| Market rebounds with green in the afternoon session |

|

Source: VietstockFinance

|

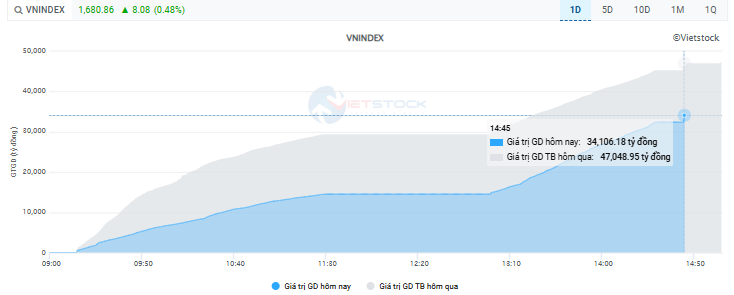

At the close on August 28, the VN-Index increased by 8.08 points to 1,680.86, the HNX-Index rose by 0.25 points to 276.63, and the UPCoM-Index climbed by 0.68 points to 110.62. The market witnessed a clear rebound with 416 green codes, in addition to 26 ceiling prices. On the contrary, there were 328 codes losing points, and the remaining 835 codes closed at the reference price.

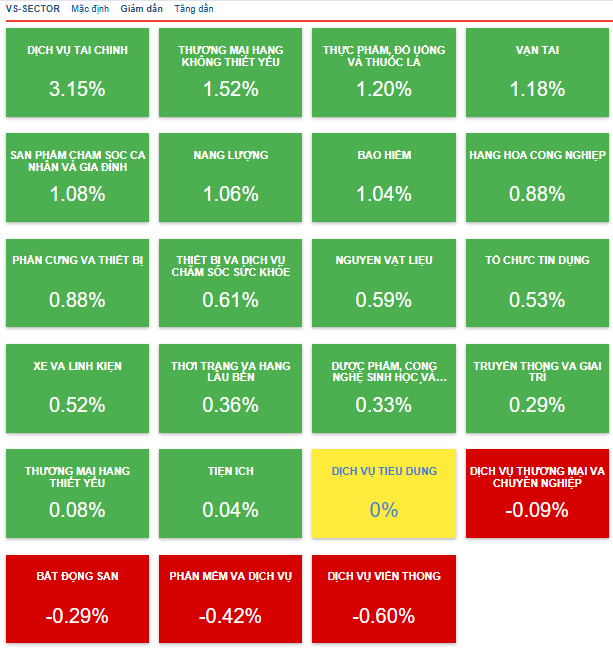

In the securities group, a series of stocks rose positively, such as SSI, VIX, VND, SHS, VCI, HCM… and even DSE, ORS, DSC, APG, TCI, EVS… hitting the ceiling price. This was also the industry with the strongest growth in the market today, reaching 3.15%.

Another impressive gaining group was essential aviation commerce, up 1.52% with momentum from MWG up 3.07%, FRT up 0.84%, DGW up 1.32%, HHS up 2.24%, and TLP up 2.7%. However, many stocks also declined, such as HUT down 1.67%, PET down 2.1%, HTM down 9.57%, HAX down 1.08%…

The market also recorded five sectors with growth above 1%, including food and beverage (up 1.2%), transportation (up 1.18%), personal and family care products (up 1.08%), energy (up 1.06%), and insurance (up 1.04%).

In addition, another notable sector with a large scale of capital was banking, which also increased by 0.29% today, thereby supporting the general trend. A more detailed assessment showed that the industry had a mixed performance, with TCB, CTG, VPB, HDB, LPB, SHB, TPB, etc., gaining points, while VCB, BID, MBB, ACB, VIB, STB, etc., lost points.

On the contrary, only four sectors declined, and the declines were not significant. However, the few declining sectors included many prominent or large-cap stocks, such as VGI, FOX, CTR (telecommunications services), FPT (software and services), VIC, KDH, NVL, PDR… (real estate).

Source: VietstockFinance

|

Speaking of one point that did not really satisfy investors, it could be the liquidity. The total trading value of the market today reached just over 37.6 trillion VND, lower than the recent average. In terms of volume, more than 1.35 billion shares were traded.

