The stock market witnessed another intense adjustment session on August 25th. Amidst heightened selling pressure in the banking and securities sectors, the VN-Index closed at 1,614 points, a decline of 31.44 points. The matching value on HoSE reached approximately VND 40,063 billion.

In this context, foreign investors continued to aggressively sell off, recording a net sell-off of VND 1,748 billion across the market:

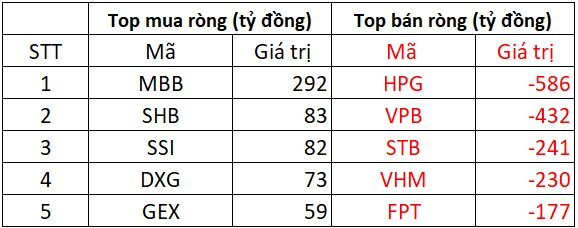

On HoSE, foreign investors net sold approximately VND 1,716 billion

On the buying side, MBB stock witnessed the strongest net buying by foreign investors, amounting to VND 292 billion. They also net bought between VND 59 billion and VND 83 billion in SHB, SSI, DXG, and GEX stocks during the session.

On the opposite side, HPG stock experienced the heaviest net selling by foreign investors, amounting to VND 586 billion. VPB followed closely with net selling of VND 432 billion. STB, VHM, and FPT stocks also faced significant net selling, with values exceeding VND 200 billion and VND 177 billion, respectively.

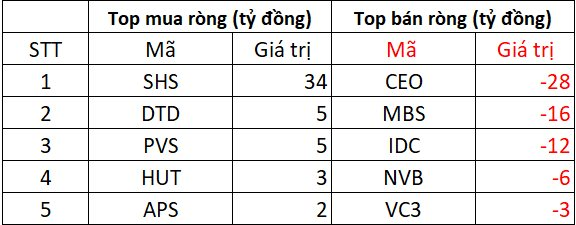

On HNX, foreign investors net sold approximately VND 24 billion

SHS stock witnessed the strongest net buying on this exchange, with a value of VND 34 billion. DTD and PVS stocks followed with net buying of VND 5 billion each. Additionally, HUT and APS stocks also received net buying in the range of VND 2-3 billion each.

On the selling side, CEO stock experienced the heaviest net selling of VND 28 billion. MBS and IDC stocks were also net sold in the range of VND 12-16 billion. NVB and VC3 stocks witnessed moderate net selling between VND 3-6 billion.

On UPCOM, foreign investors net sold nearly VND 8 billion

On the buying side, VEA, MCH, and DDV stocks attracted the most net buying, ranging from VND 5-6 billion each. DGT and PXL stocks also witnessed net buying between VND 1-2 billion each.

Conversely, ACV stock experienced the heaviest net selling of VND 28 billion. HNG, PAS, PAT, and VBB stocks also faced moderate net selling, with values in the few hundred million VND range.

Has the Stock Market Moved Past the ‘Speculative Peak’?

The sharp dip over the weekend caused the VN-Index to lose most of its previous gains, raising questions about whether the market has moved past the “speculative peak”. Analysts believe that after a heated rally and a spread of speculative money, the market may return to reflecting fundamental valuation factors and expectations for Q3 earnings. The pressure to adjust remains in the week ahead.