HD Capital Joint Stock Company (HDCapital) has recently reported a change in ownership of a major shareholder, holding over 5% of the shares at Petroleum General Services Joint Stock Company (Petrosetco, Stock Code: PET, HoSE exchange).

On August 21, 2025, HDCapital successfully sold 754,800 PET shares to reduce its ownership stake in Petrosetco.

Following this transaction, the fund’s holdings decreased from over 15.2 million shares to nearly 14.5 million shares, resulting in a drop in ownership percentage from 14.27% to 13.56% of Petrosetco’s capital.

Illustrative image

Based on the closing price of PET shares on August 21, 2025, at VND 36,000 per share, HDCapital is estimated to have earned approximately VND 27.2 billion from this sale.

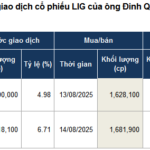

In a similar vein, several Petrosetco executives have recently reported their results from selling PET shares.

Specifically, between August 11, 2025, and August 18, 2025, Mr. Vu Tien Duong, Member of the Board of Directors and General Director, sold all 399,250 registered shares, equivalent to 0.37% of Petrosetco’s charter capital.

As a result of this transaction, Mr. Duong is no longer a shareholder of the company, holding zero shares.

Additionally, two Deputy General Directors of Petrosetco, Mr. Ho Hoang Nguyen Vu and Mr. Huynh Van Ngan, also sold their entire holdings of 78,020 shares (0.07%) and 297,000 PET shares (0.28%), respectively.

In terms of business performance, according to Petrosetco’s consolidated financial statements for the second quarter of 2025, the company recorded net revenue of nearly VND 4,721.9 billion, an increase of 4.4% compared to the same period last year. After deducting taxes and expenses, the company reported a net profit of over VND 54.6 billion, an increase of 22.1%.

For the first six months of 2025, Petrosetco’s net revenue exceeded VND 8,738.6 billion, a decrease of VND 52.5 billion compared to the same period in 2024. However, the company’s net income increased by 18.1% to VND 99.3 billion.

As of June 30, 2025, Petrosetco’s total assets increased by 14.5% compared to the beginning of the year, reaching nearly VND 11,634.7 billion. Short-term financial investments accounted for VND 4,033.6 billion, or 34.7% of total assets, while short-term receivables amounted to nearly VND 3,459.2 billion, or 29.7% of total assets, and inventory stood at nearly VND 1,736.9 billion.

On the liabilities side of the balance sheet, total liabilities were nearly VND 9,200.5 billion, an increase of 17.6% from the beginning of the year. Short-term financial borrowings and finance lease liabilities accounted for VND 5,509.7 billion, or 59.9% of total liabilities.

The Stock Pioneer Resolves to Fix Issues Leading to Warning, Sees Shares Surge.

The ORS stock witnessed a positive performance on Monday, August 25th, bucking the broader market’s downward trend.