At the beginning of 2025, few investors predicted that the market would consistently reach new historical peaks. Market liquidity frequently reached the threshold of over $2 billion, even surpassing $3 billion on some days. In this context, realistic forecasts such as those from VCBS stood out for accurately reflecting the true growth trajectory of the VN-Index.

Mid-2025 Forecast: A Solid Foundation for Investors

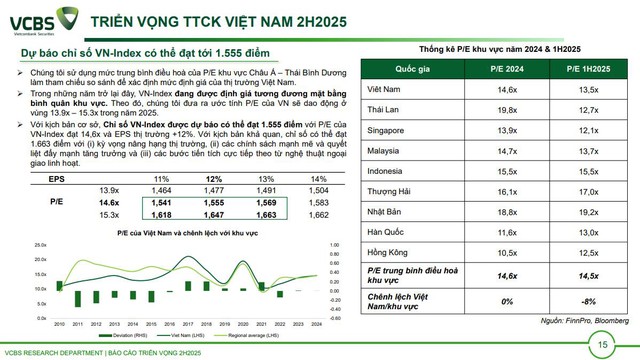

VCBS constructed its VN-Index forecast based on the harmonized P/E average of the Asia-Pacific region, aiming to determine a reasonable valuation range for the market. On this basis, the company predicts that overall market earnings (EPS) will continue to grow, driven by key sectors such as Banking (15%) and Real Estate (13%). Additionally, several other sectors are expected to achieve double-digit growth, including Retail (40%), Construction & Resources (18%), and Oil & Gas (28%).

Beyond market factors, VCBS also closely monitors macroeconomic conditions: the global trend towards monetary easing, the government’s orientation towards an 8% GDP growth target, and policy reforms to improve the legal environment and boost development in key sectors. The combination of quantitative analysis and strategic assessment provides a robust foundation for VCBS’s scenarios, making them not only predictive but also directional for investors.

VCBS Maintains Accuracy Amidst Diverse Opinions

Based on the scenarios released by securities companies at the beginning of 2025, there was a clear divergence in perspectives regarding the VN-Index. BSC suggested a base case of 1,436 points with an optimistic view of 1,550 points; VNDirect upgraded its forecast to 1,450 points from the previous prediction of 1,400 points; SSI concurred with a scenario of 1,450 points. Meanwhile, MBS, VPBankS, and TVSI took a more cautious approach with base cases ranging from 1,400 to 1,420 points. In this context, VCBS was the only entity to provide a forecast that closely aligned with the actual market movement, with a base case of 1,555 points and an optimistic scenario of 1,663 points.

The current VN-Index level stands at 1,645.47, closely aligning with VCBS’s predictions. This demonstrates not only the value of their forecasts as a reference but also underscores their analytical prowess. The forecast for the second half of 2025 remains grounded in a robust analytical foundation, with the base case maintained at 1,555 points and the optimistic scenario at 1,663 points. These predictions consider the market upgrade expectations, alongside intensified growth-oriented policies and positive strides in flexible diplomacy.

With over four months left in 2025, macroeconomic fluctuations and capital flows may present challenges and new expectations. However, a retrospective glance at the scenarios from the beginning of the year underscores the importance of forecasts rooted in solid analytical foundations from leading securities companies as a pivotal guide for investors.

Where Can the VN-Index Go?

Short-term volatility is inevitable, but many analysts believe that the stock market is on a significant upward trend, with the potential to push the VN-Index to unprecedented levels.

The Historic Peak and the Plunge: Will VN-Index Ever Stop Its Free Fall?

“Investors should focus on their personal investment portfolios rather than getting caught up in the rapid and drastic fluctuations of the VN-Index,” advised Agriseco experts.