Penny Stocks Attracting Cash Flow

In recent months, the Vietnamese stock market has consistently attracted cash flow and surged as the main indices and large-cap stocks traded at high prices. This cash flow is driven by economic stimulus measures, the government’s efforts in legal removal for projects, promotion of public investment in key national projects, and enterprises’ positive business results in the first half of 2025 due to the postponement of tax payments, boosting exports, etc. As a result, the market has witnessed a boom.

As of August 22, despite a strong correction in the banking, securities, and real estate sectors, the VN-Index still traded at 1,645.47 points, higher than the historical peak during the Covid-19 pandemic in February 2022. The market sentiment remains optimistic with an average liquidity of VND 50,000-75,000 billion per session.

However, with a strong upward trend in the first eight months, according to VNDirect Securities, as of August 22, the P/E ratio of the VN-Index rose to 14.76 times, one of the highest valuations in recent years (the lowest P/E ratio of the VN-Index was 9.82 times in November 2022).

Moreover, as large-cap stocks continuously attract cash flow and maintain relatively high valuations, profit-taking pressure has started to occur in some stocks since July 29. Cash flow is now seeking investment opportunities in penny stocks with low prices, potential for growth, and expectations of attracting cash flow soon. Some penny stocks, such as LDG, DRH, NRC, and VPH, have already witnessed strong surges.

In reality, from April 2025 to August 2025, many blue-chip stocks in securities, real estate, and banking sectors have doubled or tripled in price based on positive business performance, blockbuster IPOs, attractive valuations, and supportive macroeconomic policies. As investors start making substantial profits, and these fundamental leading stocks show signs of profit-taking, cash flow tends to shift to mid and small-cap stocks with low prices and attractive valuations to take advantage of short-term speculative waves while money remains in the market and has not been fully dispersed.

These are the companies that investors often refer to as “penny” or “vegetable and iced tea” stocks, with prices as low as VND 2,000 or 3,000 per share.

In fact, besides small-cap stocks attracting cash flow, Tien Thanh Trading and Service Joint Stock Company (code: TTH on the HNX), witnessed a trading volume of nearly 1.33 million shares on August 19, a 258% increase compared to the average trading volume of 20 recent sessions of 514,865 shares. Cash flow has been participating in this stock for more than a week.

At the 2025 Annual General Meeting of Shareholders, in addition to the projects already implemented, Tien Thanh’s management also shared that, based on their experience and current management capacity, the company is approaching some real estate projects to be developed consecutively after the completion of the current project.

In early July 2025, Tien Thanh approved the purchase of 4.75 million shares, equivalent to 19% of the charter capital of Hom Duoi Hydropower Joint Stock Company (charter capital of VND 250 billion), operating in the field of power plant construction.

Besides expanding investment and seeking new projects, Tien Thanh’s fashion brand, Valentino Creations, has been distributed in luxury stores and shopping centers nationwide, such as Vincom, Lotte Center, and Parkson Plaza.

Regarding business performance, in 2024, the company incurred a loss of VND 16.03 billion. The main reason was that in 2024, Hanoi Tax Department conducted a tax inspection for the period of 2023-2024. The company had to adjust revenue, cost of goods sold, and profit of 46 apartments in the real estate segment from 2024 to 2023, resulting in additional tax payments for 2023 and administrative fines and late payment charges. Additionally, the company had to make provisions for difficult-to-collect receivables of nearly VND 24 billion in the commercial business segment.

However, in 2025, Tien Thanh is not expected to incur such extraordinary expenses, providing a basis for the company to plan a profit of VND 2.61 billion in 2025.

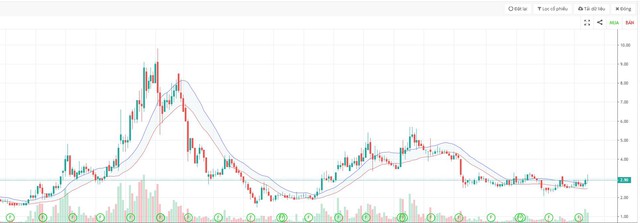

TTH shares are currently trading in the range of VND 2,700-3,000 per share and have been moving sideways since August 2024. TTH shares reached their peak on January 10, 2022, at around VND 9,800 per share.

Penny stocks tend to be volatile and are suitable for short-term investors. They often surge when there are positive changes in the company, such as restructuring, financial improvement, supportive macroeconomic policies, or when there is profit-taking in fundamental stocks, and money flows into speculative stocks with low prices that have not yet increased.

Notably, when penny stocks attract cash flow, they often hit the ceiling price with surplus buying for five or ten consecutive sessions. However, they can also quickly return to previous lows if investors are not familiar with investing in these “penny” or “iced tea” stocks. Therefore, investors should carefully consider their investment decisions to maximize profits and manage their risks effectively.

Is Now the Time to Buy Bank Stocks?

The banking sector stocks witnessed a sharp sell-off for the second consecutive session, reversing course after a scorching rally. As the VN-Index retreats from its peak, will this sector’s momentum persist or falter?

The Ultimate Guide to Reaching New Heights: Vietstock Daily 27/08/2025

The VN-Index demonstrated resilience by maintaining its position above the middle of the Bollinger Bands, and its impressive recovery was highlighted by a surge of nearly 54 points. To ensure a more sustainable upward trajectory, an improvement in trading volume is necessary. If the index surpasses the previous peak of 1,680-1,693 points in upcoming sessions, it will pave the way for reaching new heights.

Vietstock Daily: Summit Showdown

The VN-Index pared its gains towards the end of the trading session on August 27th, forming a Long Upper Shadow candle. This indicates that profit-taking pressures remain robust at the previous peak of 1,680-1,693 points. Additionally, with the Stochastic Oscillator indicator continuing to weaken after issuing a sell signal, it suggests that the index is likely to encounter further volatility in the upcoming sessions.