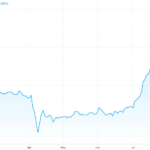

The stock market opened on a high note this week, with the VN-Index breaking through the psychological barrier of 1,600 points and quickly approaching the 1,700-point threshold. This upward momentum was led by banking groups and large-cap stocks, boosting investor confidence.

However, the joy was short-lived as selling pressure intensified during the week’s final session. Many stock groups reversed course, with the market witnessing a strong correction, especially in the last session, which saw a deep decline that nearly erased all previous gains.

At week’s end, the VN-Index still managed a 0.95% gain to close at 1,645 points. Liquidity broke new records with a total value of VND282,000 billion, and the trading volume on HoSE increased by 9.2% compared to the previous week, averaging nearly 1.9 billion shares per session. However, distribution pressure in the high-price region was evident in most sectors, with foreign investors net selling strongly, totaling more than VND7,690 billion.

Increased selling pressure in the final session nearly erased the week’s gains.

Analysts from Saigon-Hanoi Securities (SHS) believe that the market has shown signs of topping out after a sharp rise, with strong speculation and rotation in most sectors. The VN30 faced selling pressure around the 1,880-point level, while the VN-Index saw heavy selling in the 1,700-point zone. SHS predicts that the index may continue to correct towards the 1,600-point region as short-term speculative positions weaken and liquidity slows down after the explosive phase.

As the “speculative peak” phase passes, the market will return to fundamental valuations and expectations for Q3 earnings. Investors are advised to closely monitor developments, restructure their portfolios, reduce weak holdings, and prioritize stocks with strong fundamentals and industry leaders.

Experts from Bao Viet Securities (BVSC) point out that mid and small-cap stocks, which have been on a hot streak recently, still face corrective pressure. However, the market may experience a few technical rebound sessions before entering a consolidation phase later this month. The upward trend for these stocks is likely to continue into September.

Investors can maintain their current positions while managing risk by gradually raising stop-loss levels for short-term speculative trades. For T+ trading, take advantage of intra-day fluctuations to execute trades with stocks already in your portfolio.

Mr. Nguyen Viet Duc, Director of Digital Sales at VPBank Securities (VPBankS), notes that technical indicators suggest the market has entered an overbought zone following the recent sharp rise. Since 2000, this indicator has only appeared 16 times, with an approximate 80% accuracy rate. This indicates that the market is in its “hottest” phase historically, but it may not have peaked yet.

According to Mr. Duc, after the indicator signals, the VN-Index often maintains an upward trend for another 2-3 weeks before entering a corrective phase. Even after the correction, the market may continue to rise. Investors should restructure their portfolios, retaining strong stocks until the end of the cycle, while reducing weak holdings and utilizing derivatives or partial profit-taking to mitigate risks.

Mr. Duc believes that when the market nears its end, inflation tends to rise, benefiting oil and gas and petroleum retail stocks. Additionally, stocks with high valuations but maintaining strong revenue growth and gross profit margins of 18-20% are also worth considering.

However, in this phase, investors may find it challenging to achieve high returns. With the index rising from 1,000 points to the 1,600-1,700 range, finding stocks that double in value within six months is not easy. To achieve higher returns, investors must accept swing trading, selecting stocks with high beta (volatility) or leverage.

Is There a “Penny Stock” Wave on the Horizon as Money Flows Adjust for the “Ghost Month”?

The tide is turning for penny stocks as the ebb and flow of the market sees profit-taking in the core, leading stocks. As investors seek new opportunities, the focus shifts to these smaller, often-overlooked companies, offering a potential treasure trove of gains.

Is Now the Time to Buy Bank Stocks?

The banking sector stocks witnessed a sharp sell-off for the second consecutive session, reversing course after a scorching rally. As the VN-Index retreats from its peak, will this sector’s momentum persist or falter?