Bank staff counting US Dollars. (Photo: Yonhap/VNA)

|

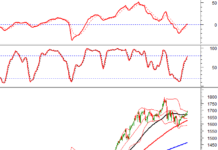

On August 27th, the exchange rate of the Vietnamese Dong (VND) against the US Dollar (USD) and the Chinese Yuan (CNY) continued its upward trend in commercial banks.

Specifically, the State Bank of Vietnam maintained the central exchange rate at 25,273 VND per USD, unchanged from August 25th.

With a permitted trading range of ±5%, the ceiling and floor rates for the day were set at 26,536 and 24,009 VND/USD, respectively.

The reference exchange rate at the Vietnam Central Bank was listed at 24,060-26,550 VND/USD (buying-selling).

As of 8:40 am, Vietcombank listed its USD buying and selling rates at 26,176 and 26,536 VND/USD, respectively, marking a 23 VND increase in both rates compared to August 26th.

Meanwhile, BIDV adjusted its rates, resulting in a 35 VND increase on the buying side and a 26 VND increase on the selling side, with the new rates standing at 26,185-26,536 VND/USD (buying-selling).

Regarding the Chinese Yuan, Vietcombank raised its rates by 6 VND on the buying side and 7 VND on the selling side from the previous day, quoting them at 3,629-3,746 VND/CNY (buying-selling).

Following a similar trend, BIDV listed its CNY rates at 3,638-3,736 VND/CNY (buying-selling), reflecting an increase of 6 VND and 5 VND, respectively./.

– 08:53 27/08/2025

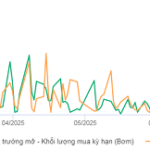

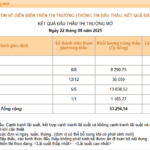

The Central Bank Pumps Over 18 Trillion VND into the Open Market

Between August 18 and 25, 2025, the State Bank of Vietnam (SBV) ramped up new issuances in the forward purchase channel to meet maturity volumes.

The Greenback Slides, but Domestic Rates Remain Lofty

“The US dollar continued its downward trajectory in the week of August 18-22, 2025, as markets reacted to hints of potential interest rate cuts from Federal Reserve Chair Jerome Powell. This development marked a significant shift in the currency’s performance, setting the stage for a potentially volatile period in global markets.”

The Fed’s Latest Cash Injection: A Boost or a Bust for the Economy?

The SBV’s decision to maintain an accommodative policy stance has provided Vietnamese banks with access to low-cost funds, but it has also exerted upward pressure on the USD/VND exchange rate, especially as the US dollar strengthens in the international market.