Source: VietstockFinance

|

In this context, foreign investors continued to sell a net, with a scale of nearly 2.7 trillion VND today. Among them, HPG was the most net sold, with more than 591 billion VND, followed by MSB with nearly 422 billion VND, and MBB with nearly 319 billion VND. The market also recorded a series of stocks that were net sold in the hundreds of billions of VND, including STB, SSI, SHB, VPB, VHM, and OIL.

On the buying side, GMD led, but the scale was only nearly 136 billion VND.

Morning session: Continuous fluctuations

The morning session of the stock market made investors feel like they were on a “roller coaster” as the market continuously changed its state between gaining and losing points. At the end of the morning session, the VN-Index decreased by 3.46 points to 1,669.32, the HNX-Index stood at the reference level of 276.38, while the UPCoM-Index increased by 0.59 points to 110.53.

Statistics for the whole market showed that the gaining and losing sides were quite balanced. While there were 308 gaining codes, 331 codes lost points, and the remaining 966 codes were stagnant. In terms of industry groups, the balance was also somewhat reflected through 13 gaining industries and 10 losing industries.

On the gaining side, financial services (mainly securities) were the brightest spot in the market, increasing by 1.62%. On the other hand, with its large capitalization, the securities group positively supported the market’s recovery.

Some notable names included SSI, up 1.86%; VND, up 2.94%; VCI, up 1.45%; BSI, up 1.15%… especially DSE, ORS, DSC, and APG… hitting the ceiling price. Some other positively gaining industries were transportation, up 1.1%, and hardware and equipment, up 0.92%.

On the losing side, media and entertainment decreased by 1.42% and was the industry with the strongest decline. Next was real estate, down 0.91%. In addition, another large-cap industry, banking, also fell by 0.37%, thereby putting significant pressure on the market in the morning session.

Foreign investors tended to increase net selling, with a temporary value of nearly 1,303 billion VND at the end of the morning session. Among them, HPG was the most net sold, with nearly 248 billion VND, followed by MBB, with nearly 182 billion VND, and VIX, with more than 120 billion VND.

On the net buying side, TCB took the lead, but the scale was only over 66 billion VND.

10:30 am: Real estate and banking reversed, VN-Index dropped sharply

The large-cap groups, such as real estate and banking, suddenly turned red, dragging the market down quickly.

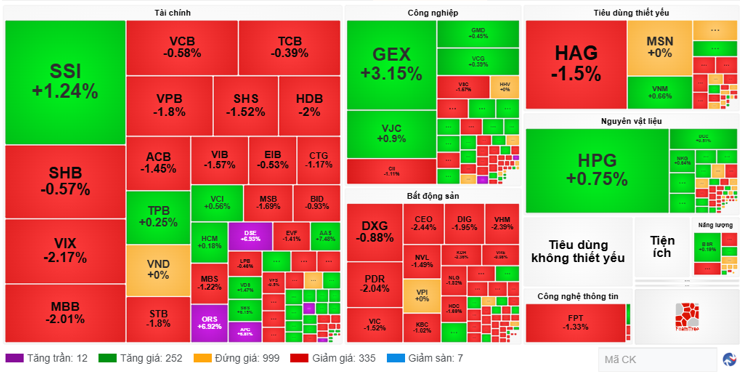

Contrary to the initial excitement, the market suddenly reversed and fell, and as of 10:30 am, the VN-Index decreased by 13.04 points to 1,659.74, the HNX-Index decreased by 1.45 points to 274.93, while the UPCoM-Index increased by 0.34 points to 110.28.

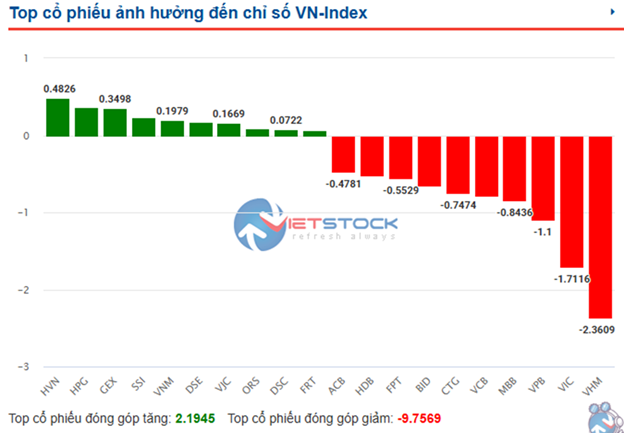

The market witnessed significant pressure from the color change of large-cap groups such as banking and real estate. Especially in real estate, the duo VHM and VIC were taking away the most points from the VN-Index, with nearly 2.4 points and more than 1.7 points, respectively. Next were a series of banking stocks, including VPB, MBB, VCB, CTG, and BID, which took away a considerable number of points.

