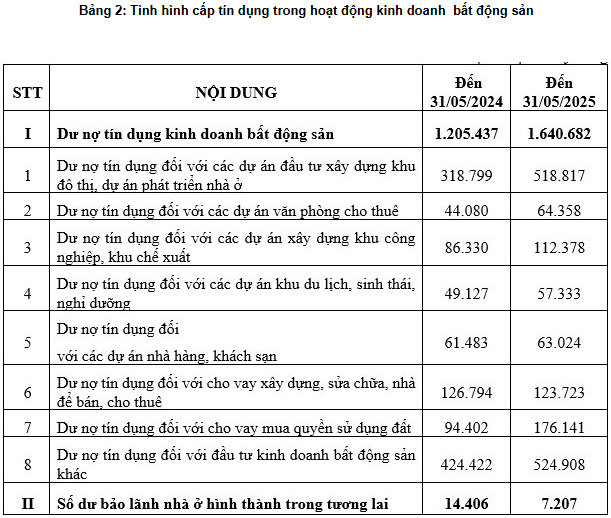

According to a report by the State Bank of Vietnam, as of May 31, 2025, credit outstanding for real estate business activities reached VND 1.64 million billion (up 36% compared to a year earlier), the highest level since 2023, indicating a recovery and expected growth this year in various economic sectors, including real estate.

Unit: Billion VND. Source: Ministry of Construction

|

The Ministry of Construction assessed that the strong increase in total credit outstanding for the real estate sector after a year reflects a relaxation of capital flows from banks into this field and a recovery of confidence from both banks and enterprises.

According to statistics from VietstockFinance, the total outstanding loans of 103 real estate enterprises on the stock exchanges (HOSE, HNX, and UPCoM) reached nearly VND 323 thousand billion at the end of June 2025, up nearly 14% from the beginning of the year. Of these, 42 enterprises had increased debt, and 39 enterprises had reduced debt.

|

Top 20 real estate enterprises with the highest increase in debt in the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

The enterprise that caused the biggest surprise was Sunshine Group Joint Stock Company (HNX: KSF) when it raised its debt to nearly VND 11.9 thousand billion, 12.5 times higher than at the beginning of the year. The company promoted restructuring by acquiring shares to own capital in a series of real estate companies, thereby adding more projects to its investment portfolio.

Specifically, KSF increased its short-term debt by more than VND 2.1 thousand billion due to business consolidation with five companies, including Xuan Dinh Construction Investment Joint Stock Company (VND 298.7 billion), Thien Tai Solution Joint Stock Company (VND 159.3 billion), Linh Lang Trading Development Co., Ltd. (VND 86 billion), AI Touch Global Co., Ltd. (VND 791 billion), and Bang Giang Trading and Service Co., Ltd. (VND 800 billion). These unsecured loans have a term of 12 months with an interest rate of 4-13%/year.

Moreover, KSF also took on an additional VND 8.4 thousand billion in long-term debt from the Vietnam Military Commercial Joint Stock Bank (MB) through business consolidation.

The above debt comes from two credit contracts that KSF signed with MB in the first half of this year. One contract, signed in March, has a limit of VND 4,620 billion with a term of 48 months. The loan is used by KSF to implement a business plan for 175 low-rise houses on lot I.B.29.No in the Nam Thang Long urban area. The collateral includes all rights, interests, and property rights arising from the project and all balances and interest arising on the company’s bank account at MB.

The other contract, signed in May, has a limit of VND 5,600 billion with a term of 48 months. The purpose of this loan is to compensate for the costs already paid from the organization’s loan capital and the remaining value to be paid to the Nam Thang Long Urban Development Company for KSF to implement a business plan for 234 low-rise houses on plots TT-01 to TT-19 in the Nam Thang Long urban area. The collateral includes property rights arising from contracts and related documents concluded between the Company and this partner.

Kinh Bac Urban Development Corporation – JSC (HOSE: KBC) also surprised with more than VND 26 thousand billion in debt, 2.6 times higher. The enterprise promoted bank borrowing, especially long-term borrowing, as its debt increased from VND 8,700 billion to VND 24,100 billion (accounting for 96% of total debt). The largest proportion of long-term debt was nearly VND 12,400 billion at VPBank – Hanoi Head Office, with an interest rate of 10.8%/year, with the collateral being the property rights arising from the Trang Cat urban and service area project.

KBC‘s move to increase bank borrowing took place in the context that the company distributed more than 174 million shares in the offering of 250 million private placement shares in the second quarter, equivalent to a rate of nearly 70%, thereby raising nearly VND 4,200 billion instead of nearly VND 6,000 billion if the entire offering was successful.

Five units with debt over VND 10 thousand billion

In terms of absolute value of outstanding debt, Vinhomes (HOSE: VHM) and Novaland (HOSE: NVL) continue to be the two familiar names at the top of the industry.

|

Top 20 real estate enterprises with the largest debt as of the end of June 2025. Unit: Billion VND

Source: VietstockFinance

|

NVL‘s debt remained almost unchanged from the beginning of the year, maintaining nearly VND 62 thousand billion. However, it is noteworthy that the total debt maturing within the next 12 months amounted to about VND 32 thousand billion.

According to information in May 2025, NVL said that although it is in the recovery phase, debt negotiation and restructuring still entail many risks and difficulties. The company currently does not have the financial capacity to repay the debts, and most of the loans and bond debts will be handled from the end of 2026-2027.

