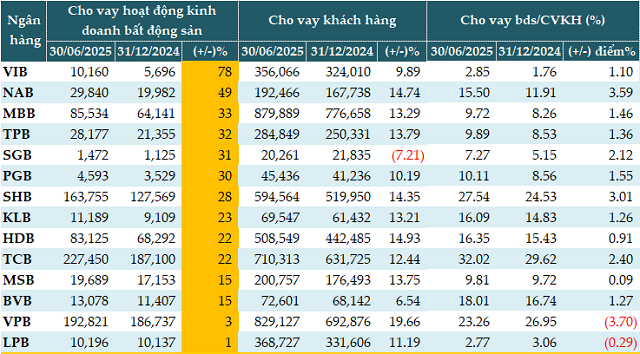

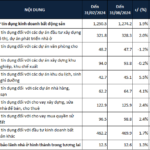

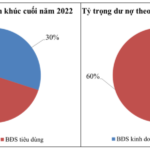

According to VietstockFinance, credit outstanding at 14 banks with loan explanations as of June 30, 2025, amounted to over 5.1 million billion VND, up 14% from the beginning of the year. Of which, lending for real estate business activities reached more than 881 thousand billion VND, up 20% from the beginning of the year, accounting for more than 17% of outstanding loans.

In particular, Techcombank (TCB) lent VND 227,450 billion for real estate business activities, up 22% from the beginning of the year, accounting for 32% of outstanding loans.

VPBank lent VND 192,821 billion for real estate business activities, up slightly by 3% from the beginning of the year, accounting for more than 23% of outstanding loans. In addition, VPBank also had VND 108,768 billion in consumer real estate loans, up 16%.

SHB also increased real estate business loans by 28%, to VND 163,755 billion. MBB increased by 33%, to VND 85,534 billion; HDBank (HDB) increased by 22%, to VND 83,125 billion…

|

Outstanding real estate loans at banks as of June 30, 2025 (Unit: Billion VND)

Source: VietstockFinance

|

At the regular July meeting of the Government, held on August 7, Governor of the State Bank of Vietnam (SBV) – Ms. Nguyen Thi Hong – said that credit of the whole system in the first seven months of the year increased by about 10% compared to the end of 2024 – a high increase compared to 6% in the same period last year.

With concerns about credit “flowing” strongly into real estate and securities, Governor Nguyen Thi Hong analyzed that the growth rate of credit into these two sectors is higher than the average, but it is in line with the orientation of removing difficulties for the real estate market. When projects are unblocked legally, capital demand for implementation is inevitable.

At the same time, SBV always closely monitors safety indicators. The ratio of short-term capital use for medium and long-term loans is still below the 30% threshold. At the same time, SBV also continuously directs credit institutions to balance capital by term to ensure system safety.

Not always risky

Mr. Nguyen Quang Huy – CEO of Finance – Banking, Nguyen Trai University said that the strong increase in bank credit for real estate is not always risky. The problem lies in how the capital flow is allocated and the quality of each loan.

When banks allocate too much capital to real estate, the loan portfolio becomes sensitive to fluctuations in housing prices. If prices fall significantly, the value of collateral may not be enough to compensate.

Many real estate loans extend for many years, but banks mainly mobilize short-term capital. If the market slows down, banks will easily face liquidity pressure.

Some loans rely on price increases to repay debts, instead of relying on actual income from leasing or exploitation. When the market is illiquid, the ability to repay debts will decrease rapidly.

If the project is slow to approve or slow to construct, it will prolong the capital recovery time and increase risks.

Banks may not lend directly to projects but lend to contractors, material companies, or buy corporate bonds. All are indirectly related risks.

The key point is that if banks apply strict conditions such as reasonable loan-to-value ratios, require borrowers to have income to ensure debt repayment, disburse according to legal progress, and regularly check the loan portfolio, they can still expand real estate credit while maintaining safety.

However, the over-concentration of credit in real estate can weaken production sectors. When other investment channels are less attractive, manufacturing and exporting enterprises are at risk of difficulty in accessing loans, reducing the competitiveness of the economy. Another risk is that house prices far exceed the actual income of the vast majority of people when the demand for buying houses with borrowed capital increases faster than supply. History has also shown that the real estate market often has very strong cyclical fluctuations. When the macro economy encounters difficulties, this is the field that recovers slowly and can have negative chain effects on the banking system and the purchasing power of the whole society.

In short, real estate credit is only beneficial when properly oriented to segments serving real housing needs, with sustainable exploitation cash flow and transparent legal status.

Market outlook for the next 6-18 months to recover selectively

Mr. Huy forecasted that the real estate market in the coming period will witness a selective recovery, instead of growing evenly across all segments.

Social housing and affordable housing are the brightest segments thanks to the huge real demand, strong support from government policies, and affordability for the majority of people.

Industrial real estate continues to be a bright spot due to the trend of global supply chain shifts, boosting demand for modern factories, warehouses, and logistics infrastructure.

The mid-range segment remains a product group with stable demand and good liquidity, provided that the project has a reasonable design, competitive price, and full utilities.

The high-end segment still has opportunities to exist but will be more selective, only for truly unique, smart, and optimized area products, with a reasonable total selling price, targeting customers who buy for living or effective rental exploitation.

However, the market recovery will depend on three main factors: legal policies, capital costs, and credit discipline. The speed of removing legal obstacles will determine the new supply, while interest rates and access to capital will directly affect purchasing power. Banks’ maintenance of discipline in appraisal and disbursement will help the market develop sustainably, avoiding the scenario of “overheating” and then “strong adjustment”.

In that context, Mr. Huy recommended that banks prioritize capital for projects serving real housing needs, industrial real estate with long-term tenants, and housing products that are about to be completed and have clear legal status.

For real estate enterprises, they must focus on segments with real liquidity, proactively adjust product structures (area, selling price) to suit purchasing power, and manage cash flow tightly.

Individual investors should prioritize assets with complete legal status, good location, and potential for real cash flow exploitation (for lease). Be very careful with the use of high financial leverage, especially for speculative products that are difficult to sell.

– 08:00 28/08/2025

KienlongBank Reports Impressive Business Results for 2024

In Q4 of 2024, Kienlong Commercial Joint Stock Bank (KienlongBank; UPCoM: KLB) reported positive financial results. According to the consolidated financial statements, KienlongBank achieved impressive business growth, with pre-tax profits surpassing VND 1,100 billion for the first time.

Unlocking Capital Flow: Three Insights from Techcombank’s Chairman for the Final Quarter of 2024

“The Chairman of Techcombank’s Board of Directors, Ho Hung Anh, emphasizes the need for a range of supportive measures to ease financial burdens on businesses. These include introducing and extending loan packages with low-interest rates, stabilizing the foreign exchange market, and implementing tax relief policies such as reductions in corporate income tax and value-added tax (VAT). He also suggests extensions for tax payments and controlling production and business-related costs, such as transportation and import-export expenses, to ensure businesses can weather economic challenges.”