Credit growth outpaces deposits

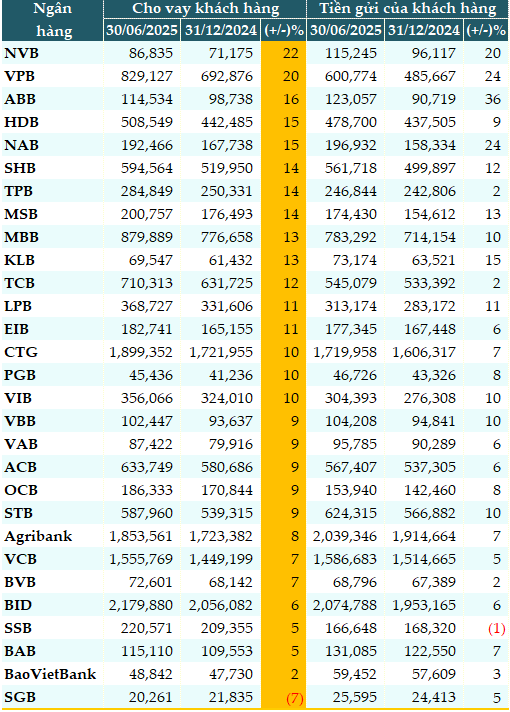

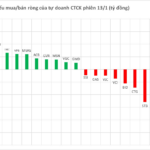

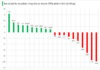

Data from VietstockFinance shows that as of June 30, 2025, the total outstanding loans of 29 banks in the system were nearly VND 14,990 trillion, up 10% from the beginning of the year.

NCB (NVB) was the bank with the strongest credit growth (+22%), followed by VPBank (VPB, +20%), ABBank (ABB, +16%), HDBank (HDB, +15%), and Nam A Bank (NAB, +15%)… Saigonbank (SGB) was the only bank with negative credit growth at -7%.

|

Customer lending and deposits as of June 30, 2025 (in VND trillion)

Source: VietstockFinance

|

Meanwhile, total customer deposits at the 29 banks were nearly VND 14,160 trillion, up 8% from the beginning of the year.

Except for a slight decrease of 1% at SeABank (SSB), all other banks recorded growth. ABB Bank attracted the most deposits (+36%), followed by NAB (+24%), VPB (+24%), NVB (+20%), and KienlongBank (KLB, +15%).

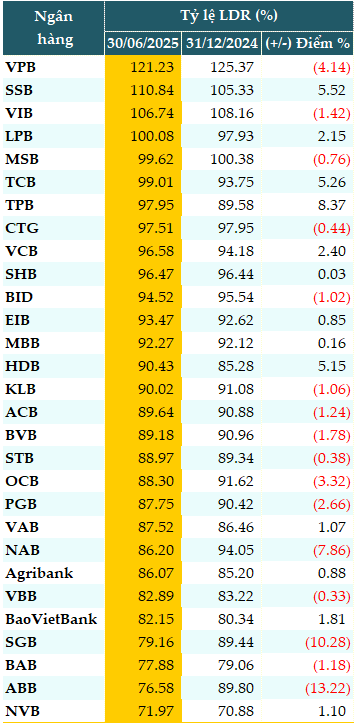

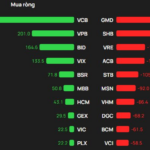

LDR ratio tends to decrease

Credit increased by 10% while deposits grew by 8%, but the loan-to-deposit ratio (LDR) of banks at the end of the second quarter tended to decrease compared to the first quarter. The average LDR of 29 banks at the end of the second quarter was 91.76%, down sharply from 92.32% at the beginning of the year.

There were 16 out of 29 banks with a decrease in the LDR ratio compared to the beginning of the year, up from 12 banks at the end of the first quarter, indicating that banks are becoming more defensive.

As of June 30, 2025, 6 out of 29 banks had an LDR ratio below 85%. Four banks had this ratio exceeding 100%, including: VPB (121.23%), SSB (110.84%), VIB (106.74%), and LPBank (LLB, 100.08%).

|

LDR ratios of banks as of June 30, 2025

Source: VietstockFinance

|

Mr. Nguyen Quang Huy – CEO of Finance – Banking, Nguyen Trai University assessed that the decrease in LDR ratios at many banks signals a strategic defensive move.

Compared to the beginning of the year, 12 banks recorded a decrease in the LDR ratio, indicating that credit growth is concentrated in a few large banks, while most others are choosing to slow down lending.

