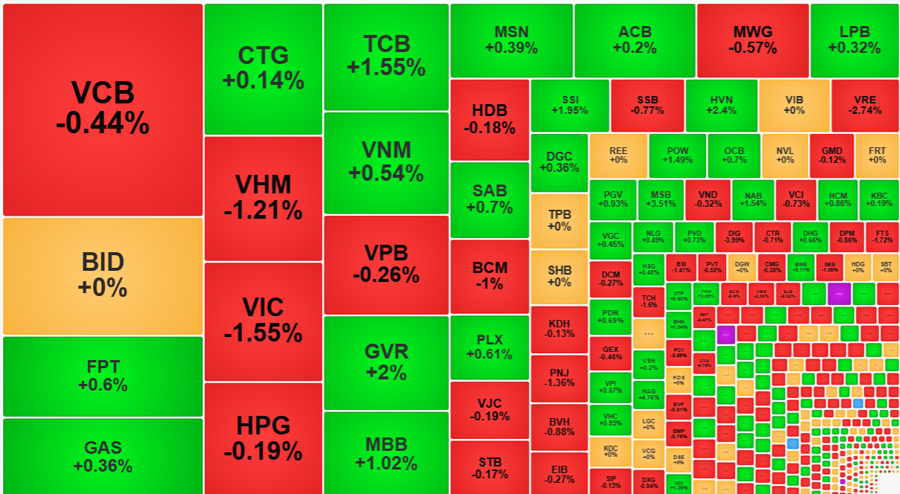

The Vietnamese stock market staged a positive performance, rebounding strongly after two consecutive losing sessions. The VN-Index extended its gains and closed at a new high of 1,667.63 points on August 26, an increase of 53.6 points. However, liquidity on the HoSE fell short compared to the 20-session average, with a matching value of approximately VND34,600 billion.

Another bright spot was foreign investors’ trading. After 13 consecutive net-selling sessions, foreign investors unexpectedly returned to net buying with a value of nearly VND742 billion in the market. Specifically:

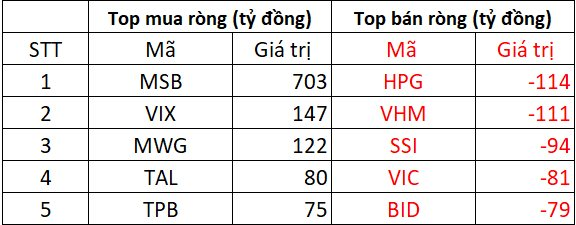

Foreign investors net bought nearly VND940 billion on HoSE

In the buying side, MSB bank stocks surprisingly led the net buying value on the market with a surge of VND703 billion. VIX and MWG were also actively net bought with values of VND147 billion and VND122 billion, respectively. Following were TPB and TAL, net bought in the range of VND75-80 billion each.

On the opposite side, HPG and VHM were the two stocks with the largest net sell value, both exceeding VND100 billion. Additionally, SSI, VIC, and BID were among the top net sold stocks, with net sell values ranging from VND79 billion to over VND94 billion.

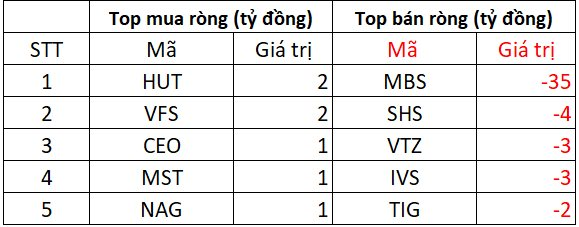

Foreign investors net sold about VND50 billion on HNX

On the buying side, HUT and VFS stocks were net bought at around VND2 billion each. CEO, MST, and NAG also witnessed net buying in today’s session, with values of about VND1 billion each.

Conversely, MBS suffered the largest net sell value of VND35 billion. SHS, VTZ, IVS, and TIG were net sold in the range of VND2-4 billion each.

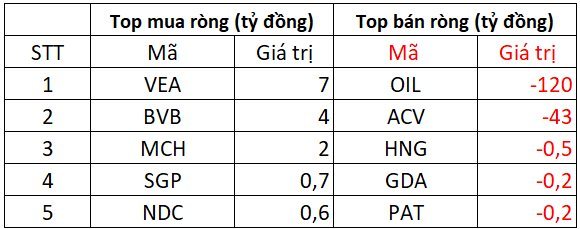

Foreign investors net sold nearly VND148 billion on UPCOM

In terms of net buying, VEA and BVB witnessed net buying values of around VND4-7 billion each. Meanwhile, MCH, SGP, and NDC also experienced light net buying, ranging from a few hundred million to VND2 billion.

On the other side, OIL witnessed a surge in net selling value of VND120 billion. ACV was net sold at VND43 billion, while HNG, GDA, and PAT witnessed smaller net selling values of a few hundred million each.

Has the Stock Market Moved Past the ‘Speculative Peak’?

The sharp dip over the weekend caused the VN-Index to lose most of its previous gains, raising questions about whether the market has moved past the “speculative peak”. Analysts believe that after a heated rally and a spread of speculative money, the market may return to reflecting fundamental valuation factors and expectations for Q3 earnings. The pressure to adjust remains in the week ahead.

“SSI Stock Soars to New Heights: Record Market Cap Has Investors Betting on Digital Assets”

Since the beginning of the year, SSI’s stock has surged over 50% in market value, pushing its market capitalization to over VND 77 trillion.