Source: VietstockFinance

|

The number of losing codes suddenly increased to 342, of which 7 codes hit the floor price. Meanwhile, the number of gaining codes dropped to 264 codes, including 12 ceiling codes.

Source: VietstockFinance

|

The market’s liquidity was generally still low. In this context, foreign investors also net sold slightly over 850 billion VND. Many notable net sold stocks included HPG, net sold nearly 143 billion VND; MBB, nearly 133 billion VND; and VIX, nearly 102 billion VND.

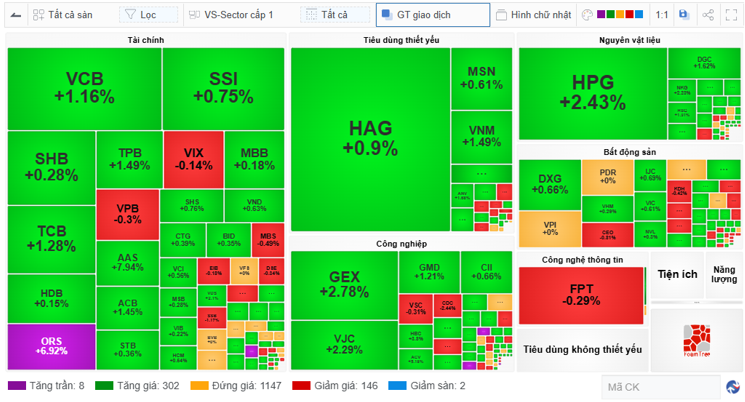

Opening: Exciting start

The Vietnamese stock market opened on August 28 with excitement, as the VN-Index quickly increased by 9.44 points (0.56%) to 1,682.22 as of 9:30 am. Meanwhile, the HNX-Index rose by 0.76 points to 277.14, and the UPCoM-Index climbed by 0.51 points to 110.45.

However, liquidity was not too prominent, with only more than 112 million units traded, corresponding to a trading value of nearly 3 trillion VND.

Looking at the market picture, it was easy to see that 310 gaining codes were dominating compared to 148 losing codes. The remaining 1,147 codes were stagnant.

In terms of industry groups, transportation was growing impressively, up 2.29%, driven by aviation giants such as ACV, up 5.51%; VJC, up 2.01%; HVN, up 3.56%… Two other industries with good growth rates were food and beverage and raw materials, up 1.13% and 1.03%, respectively.

In addition, the green color in the banking and securities groups could not be ignored, with a series of stocks rising, such as VCB, TCB, TPB, ACB, SHS, SSI, and especially ORS, which soon hit the ceiling price. Among these stocks, TPB and ORS stood out with the information that TPB wanted to participate in the private offering of ORS, expecting to “upgrade” the relationship to a parent-subsidiary one.

Source: VietstockFinance

|

In Asian markets, the picture was mixed, with the Nikkei 225 up 0.49%, the Shanghai Composite up 0.21%, and the Singapore Straits Times up 0.08%… In contrast, the All Ordinaries fell by 0.06%, and the Hang Seng dropped by 0.95%…

Last night on Wall Street, the S&P 500 rose as investors shifted their attention to Nvidia’s earnings report, which could be a make-or-break moment for the bull market.

At the close of the trading session on August 27, the S&P 500 advanced 0.24% to 6,481.40, marking its highest-ever closing level. Meanwhile, the Nasdaq Composite increased by 0.21% to 21,590.14, and the Dow Jones rose by 0.32% to 45,565.23.

– 16:00 28/08/2025

Reviewing the VN-Index 2025 Forecast: VCBS Stands Out With Its Realistic Scenario

VCBS, or Vietnam Joint Stock Commercial Bank for Foreign Trade Securities Corporation, stands out as the sole entity, since late 2024, to forecast the VN-Index reaching 1,555 points in a base scenario and 1,663 points in an optimistic one. This prediction has proven remarkably accurate, closely mirroring the index’s actual performance.

Where Can the VN-Index Go?

Short-term volatility is inevitable, but many analysts believe that the stock market is on a significant upward trend, with the potential to push the VN-Index to unprecedented levels.