In Q2 of 2025, global crude oil prices generally trended upwards, especially during the Israel-Iran conflict in June. This was in contrast to the overall downward trend in oil prices during the same period in 2024.

| Global oil price movement in Q2 2025 |

|

Source: VietstockFinance

|

| Global oil price movement in Q2 2024 |

|

Source: VietstockFinance

|

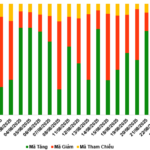

According to VietstockFinance, out of the 20 enterprises in the gasoline-oil-gas industry that announced their business results for Q2, 12 enterprises reported increased profits (with 1 unit turning losses into profits); 4 enterprises reported decreased profits, and 4 units incurred losses.

The giants’ high-flying quarter

|

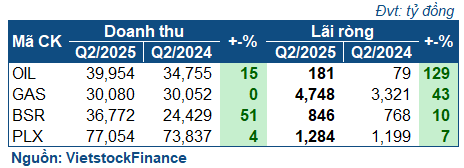

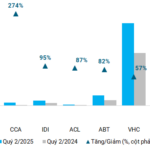

Q2 2025 business results of the four largest gasoline-oil-gas companies

|

The four largest companies in the industry performed well in Q2. Leading the growth was PVOIL (UPCoM: OIL) with a profit of 181 billion VND, 2.3 times higher than the same period last year. OIL’s revenue also increased by 15% to nearly 40 trillion VND.

OIL attributed the positive results to the volatile oil price movement during the period, which brought opportunities for trading activities. Additionally, financial income increased significantly due to reduced foreign exchange losses.

| OIL’s business performance |

Benefiting from the oil price movement, BSR also had a booming Q2 with a 51% increase in revenue to nearly 36.8 trillion VND and an 846 billion VND profit, a 10% increase. The significant revenue growth was also due to the scheduled total maintenance in Q2 2024.

Petrolimex (HOSE: PLX), the giant in the gasoline industry, reported Q2 revenue of over 77 trillion VND, a 4% increase, and a profit of nearly 1.3 trillion VND, a 7% increase. Although the growth was modest, this was PLX’s most profitable quarter since Q2 2021.

| PLX had the most profitable quarter in 4 years |

In the gas segment, PV GAS (HOSE: GAS) reported a net profit of 4.7 trillion VND, a 43% increase compared to the same period last year, the highest since Q2 2022. In fact, GAS’s gross profit decreased significantly, but its profit increased due to the reversal of allowance for doubtful accounts of over 1.8 trillion VND.

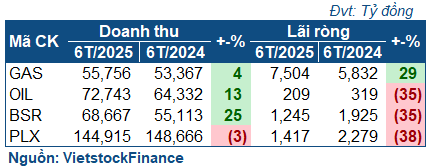

The positive Q2 results helped improve the cumulative performance of the giants after a deep decline in Q1. PLX, OIL, and BSR reported profit decreases of about 35-38% compared to the same period, with most of the profits coming from Q2. Meanwhile, GAS, with a positive Q1, achieved a net profit of over 7.5 trillion VND, a 29% increase.

|

Q2 2025 results of the leading gasoline-oil-gas companies

|

The upstream group shines

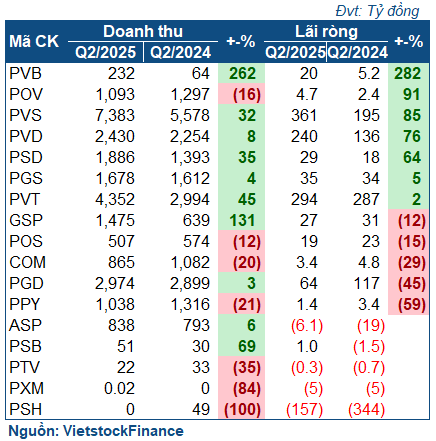

Among the remaining enterprises, there was a differentiation between the upstream (exploration and production), midstream (gathering and transportation of resources), and downstream (refining) segments.

