Black Pepper Prices Surge in Vietnam’s Domestic Market

Domestic Black Pepper Prices Reach 148,000 VND/kg

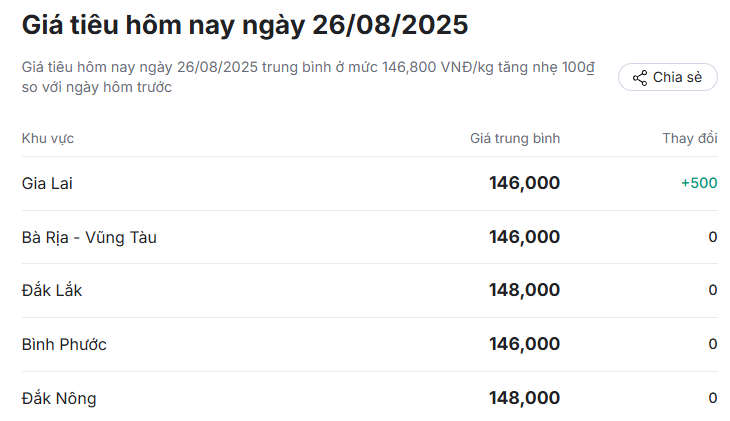

As of this morning, August 26th, black pepper prices surged to a range of 146,000 – 148,000 VND/kg following a strong performance in the previous trading session.

Specifically, in Dak Nong and Dak Lak provinces, the buying price peaked at 148,000 VND/kg. In Gia Lai province, black pepper prices rose to 146,000 VND/kg. Similarly, in the Southeast region, including Ba Ria-Vung Tau, Dong Nai, and Binh Phuoc, prices were adjusted upwards to 146,000 VND/kg.

Vietnam’s Black Pepper Export Prices Remain Stable

In Vietnam, export prices for black pepper remain unchanged at 6,240 – 6,370 USD/ton for the 500 g/l and 550 g/l varieties.

Global Black Pepper Prices on an Uptrend

In other top-producing countries, prices have generally remained stable. Malaysian ASTA black pepper is currently at 9,600 USD/ton, while Brazilian ASTA 570 black pepper is lower at 6,000 USD/ton. In the latest trading session, the International Pepper Community (IPC) quoted Indonesian black pepper at 7,307 USD/ton, up 2.44% from the previous day.

At the same time, the price of Indonesian Muntok white pepper increased by 1.86% to 10,155 USD/ton.

Meanwhile, Malaysian ASTA white pepper remained unchanged at 12,800 USD/ton, and Vietnamese white pepper reached 8,950 USD/ton.

According to the Import-Export Department (Ministry of Industry and Trade), the US plans to impose a 50% tariff on black pepper from Brazil and India, while Vietnam faces a lower tariff of 20%, and Indonesia, only 19%. This presents a significant opportunity for Vietnamese black pepper to expand its market share in the US in the coming years.

In the second half of 2025, global black pepper prices are forecast to continue their upward trajectory as demand from the US, Europe, and China rebounds strongly. Export orders are expected to boom in Q4 2025 and Q1 2026, ensuring the sustainable development of Vietnam’s black pepper industry.

Regarding domestic black pepper prices, forecasts for 2025 predict a continued strong upward trend, possibly surpassing the 240,000 – 250,000 VND/kg mark. The main reason for this is the expected decrease in production for the 2025 crop season and low inventory levels, coupled with persistently high global demand.