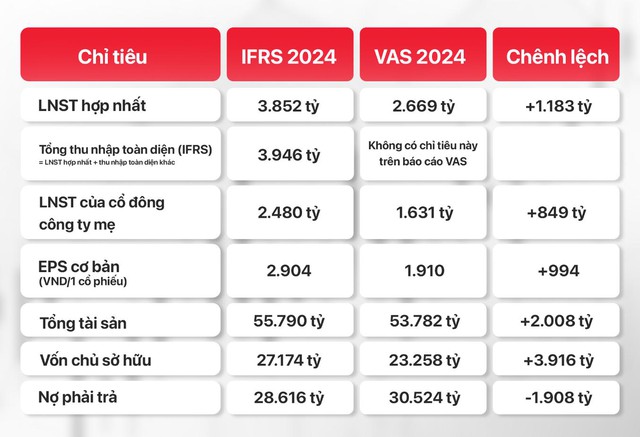

GELEX’s IFRS financial report for 2024 showcases a significant improvement in profit and balance sheet health compared to the VAS-compliant financial report released on February 28, 2025. The IFRS version enhances transparency with the capital market, adhering to international standards.

A summary comparison of the differences between GELEX’s IFRS and VAS reports.

GELEX’s IFRS 2024 report displays a substantial increase in EPS, thicker equity, and reduced financial leverage, showcasing enhanced value creation and risk management capabilities on par with international standards.

During the transition to IFRS-compliant financial reporting, the GELEX Group implemented fair value measurement accounting standards with the support of CBRE and reputable valuation organizations in Vietnam. The determination of fair value for trade advantages, investment properties for lease, long-term investments, and impaired assets was conducted according to international standards, seamlessly blending global expertise with a profound understanding of the domestic market.

Currently, IFRS is employed in over 140 countries and territories, serving as a global “common language” that standardizes financial reporting, mitigates information risks, and enhances access to international capital. IFRS also ensures the faithful representation of the economic substance of transactions through core standards such as IFRS 15 (Revenue), IFRS 16 (Leases), IFRS 9 (Financial Instruments), and IFRS 13 (Fair Value Measurement). As a result, the quality of financial information is significantly improved, effectively aiding strategic forecasting and decision-making.

Vietnam’s Ministry of Finance has approved the IFRS implementation plan through Decision 345/QD-BTC, with a voluntary phase from 2022 to 2025 and mandatory adoption after 2025. Thus far, only a handful of pioneering enterprises have proactively transitioned to IFRS, mostly comprising conglomerates with expansionary strategies, international fundraising ambitions, or plans for overseas IPOs.

Mr. Bui Dang Khoa, Director of the GELEX Group’s Finance and Accounting Division, shared: “Our guiding philosophy during the IFRS transition has been ‘substance over form.’ Our financial reports will accurately reflect the economic substance of transactions rather than merely legal formality. This enhances our enterprise valuation in the eyes of investors, boosts our competitiveness in M&A, and facilitates international capital mobilization by standardizing data according to global norms. Simultaneously, we expand our strategic investor base from Europe, the US, Japan, and South Korea, where IFRS is a mandatory requirement.”

Despite the challenges, adopting IFRS-compliant financial reporting demonstrates a proactive approach to enhancing transparency and professionalism in corporate governance, aligning with international practices. It also signifies the enterprise’s alignment with the government’s initiatives to upgrade the market, deepen integration, and elevate the nation’s standing.

“From ‘Messenger’ to ‘Strategic Companion’”

Over the past decade, the role of Investor Relations (IR) in listed companies has undergone a significant evolution. Once considered merely a conduit for information, a logistical arm of public relations or corporate secretarial function, IR has now become integral to strategic planning, not just for the company but also in meeting the expectations and evaluations of institutional investors.

Crafting Trust in the Capital Markets

In today’s dynamic financial landscape, characterized by increasing demands for transparency, the quality of corporate disclosures plays an instrumental role. It significantly impacts investment decisions, shapes market confidence, and determines enterprises’ access to capital. However, despite notable improvements, the reality is that the quality of disclosures by listed companies still leaves much to be desired.

Unlock IR Awards 2025 Voting – Investors Gear Up for Big Rewards!

The IR Awards 2025 voting portal is now live as of 00:00 on August 1, 2025, marking the commencement of the program’s dynamic final stage. This prestigious initiative recognizes excellence in investor relations activities across Vietnam.