NVL‘s management said that they have a plan to repay for each group, expecting to pay off most of the debt within the next three years. For domestic loans, the company relies on the legal progress and cash flow at the projects within two to three years to repay the debt. At the same time, banks/credit institutions agreed to provide a credit limit of nearly VND 12,450 billion, which is an important source of capital to help Novaland ensure continuous operations and implement projects on schedule. For foreign loans and bonds, the company is still in the process of negotiating to restructure and extend the maturity from 2025 to 2026-2027.

Regarding the international bond package of $300 million listed on the Singapore Stock Exchange, NVL has negotiated with bondholders to change the interest payment plan in 2025. Accordingly, the interest of the interest payment installments on January 16 and July 16, 2025, will be capitalized into the principal amount.

Many enterprises reduced their debt, especially bank debt

Regarding enterprises with reduced debt, An Duong Thao Dien Real Estate Investment and Trading Joint Stock Company (HOSE: HAR) recorded the sharpest decrease of 75%, to only VND 157 million. The company has only one loan at Vietcombank under a credit contract with a limit of nearly VND 2.8 billion, a term of 60 months, with a Hongqi car as collateral.

Nam Tan Uyen Industrial Zone Joint Stock Company (UPCoM: NTC) ranked second with a debt decrease of 64%, from nearly VND 2,700 billion to VND 951 billion. Similar to HAR, all of NTC‘s debt comes from two contracts with Vietcombank. The main reason for the sharp decrease in debt after the first half of the year was due to a credit contract with a limit of VND 2,755 billion for dividend payment and investment in the Nam Tan Uyen Expansion – Phase 2 project, with a term of 6-12 months, an interest rate of 3.9-4.2%/year, and collateral.

A contract for a loan of VND 138 billion to pay expenses related to the investment project has a term of 18 months, an interest rate of 6%/year, and collateral.

|

Top 20 real estate enterprises with the largest debt reduction in the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

LDG Investment Joint Stock Company (HOSE: LDG) was also among the enterprises with a significant debt reduction of 27%, to VND 786 billion, mainly due to the company’s repayment of long-term debt upon maturity at Sacombank – Branch 11.

Notably, of the above VND 786 billion, LDG had overdue unpaid debt (principal) of nearly VND 445 billion, including: more than VND 186 billion from bond lot LDGH2123002, which matured in 2023; nearly VND 200 billion in loans at VPBank; and nearly VND 59 billion in loans at SeABank.

In addition to the above enterprises with fluctuating debt, 16 real estate enterprises remained “loyal” to the strategy of no debt.

|

16 real estate enterprises without debt as of June 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

Interest expense increased by nearly 52%

In the context of a 14% increase in outstanding credit, the interest expense of 103 real estate enterprises in the first half of 2025 increased by 52% over the same period, exceeding VND 10 thousand billion.

Topping the list was Investment and Construction Development Joint Stock Company (UPCoM: ING) with a sudden interest expense of more than VND 152 billion, while in the same period last year, it was only more than VND 1.1 billion, 136 times higher. ING said that the company borrowed to pay expenses to soon complete the legal procedures of the Green City project. The large interest expense, combined with zero revenue, caused ING to incur a post-tax loss of nearly VND 154 billion in the first six months of 2025 (a loss of more than VND 3 billion in the same period last year).

Two real estate enterprises, namely NTC and Saigon VRG Investment Joint Stock Company (HOSE: SIP), also recorded a 2.4-fold and 2.2-fold increase in interest expense, to VND 10 billion and VND 71 billion, respectively. Despite the sharp increase in interest expense, the two companies still recorded a 27% and 21% increase in net profit, respectively, compared to the first half of 2024. Notably, SIP had more than VND 7,000 billion in bank deposits, up 33% from the beginning of the year.

|

Top 20 enterprises with the largest interest expense in the first half of 2025. Unit: Billion VND

Source: VietstockFinance

|

The Ministry of Construction assessed that real estate credit is being oriented to prioritize segments serving social security such as social housing, worker housing, and commercial projects that meet the actual housing needs of the people. Accordingly, with a 16% credit growth target in 2025 (equivalent to about VND 2.5 million billion), there is a high possibility that real estate credit will continue to increase, especially in the context of low-interest rates supporting home purchases and preferential credit packages for young people.

– 08:13 27/08/2025

Riding the Wave of Da Nang’s Coastal Property Renaissance Post-Merger

The decision to merge Quang Nam and Da Nang provinces carries significant strategic weight in administrative terms, but it also sparks a new wave of development, particularly for the coastal real estate market stretching from Da Nang to Hoi An.

The Future of Da Nang: A Visionary Project

The Lang Van Tourism and Urban Resort Complex is a visionary development that is set to redefine the landscape of Danang. This ambitious project is a masterpiece in the making, a fusion of architectural brilliance and a catalyst for growth in this vibrant central coastal city. With its meticulous design and world-class amenities, Lang Van is poised to become an iconic destination, elevating Danang’s reputation as a leading tourist hub in the region.

VietinBank to Auction My Khe Duc Long Hotel

Introducing, the Vietnam Joint Stock Commercial Bank for Industry and Trade – Gia Lai Branch (VietinBank Gia Lai) as it announces its 7th auction of secured assets from Duc Long Dung Quat Limited Company.