Banks are also proactively tightening lending standards and conducting thorough credit appraisals to control potential non-performing loans. Instead of focusing on loan growth, banks are prioritizing potential customers and accepting slower credit growth to ensure safety.

In addition to liquidity management, the second quarter was also affected by the context of US countervailing duties on Vietnamese imports. During the negotiation process, many businesses, especially those related to import and export, took a defensive stance, temporarily suspending production expansion and delaying new loans. As a result, the credit absorption capacity of this group of customers decreased, causing the LDR ratio of many banks to decline.

However, the outlook for the second half of the year is positive. Once the trade agreement is clarified, the demand for capital for production, import and export, and inventory is expected to increase sharply, creating an opportunity for the LDR ratio to recover.

Associate Professor Dr. Nguyen Huu Huan – Senior Lecturer, University of Economics Ho Chi Minh City believes that the second-quarter data shows a reversal in the ratio of non-term deposits (CASA) and fluctuations in the loan-to-deposit ratio (LDR). However, the market in July and August has evolved rapidly.

Just in the past few weeks, as the stock market became vibrant again, the State Bank (SBV) had to continuously inject money to ensure liquidity, and interbank interest rates surged. This indicates that money is flowing very fast.

In addition, credit is expected to grow strongly, especially when the mechanism for the credit “room” is removed and low-interest rates are maintained. Capital may flow strongly into fields such as real estate and securities.

However, hot credit growth always comes with risks related to quality. The issue to consider is credit quality. When removing the “room”, the SBV needs to have more effective supervisory tools to control system risks and prevent bad debt from increasing.

According to SSI Research’s update on the banking sector on July 8, a low-interest rate environment is expected to persist in the second half of 2025, thanks to the abundant deposits of the State Treasury and continuous liquidity support from the SBV. However, in the case of stronger credit growth, interest rates are likely to fluctuate in the second half of 2025 due to pressure from multiple factors.

First, seasonal factors usually lead to higher credit demand towards the end of the year, putting pressure on the LDR ratio and forcing commercial banks to step up capital mobilization.

Second, faster disbursement of public investment may lead to a reduction in State Treasury deposits at commercial banks, especially state-owned commercial banks, which could put short-term pressure on the system’s liquidity.

Finally, foreign exchange rates tend to face appreciation pressure in the third quarter and the beginning of the fourth quarter before cooling down towards the end of the year.

However, SSI believes that the interest rate environment will remain stable to promote economic recovery. Short-term fluctuations may occur, but they will be localized and specific to individual banks rather than systemic or widespread.

– 08:00 26/08/2025

“Eximbank Maintains B+ Rating with Stable Outlook from S&P Global Ratings”

The renowned international credit rating agency, S&P Global Ratings (S&P), has assigned a ‘B+’ long-term issuer credit rating with a stable outlook to the Vietnam Export Import Commercial Joint Stock Bank (Eximbank). This endorsement underscores Eximbank’s strengthened financial foundation, clear business strategy, and notable enhancements in asset quality, even amidst a volatile macroeconomic landscape.

HDBank: Among the Top 50 Listed Companies of 2025

As of August 21, 2025, Forbes Vietnam unveiled its list of Vietnam’s 50 Best Listed Companies for 2025, featuring leading enterprises across vital sectors. Among them, HDBank stands out as a prominent multi-functional retail bank, solidifying its position and pioneering role in the private sector of Vietnam’s financial and banking system.

“VPBank’s Deposits Soar in H1 2025: Outpacing Peer Group Growth, Surpassing Two Big4 Banks”

“VPBank stands out amidst a challenging landscape where many banks struggle to keep pace with credit growth, exerting pressure on liquidity. The bank has impressively outperformed several state-owned giants in terms of mobilization, showcasing its prowess in both scale and the quality of its capital sources. VPBank’s remarkable CASA growth and its ability to attract international capital have solidified its position as a leader in the industry.”

Credit Growth and the ‘Carrot’ for Select Banks

The rapid growth of credit contrasted with slower capital mobilization has put significant strain on the banking system’s liquidity. In response, the State Bank has intervened by reducing the statutory reserve ratio by 50% for four banks that are recipients of mandatory transfers from four banks under special control.

The Capital Pump: How Banks are Boosting the Stock Market with a Whopping $250 Billion

“Despite the higher-than-average growth in credit balance in the securities sector, Governor Nguyen Thi Hong assures that it does not pose a systemic risk to the banking system.”