|

Q2 2025 performance of gasoline-oil-gas companies

|

The upstream group stood out in Q2. Leading the group was PVB, a pipe-coating company of PetroVietnam (PVN), with 232 billion VND in revenue, 3.6 times higher than the same period last year, and a net profit of 20 billion VND, nearly 4 times higher. The growth was driven by the implementation of signed and ongoing projects such as the pipeline coating project for the onshore section of Lot B, the pipeline coating project for the onshore section of the Golden Camel Lot, and the Lac Da Vang project.

| PVB benefits from large projects |

PVS also reported strong results, with a 32% increase in revenue to 7.4 trillion VND and a 361 billion VND net profit, an 85% increase. The Mechanical & Construction (M&C) segment accounted for about 60% of the total revenue. The growth was driven by EPC contracts such as the contract to supply jackets for the Greater Changhua offshore wind power project (CHW2204), and large projects such as Hai Long OSS, Baltica 02, Feng Miao offshore wind power, and the gas-power chain of Lot B and Golden Camel projects, which are on schedule.

PVD recovered well with a 76% increase in net profit to 240 billion VND, thanks to increased revenue in drilling-related services, dividends received from its subsidiaries, and insurance income related to PV Drilling VI drilling rig. Additionally, foreign exchange losses decreased due to the depreciation of the USD during the period, and lower principal debt helped reduce interest expenses.

The midstream group did not show significant changes. PVTrans (HOSE: PVT) reported a 45% increase in revenue to nearly 4.4 trillion VND and a net profit of 294 billion VND. However, net profit decreased slightly by 2% to 294 billion VND. Meanwhile, GSP reported an 8% decrease in net profit to 27 billion VND.

| PVTrans records significant revenue growth |

On the other hand, the downstream group performed rather poorly. In the gas segment, PGS reported positive results with a 5% increase in net profit to 35 billion VND. ASP continued to incur losses but improved from 19 billion VND to 6.1 billion VND. However, PGD reported a 45% drop in net profit to 64 billion VND. The company attributed the decline to the impact of oil prices, which increased the cost of goods sold, despite higher gas output.

Retail gasoline companies continued to struggle. COM reported a 29% decrease in net profit to 3.4 billion VND. PSH remained heavily loss-making at 157 billion VND, and the situation was worse as it had zero revenue. However, the case of the “Western gasoline giant” was quite unique, as the main reason was that the company had not been able to resolve a tax debt of more than 1,000 billion VND since the end of 2023, leading to forced invoice suspension and inability to operate.

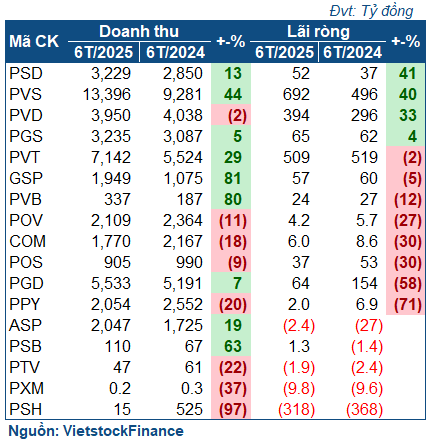

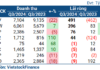

The cumulative picture for the first six months was similar to Q2. Upstream companies such as PVS and PVD achieved profit growth, while PVB declined due to poor Q1 performance. Midstream companies such as PVT remained stable, while retail gasoline companies continued to report sharp declines.

|

Performance of gasoline-oil-gas companies in the first six months of 2025

|

Seafood in Q2: Capitalizing on the Tax “Loophole” from the US

The second quarter of 2025 witnessed a remarkable surge in seafood exports, particularly tra fish, as the US postponed its retaliatory tariffs for an additional three months until after July 9. This strategic move provided a window of opportunity for businesses to ramp up their shipments to key markets, resulting in exceptional revenue and profit growth for the industry.