Market Valuations Remain Attractive

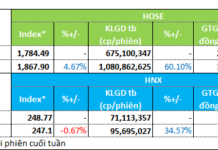

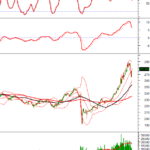

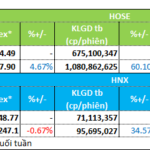

The VN-Index witnessed a strong surge after two consecutive corrective sessions. On August 26, the VN-Index closed nearly 54 points higher, climbing to 1,667.63.

At the event “Vietnam and the Indices: Financial Prosperity,” Mr. Dao Hong Duong, Director of Industry and Equity Analysis at VPBank Securities (VPBankS), opined that the volatility in the past two sessions does not confirm a corrective phase but rather indicates fluctuations within an uptrend.

A corrective wave is typically defined as being at least one-third and at most two-thirds the size of the preceding upward wave. While the market has experienced several minor corrections, such as on June 5 and July 29, none of these corrections have reached the one-third mark.

“Technically speaking, and in terms of wave counting, the recent volatility does not confirm a corrective phase but rather indicates fluctuations within an uptrend. Hence, these are secondary fluctuations. A major correction would be confirmed at around 1,450 points, which is quite far from the current level,” clarified Mr. Duong.

According to FiinPro data, the market’s P/E ratio stands at approximately 15. Bloomberg, meanwhile, reports a market P/E of 15.4. The P/E and P/B ratios of the VN-Index are slightly above the 10-year average but still far from the average plus one standard deviation.

An important consideration is whether the substantial inflows of capital witnessed recently were anticipating a P/E of 15. Addressing this question, the VPBankS expert suggested that while short-term capital may be influenced by such factors, long-term investors tend to focus more on the market’s profit growth prospects for the year.

As of Q2 2025, post-tax profits for the entire market have increased significantly. Investors have relatively high expectations for profit and EPS growth in 2025. Bloomberg data indicates a forward P/E of 12.8, implying an EPS growth projection of 18-20% compared to 2024. With a P/E of 12.8, the market remains attractive.

Given the six-month performance closely tracking EPS growth dynamics and the pivotal role of EPS and profit growth expectations in market sentiment, the VPBankS expert believes that

market valuations remain attractive rather than expensive

.

Mr. Duong also emphasized that valuation perspectives differ from historical P/E comparisons. In 2021, the market rally was driven by fiscal and monetary policies supporting businesses affected by the COVID pandemic, and GDP was impacted by the health crisis. Today, GDP has been robustly boosted, presenting a starkly different context. While liquidity was the key driver in 2021, profit growth expectations now take center stage.

In summary, from both a technical and fundamental perspective, the expert assessed that the market has not peaked yet, neither in terms of Elliott wave theory nor market valuations.

Notable Sectors for the Rest of the Year

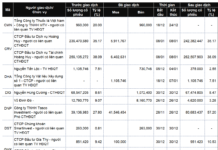

Regarding investment opportunities from now until the end of the year, the VPBankS expert highlighted seven criteria: favorable industry business environment (public investment, new partners, etc.); minimum 10% growth in 2025 post-tax profit; positive profit cycle in the second half; benefits from market upgrades; fiscal policy; monetary policy; capitalization and liquidity.

Based on these criteria, six sectors were identified as suitable for investment:

banking, basic resources, industrial goods & services, financial services, information technology, and retail.

In the basic resources sector, the focus remains primarily on HPG. For industrial goods & services, three groups stand out: electrical equipment, ports, and shipping.

In the financial services sector, the spotlight is on securities, benefiting from an extremely favorable business environment and meeting all seven criteria.

In the retail sector, the recovery pace depends largely on expectations for the ICT & CE market. This industry typically experiences profit cycles in Q3 and Q4. Other retail segments have already been reflected to some extent in the six-month results.

As for information technology, with post-tax profit growth rates of around 18-20% compared to 2024 and attractive valuations, this sector is also worth prioritizing. In the event of a Vietnam market upgrade, IT stocks could attract substantial capital inflows, reversing the trend of the past six months.

Is There a “Penny Stock” Wave on the Horizon as Money Flows Adjust for the “Ghost Month”?

The tide is turning for penny stocks as the ebb and flow of the market sees profit-taking in the core, leading stocks. As investors seek new opportunities, the focus shifts to these smaller, often-overlooked companies, offering a potential treasure trove of gains.

Is Now the Time to Buy Bank Stocks?

The banking sector stocks witnessed a sharp sell-off for the second consecutive session, reversing course after a scorching rally. As the VN-Index retreats from its peak, will this sector’s momentum persist or falter?

The Ultimate Guide to Reaching New Heights: Vietstock Daily 27/08/2025

The VN-Index demonstrated resilience by maintaining its position above the middle of the Bollinger Bands, and its impressive recovery was highlighted by a surge of nearly 54 points. To ensure a more sustainable upward trajectory, an improvement in trading volume is necessary. If the index surpasses the previous peak of 1,680-1,693 points in upcoming sessions, it will pave the way for reaching new heights.