a significant drop in market share after the provincial merger. If the bank does not re-measure the TPS, this branch will still be considered excellent, despite its declining performance. Conversely, a transaction office in a commune adjacent to an expressway may unexpectedly become the gateway to a smart city, with the potential to achieve retail credit growth of over 30% per year, but it is denied resources due to its small scale, thus missing out on growth opportunities. Therefore, rebuilding the market potential assessment framework must be completed in the second half of 2025 to lay the foundation for the 2026 business plan.

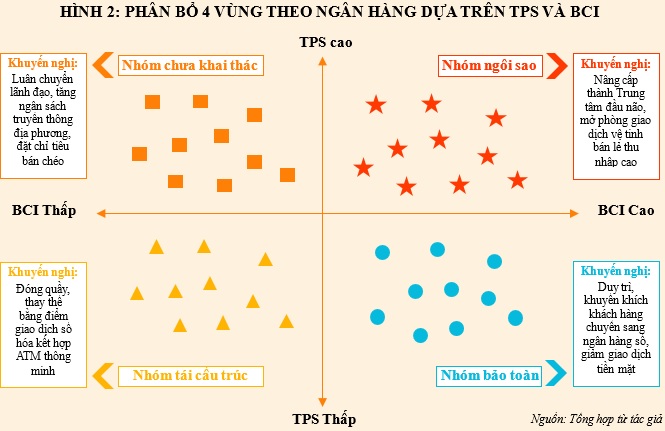

Optimizing efficiency with the branch competitiveness index

While the TPS market potential index measures market potential, the branch competitiveness index (BCI) – calculated by dividing actual market share by expected market share – indicates how well each branch captures opportunities. A transaction office with a high TPS of 90 but a BCI of only 60 suggests that potential remains untapped, while a TPS of 40 and a BCI of 110 indicates that the branch has maximized its market potential, and further growth opportunities may be limited. Based on the TPS (high/low) – BCI (high/low) matrix, banks can categorize branches into four groups: Stars (invest heavily), Unexploited (push sales, rotate directors), Preserve (reduce cash costs, shift customers to digital channels), and Restructure (close or merge). This mechanism ends the practice of allocating resources based on habits, as many branches that were once cash cows are now silently losing market share.

|

For example, let’s assume that the Northeast province is merged from three old provinces, with a population of 4.2 million and a GDP of VND 380,000 billion. Bank XYZ maintains 12 branches. After recalculating the TPS and BCI, the results show that after 12 months of experimentation, the network budget decreased by 15%, regional profits increased by 9%, and the cost-to-income ratio for the entire province decreased by 3%, confirming the effectiveness of optimizing the branch network and reallocating resources.

Province mergers have unveiled a completely new playing field, where opportunities and challenges are not evenly distributed but concentrated in newly formed hot zones. Banks that promptly complete the TPS map to identify their destinations and measure BCI to understand the capabilities of each link will proactively allocate capital, human resources, and technology to the right places with untapped profit potential. The core message can be summed up in four characters: chase scores, not the number of branches or absolute credit balances, but focus on raising TPS and BCI – two metrics that accurately reflect profitability.

Three immediate actions for banks are: (1) enclose the potential of each super province with the four-layer data framework, (2) adjust branch targets based on BCI instead of historical scale, and (3) plan the network according to the Hub – Satellite – Digitization model, linked to cost-cutting and digital transaction plans. If banks strictly follow this roadmap, they will not only save hundreds of billions of dong in costs and increase profit margins during the slow credit growth period but also improve customer service standards on Vietnam’s new administrative map.

Lê Hoài Ân, CFA